Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

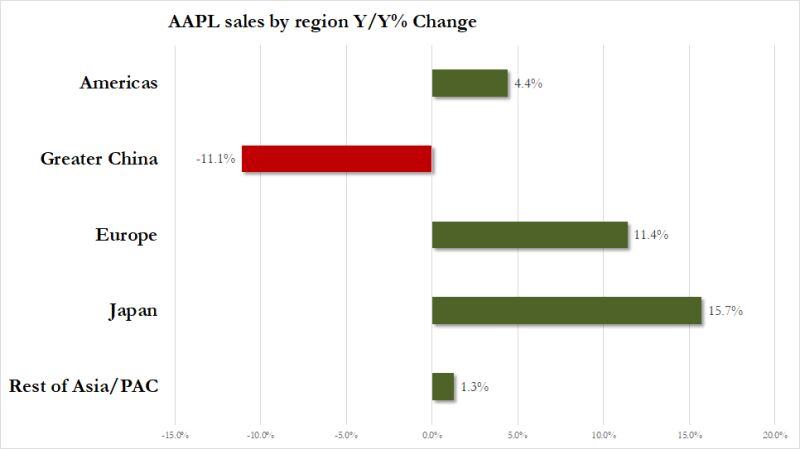

Apple Slides After iPhone Sales Miss, China Revenues Unexpectedly Tumble

The one - very big - fly in the ointment was the usual suspect: China, where revenues unexpectedly tumbled, sliding a whopping 11%, and badly missing estimates of a $21.57BN print Greater China rev. $18.51 billion, -11% y/y, estimate $21.57 billion Source: zerohedge.com

OpenAI is in early talks to raise a large funding round at a $340 billion valuation,

more than doubling what it was worth in October, according to the Wall Street Journal, citing unnamed people familiar with the matter.

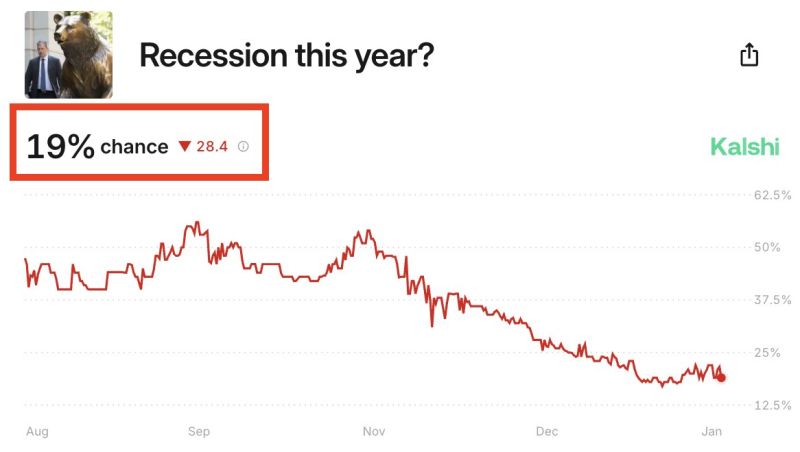

The odds of the US economy entering a recession in 2025 have fallen to a fresh low of just 19%.

Since Election Day, the odds of the US economy entering a recession are down 35 percentage points, per @Kalshi .This comes after the preliminary reading of Q4 2024 GPD showed the US economy grew by 2.3%. Even as interest rates remain elevated and inflation rebounds, the US economy is growing. Source: The Kobeissi Letter

GAME CHANGER ? APPLE QUIETLY ADDS STARLINK TO IPHONES IN iOS 18.3

Apple just opened iPhone doors to Starlink's satellite network, giving users an alternative to their Globalstar service for off-grid communication. The key difference? No more pointing your phone at the sky - Starlink works right from your pocket. T-Mobile to beta testers: "You can now stay connected with texting via satellite from virtually anywhere" While it's text-only for now, SpaceX and T-Mobile plan to add voice calls and data in the future. The race for space-based cellular just got interesting. Source: Bloomberg thru Mario Nawfal on X

Donald Trump was once asked on 'The Apprentice': "What's the most important lesson in business?"

Here's what he answered: SPEED. When Trump saw big opportunities, he acted fast: • Trump Tower: Seized prime Fifth Avenue location • Plaza Hotel: Record-breaking purchase • Mar-a-Lago: Turned $10M investment into $22.7M annual revenue. But there's a crucial lesson here: Success isn't just about the size of your moves. It's about the speed at which you make them. Trump's philosophy works because it combines two critical elements: 1. Spotting massive opportunities 2. Acting before others can Source: Hosun @hosun_chung on X

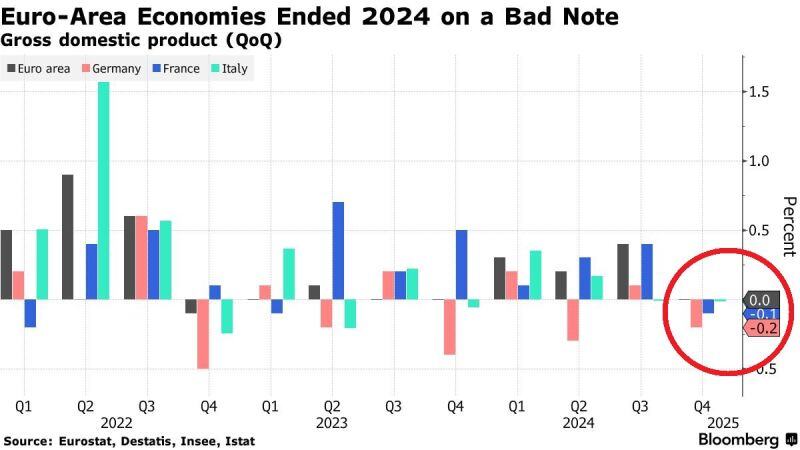

🚨What is happening with the eurozone economy?

Germany and France GDP fell 0.2% and 0.1% in Q4 2024. Italy's GDP was flat for the 2nd consecutive quarter. In effect, Euro-area economy did not grow in Q4 2024. Germany has contracted for 2 consecutive years in 2023 and 2024... Source: Bloomberg, Global Markets

Investing with intelligence

Our latest research, commentary and market outlooks