Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Beginning Monday, China will implement tariffs of up to 15% on $14 billion in U.S. exports, including LNG, coal, crude oil, farm equipment, and select vehicles.

Looks like China is fighting back against Trump's 10% tariffs on Chinese imports that he announced last week... Source: Financial Times

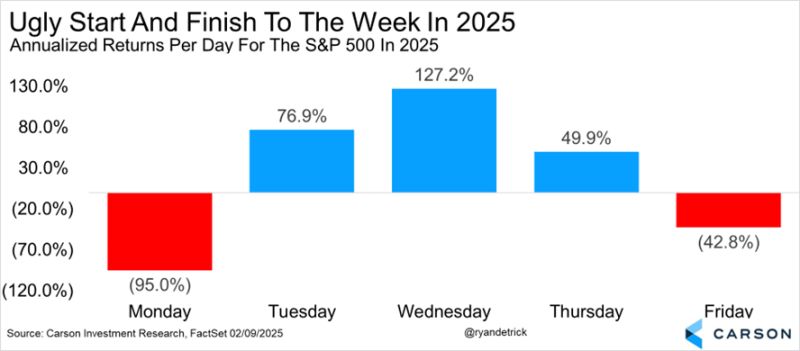

Monday and Friday have been quite bad for stocks so far in 2025.

The other three days have been solid. Source: Ryan Detrick, Carson

China's retaliatory tariff will hit the United States today.

Here is how the U.S Corporations and consumers will be impacted. Source: Unicus @UnicusResearch

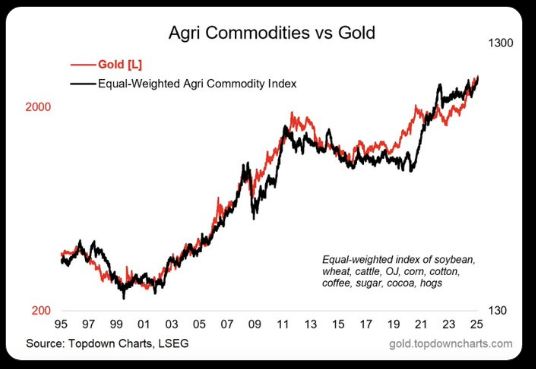

Gold has been truly one of the GREATEST assets over the last few years, widely outperforming the S&P 500:

🔴 1-year performance: Gold +41% S&P 500 +21% 🔴 3-year: Gold +59% S&P 500 +34% 🔴 5-year: Gold +84% S&P 500 +80% Source. Global Markets Investor

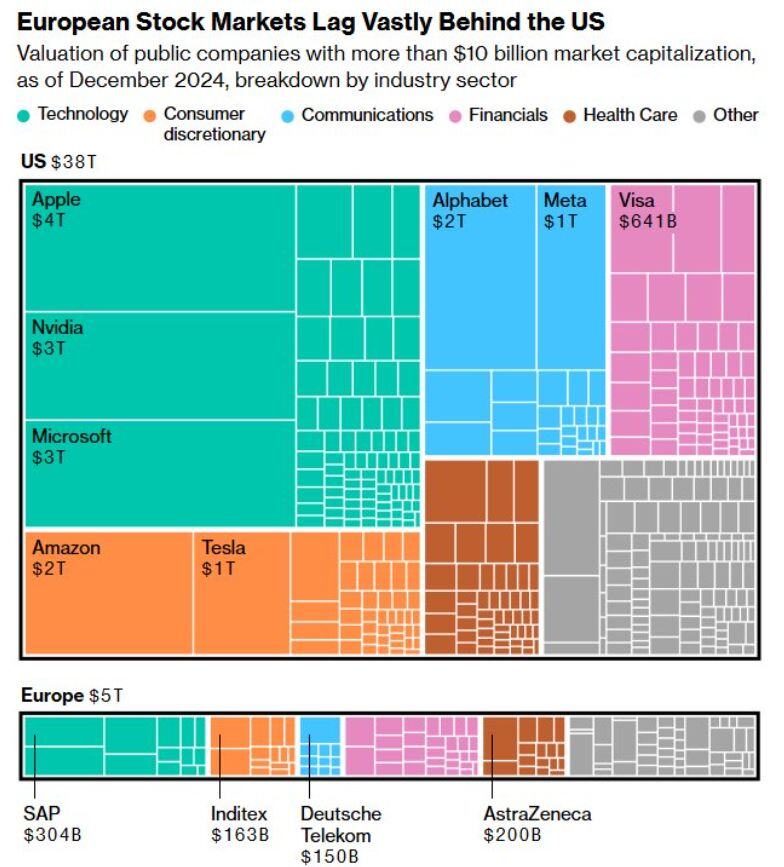

Valuation of Public Companies with Market Caps Over $10B

The gap between European and U.S. equities continues to widen. While U.S. stocks trade at historically high valuations, their European counterparts lag significantly behind. source: A.Arouet

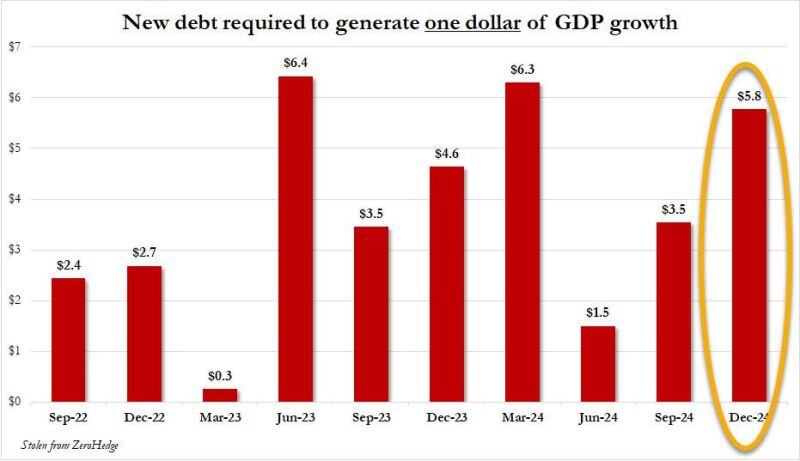

The US economy has been driven by a massive DEBT BUBBLE: In 2024, to generate 1 unit of GDP growth it took $3.8 of national debt...

In Q4 alone, it took $5.8 of debt to create $1 of economic growth. If not for the huge debt, the US economy would have been in a recession. Source: Global Markets Investor

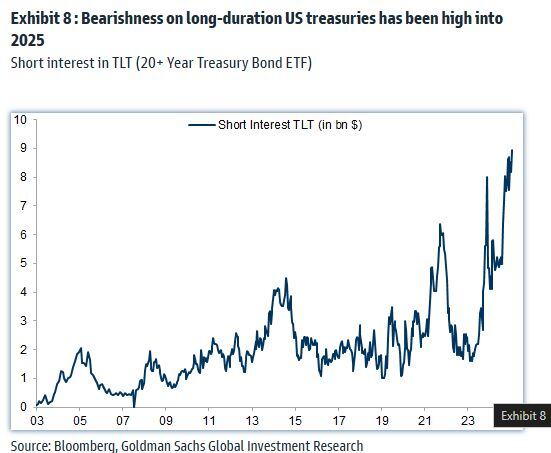

GS: Short interest in $TLT is near century-highs

Source: Mike Zaccardi, CFA, CMT, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks