Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

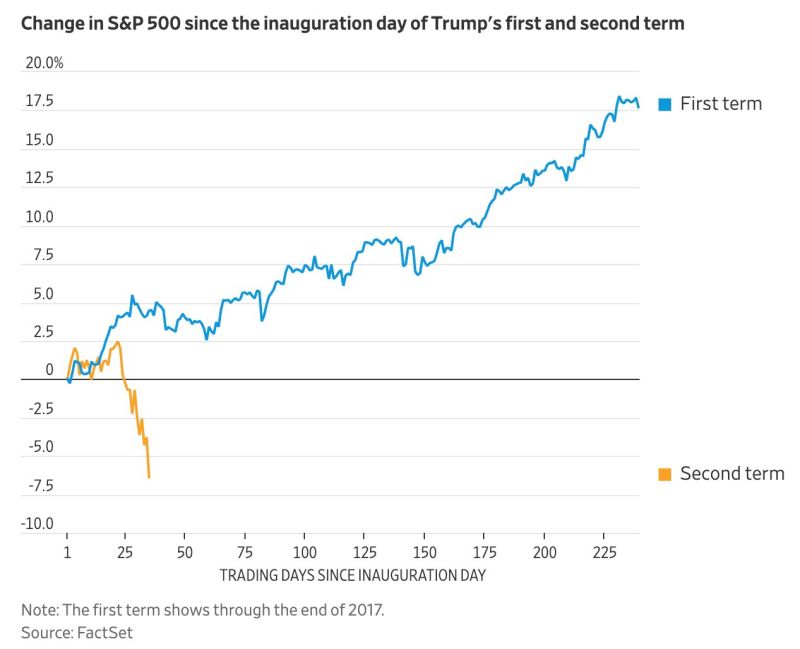

Trump’s approval rating goes negative for first time in second term

.

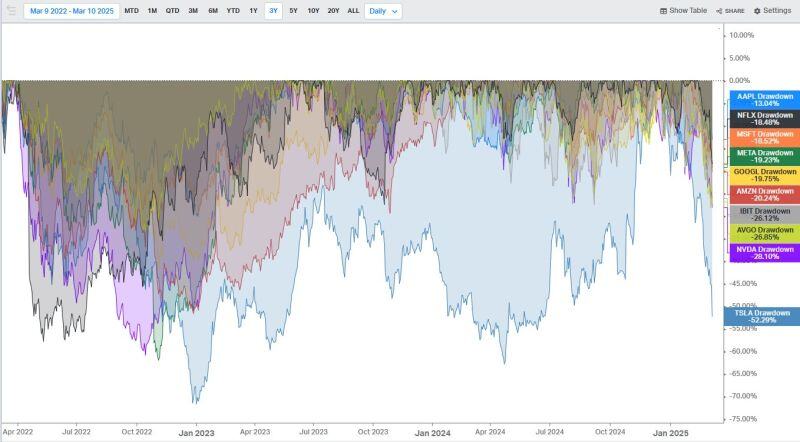

Mag7 stocks had their biggest overall marketcap decline ever ($3.3 trillion from its peak)...

Source: www.zerohedge.com, Bloomberg

MONDAY US STOCK MARKET PLUNGE —$1.75 TRILLION WIPED OUT IN A SINGLE DAY

Source: Mario Nawfal

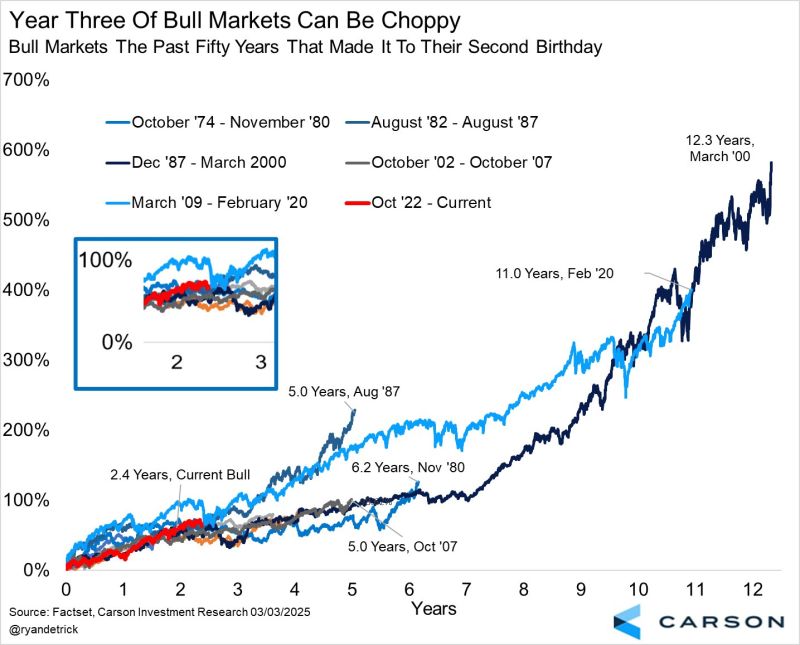

Not all bull markets make it to their third year, but when they do it is perfectly normal to see some chop and frustration.

Source: Ryan Detrick, CMT @RyanDetrick, Carson

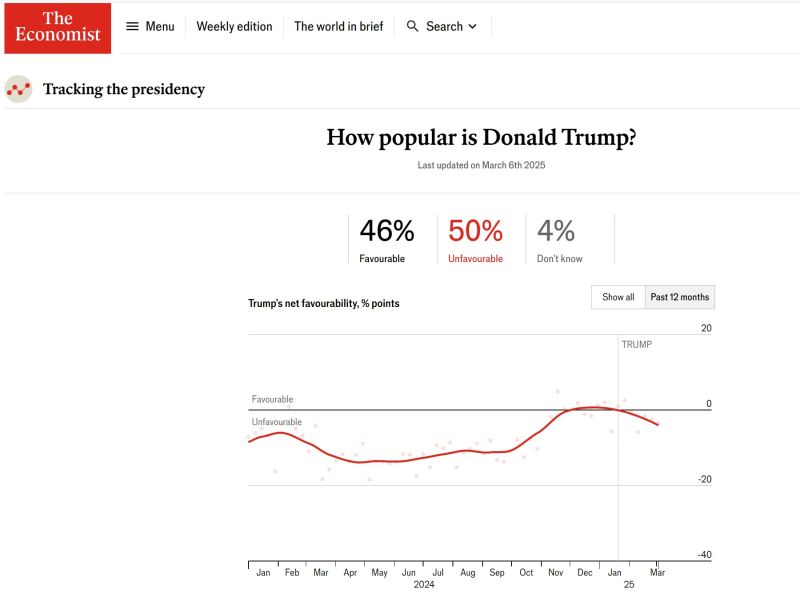

Five of the billionaires who attended Donald Trump's inauguration have lost a combined $210 billion in wealth since then, according to the Bloomberg Billionaires Index.

Source: Bloomberg Markets

Magnificent drawdowns

$AAPL -13% $NFLX -18% $MSFT -19% $META -19% $GOOGL -20% $AMZN -20% $IBIT bitcoin -26% $AVGO -27% $NVDA -28% $TLSA -52% Source: Mike Zaccardi, CFA, CMT, MBA

Investing with intelligence

Our latest research, commentary and market outlooks