Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This is what happened to US government revenues from tariffs during Trump's first tradewar.

Source: DB

TRUMP: "Am I going to impose tariffs on the European Union? Do you want the truthful answer or the political answer?

REPORTER: "The truthful answer." TRUMP: "Absolutely." source : unusual whales

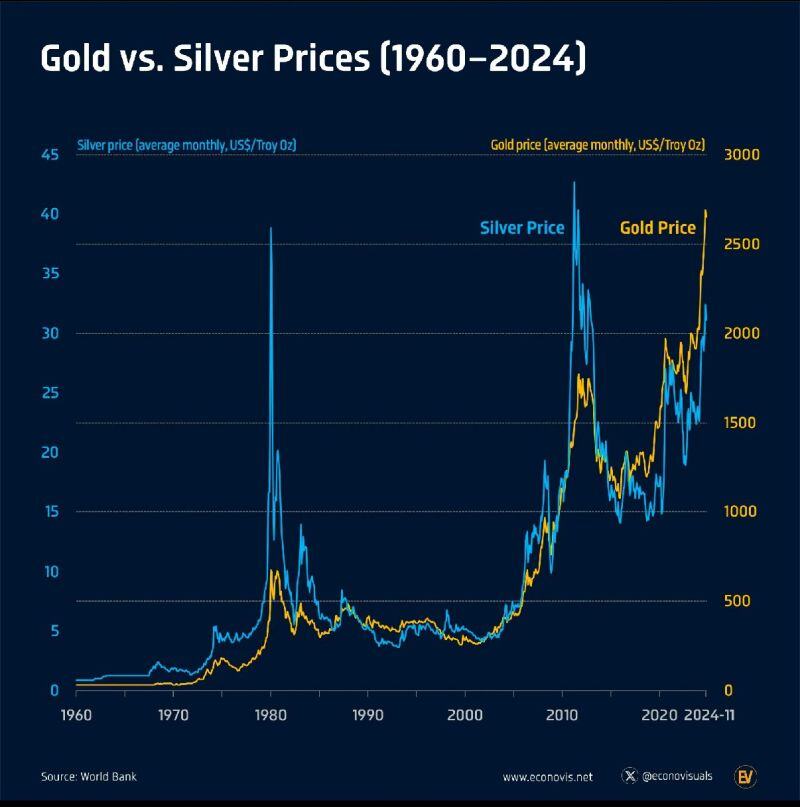

60 years of Gold and Silver price spikes.

Source: Rick Rule Rhetoric @RickRuleRulz

The PaxGold stablecoin is tradeable 24/7. On the back of Trump's Tariff announcement, it went parabolic trading above $3,000 at some point...

PAX Gold (PAXG) is a commodity-backed, gold stablecoin issued by Paxos. Each token is backed by 1 fine troy ounce of gold kept in Brink’s vaults managed by Paxos. Source: kucoin

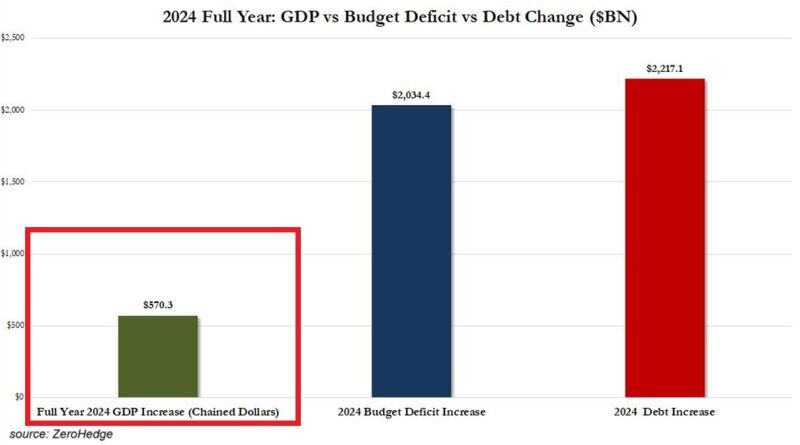

US growth is not a miracle, it is fully DEBT driven:

It took a MASSIVE $2.2 trillion in public debt to create $570 billion in GDP growth in 2024 (before revisions). In other words, it took $3.9 of debt to generate $1 of economic growth. Source: Global Markets Investor

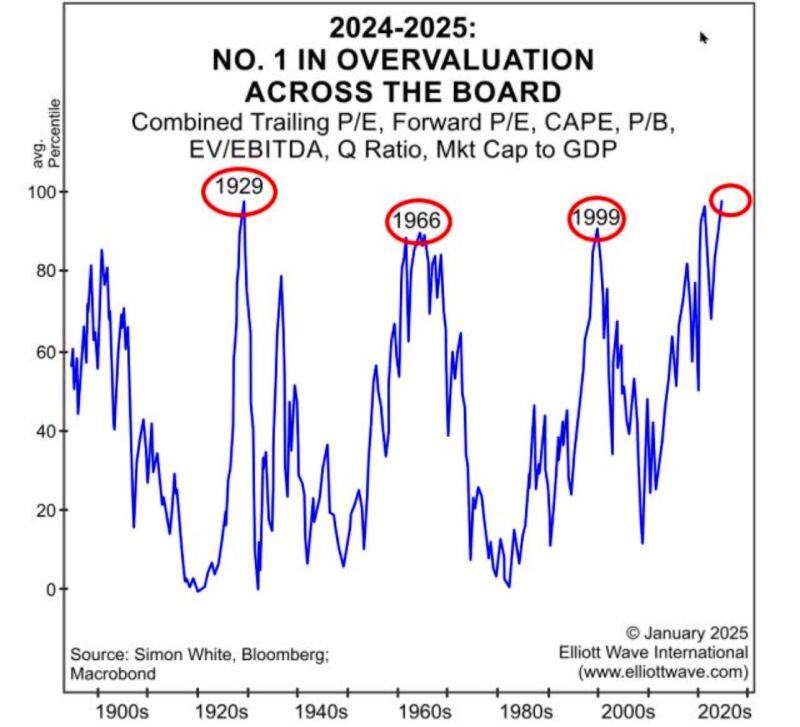

Market valuations are at their highest levels in history, when taking into account multiple methodologies

Source: MacroEdge Vision @MacroEdgeVision

Investing with intelligence

Our latest research, commentary and market outlooks