Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

2025 could be a great year for IPOS

9 potential IPOs for 2025 by WOLF Wolf Financial

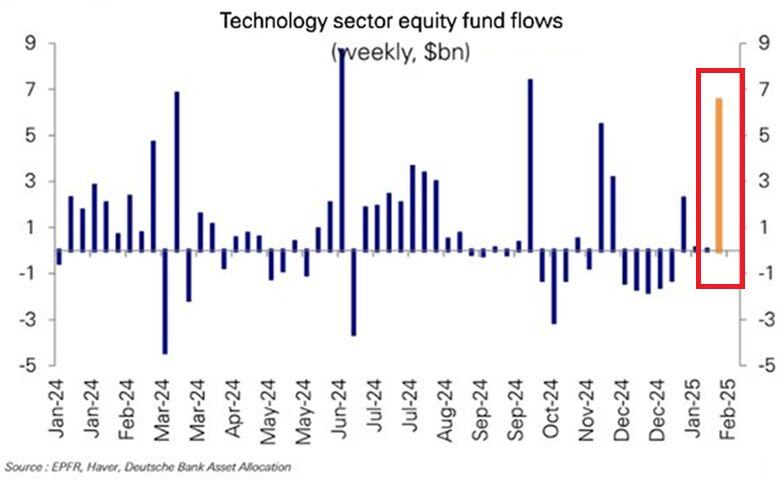

🔴 The Fear of Missing Out (FOMO) is still alive: US technology equity funds saw nearly $7 BILLION in net inflows last week, one of the biggest flows in 14 months.

Net positioning in US mega-cap and technology stocks at one of the most extreme levels in history. Source: Global Markets Investor, EPFR, Haver, DB

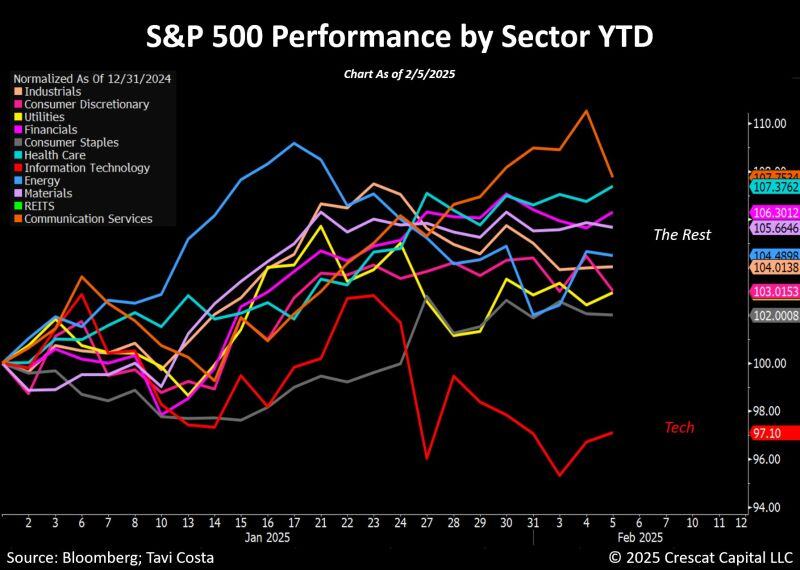

There has been significant rotation happening beneath the surface of the markets.

Tech is the only sector down year-to-date, while every other sector has climbed—some quite substantially already. Source: Otavio (Tavi) Costa

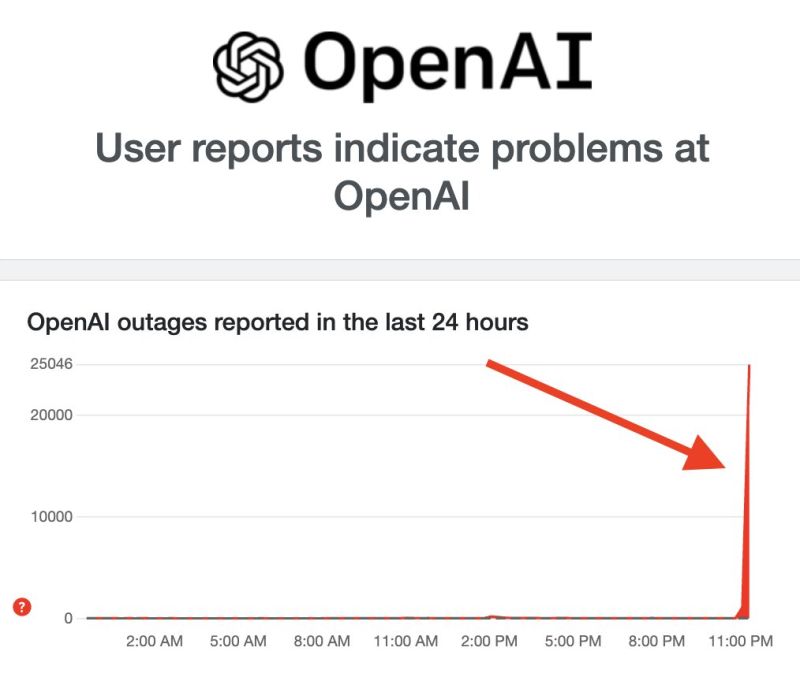

BREAKING: ChatGPT is down worldwide with millions of users unable to access the platform.

Source: The Kobeissi Letter

Treasury Secretary Scott Bessent says Trump 2.0 focusing on 10Y yields, not Fed

Bessent repeated his view that expanding energy supply will help lower inflation. For working-class Americans, “the energy component for them is one of the surest indicators for long-term inflation expectations,” he said. Cheap capital is coming... Source: www.moneycontrol.com

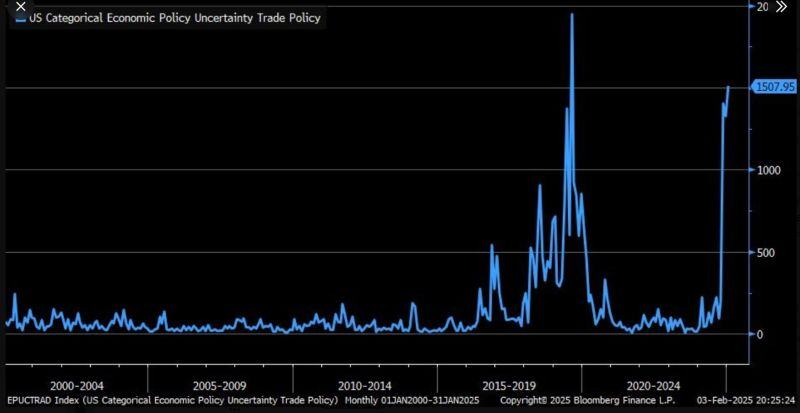

Trade Policy Uncertainty Index hits 2nd highest level in AT LEAST the last 25 years

source : barchart

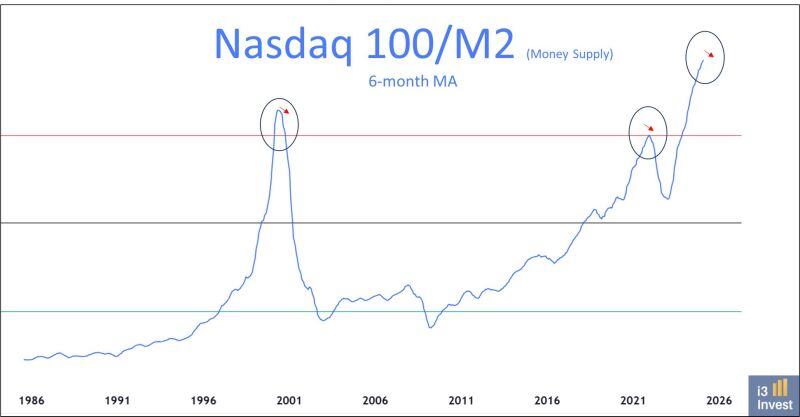

As shared by Guilherme Tavares i3 invest :

Nasdaq 100 / M2 Levels never seen before...

Investing with intelligence

Our latest research, commentary and market outlooks