Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Xi’s Reply to Trump Tariffs Shows China Has More to Lose - Bloomberg

https://lnkd.in/ez4qCpZa Source: Bloomberg thru C.Barraud

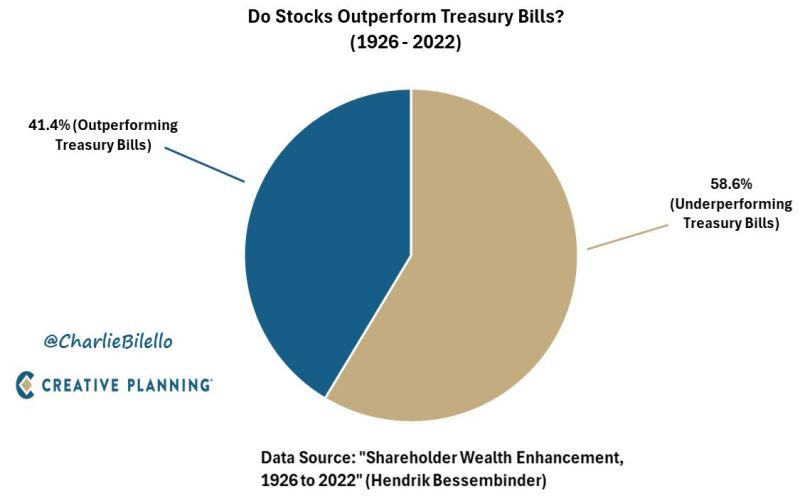

A majority of stocks (59%) underperform Treasury bills over their lifetime and more than half end up having a negative cumulative return.

“Don’t look for the needle in the haystack. Just buy the haystack.” - Jack Bogle Source: Charlie Bilello, Peter Malouk

Job Openings Unexpectedly Crater By More Than 500K In December

Source: zerohedge

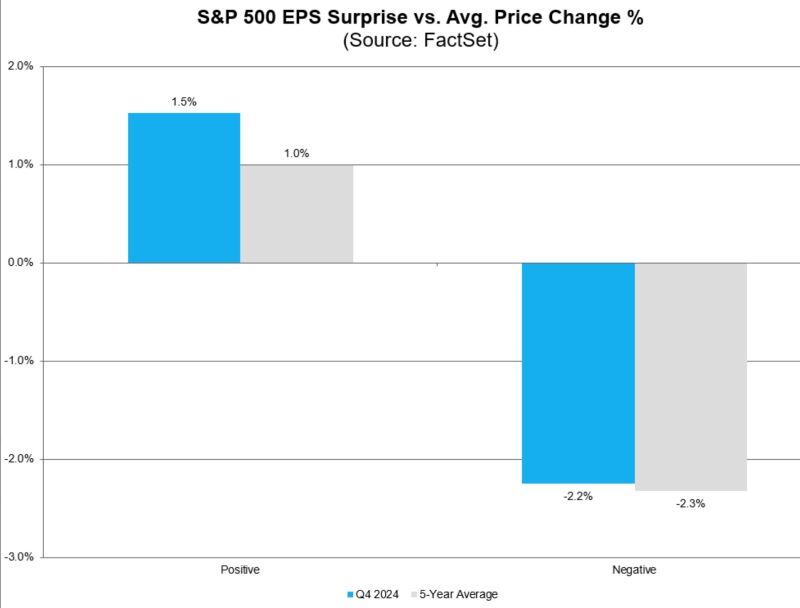

With deepSeek and tariffs, we almost forgot that we are in the middle of the earnings season.

FactSet notes that beats are being rewarded above average and misses are being punished around average.

Peter Lynch on expectations in investing...

Source: The Investing for Beginners Podcast @IFB_podcast

BREAKING: China has opened antitrust investigations into Nvidia and Google just hours after imposing 10%-15% tariffs on some US imports, per FT.

China is reportedly looking for new trade war leverage against President Trump. Source: FT

BREAKING: Alphabet stock, $GOOGL, falls over -7% after reporting Q4 2024 earnings.

Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks