Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

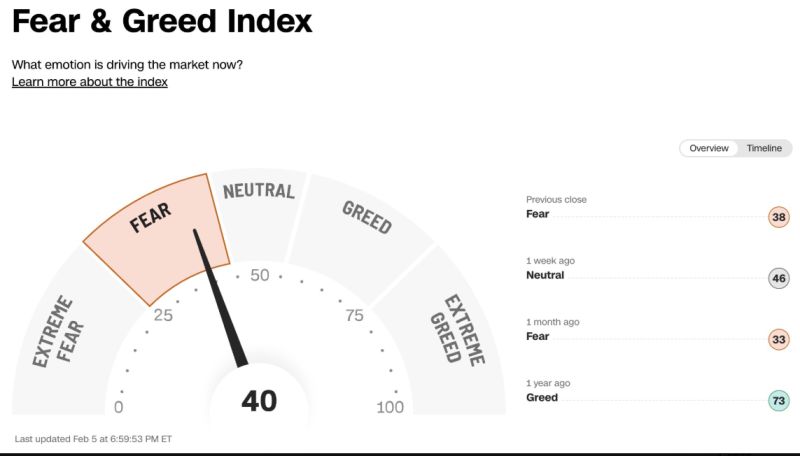

Stock Market Sentiment: Fear Amidst Gains?

Despite trading in the green for two consecutive days and sitting just 1.1% away from all-time highs, market sentiment remains cautious. Fear still lingers. source : cnnsentiment

Roughly 20,000 federal employees have accepted President Trump's buyout offer to leave their jobs and receive an 8-month severance.

The goal is to reduce the federal budget by removing unnecessary bureaucrats. Source: Wall Street Mav

Cut cut cut...

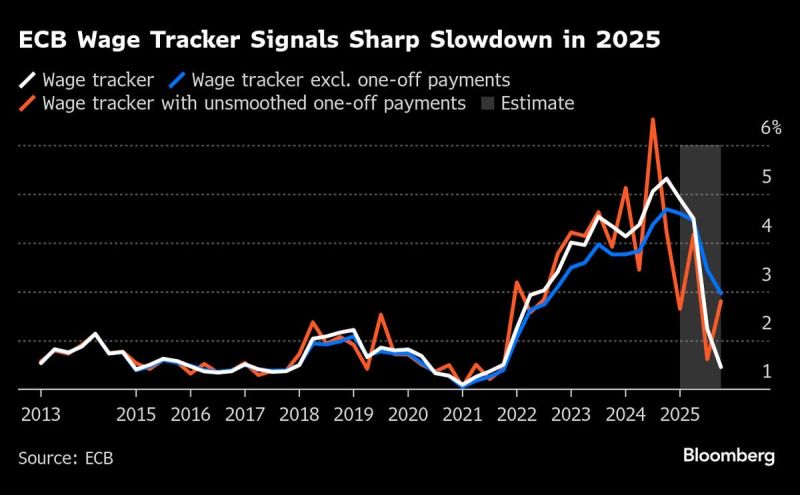

ECB’s Wage Tracker Points to Steep Slowdown This Year - Bloomberg Source: Bloomberg

2025 could be a great year for IPOS

9 potential IPOs for 2025 by WOLF Wolf Financial

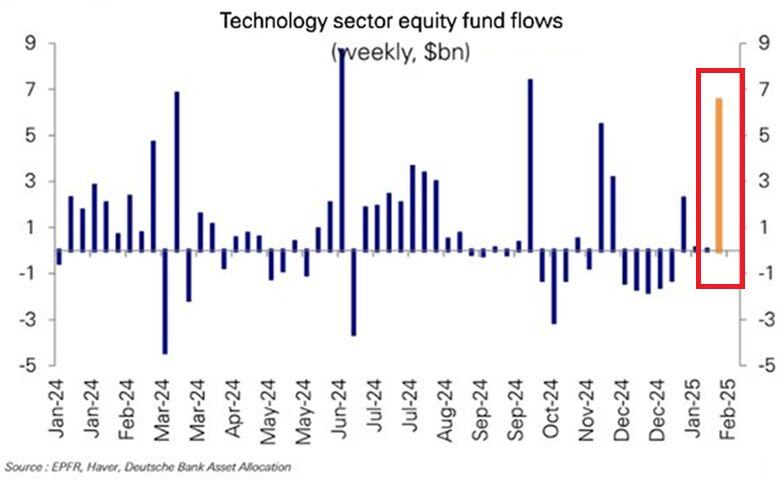

🔴 The Fear of Missing Out (FOMO) is still alive: US technology equity funds saw nearly $7 BILLION in net inflows last week, one of the biggest flows in 14 months.

Net positioning in US mega-cap and technology stocks at one of the most extreme levels in history. Source: Global Markets Investor, EPFR, Haver, DB

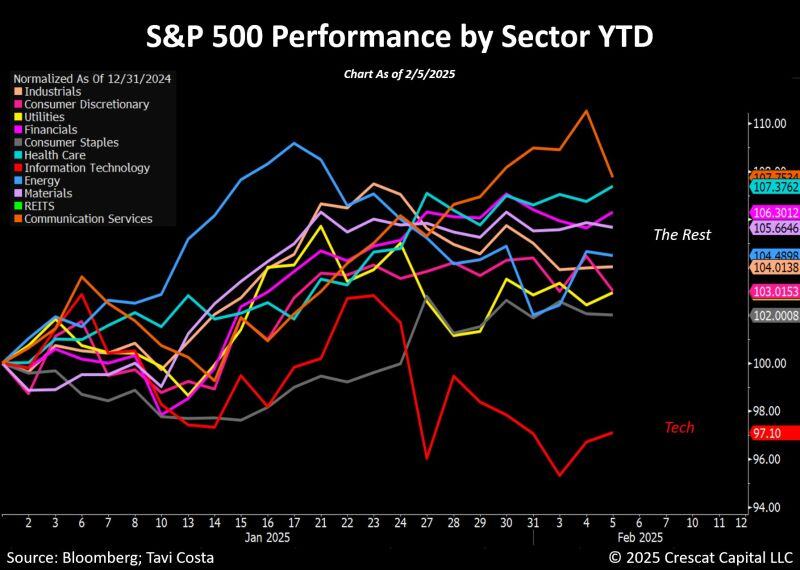

There has been significant rotation happening beneath the surface of the markets.

Tech is the only sector down year-to-date, while every other sector has climbed—some quite substantially already. Source: Otavio (Tavi) Costa

Investing with intelligence

Our latest research, commentary and market outlooks