Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US innovation & entrepreneurial spirit versus overregulation, left redistribution mindset and lack of innovation.

EU is straight on its way to become an open-air museum. Source: Michel A.Arouet, Augur infinity

GS: "DeepSeek Monday" more about a rotation in the AI trade, rather than outright negative

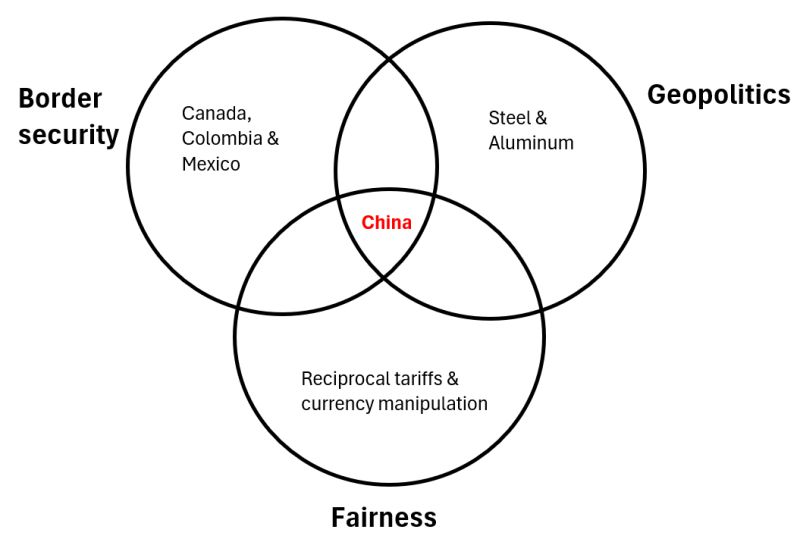

(i) border security (Canada, Colombia, Mexico); (ii) geopolitics (steel & aluminum); (iii) fairness (reciprocal tariffs & currency manipulation). China is the only country to be tariffed - and will get tariffed more - as it hits all of these...

A nice one by Robin Brooks on X: There's 3 drivers of Trump tariffs:

(i) border security (Canada, Colombia, Mexico); (ii) geopolitics (steel & aluminum); (iii) fairness (reciprocal tariffs & currency manipulation). China is the only country to be tariffed - and will get tariffed more - as it hits all of these...

RIP to Penny?

President Donald Trump has directed the US Treasury to stop minting new pennies citing the rising costs,. In 2024 every penny which represents 1 cent costed 3.69 cents to make. source : evan

Israel continues to be a leader this bull market.

That's another new all-time weekly closing high for the Tel Aviv 125 Index. Source: J.C. Parets @allstarcharts

‼️ 🚨 BREAKING: Elon Musk-led group makes $97.4B bid for control of OpenAI. 👀

A consortium of investors led by billionaire Elon Musk is offering $97.4 billion to buy the nonprofit that controls artificial intelligence startup OpenAI, the Wall Street Journal reported on Monday. Musk's attorney, Marc Toberoff, said he submitted the bid to OpenAI’s board on Monday, according to the report. "It's time for OpenAI to return to the open-source, safety-focused force for good it once was," the WSJ cited Musk as saying in a statement provided by Toberoff. "We will make sure that happens." SOURCE: REUTERS, WSJ

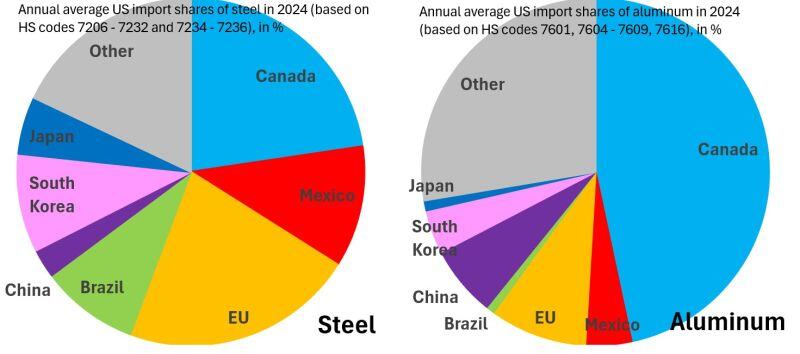

Canada just can't quite make it out of the crosshairs of the new US administration.

Canada is biggest foreign supplier of steel (lhs, blue) - just edging out the EU (lhs, orange) - and by far the biggest foreign supplier of aluminum (rhs, blue). China is NOT a big supplier... Source: Robin Brooks

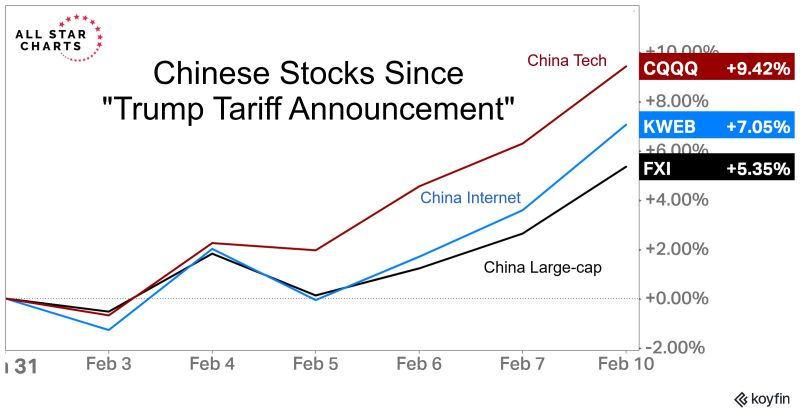

Here's how Chinese stocks have done since they all told you that Chinese stocks were going to crash because of something they're calling "Tariffs"

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks