Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

🔴 BREAKING >>> UKRAINE READY TO ACCEPT US PROPOSAL FOR 30-DAY TEMPORARY TRUCE. UKRAINE: TRUCE POSSIBLE IF SIMULTANEOUSLY OBSERVED BY RUSSIA ‼️

.

Here are the countries that own the most US debt

Source: Visual Capitalist

Don't be obsessed by trying to avoid corrections

Peter Lynch: "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves".

"What we learn from history is that people don't learn from history."

— Warren Buffett

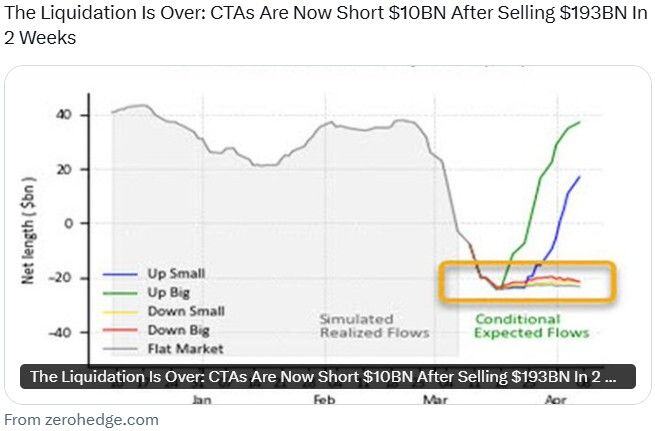

Is the liquidation over?

According to Goldman, CTAs are now short $10BN after selling $193BN in 2 weeks? Source. Goldman, www.zerohedge.com

Behold your new volatility regime...

VIX curve is now inverted: Source: Bloomberg, Tracy Alloway @tracyalloway

Switzerland remains the best migration destination in the world

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks