Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

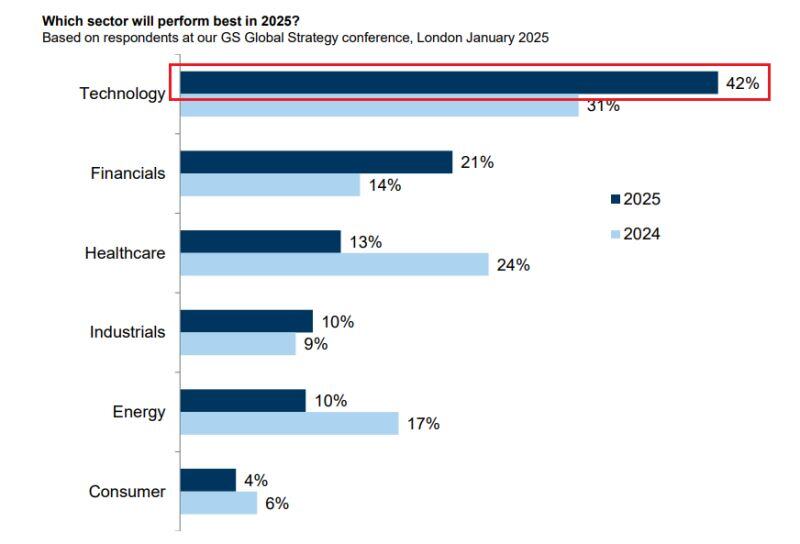

Overweight technology is a crowded trade.

"Goldman Sachs: Most of our clients expect Technology to outperform in 2025" Source: Mike Zaccardi, CFA, CMT, MBA

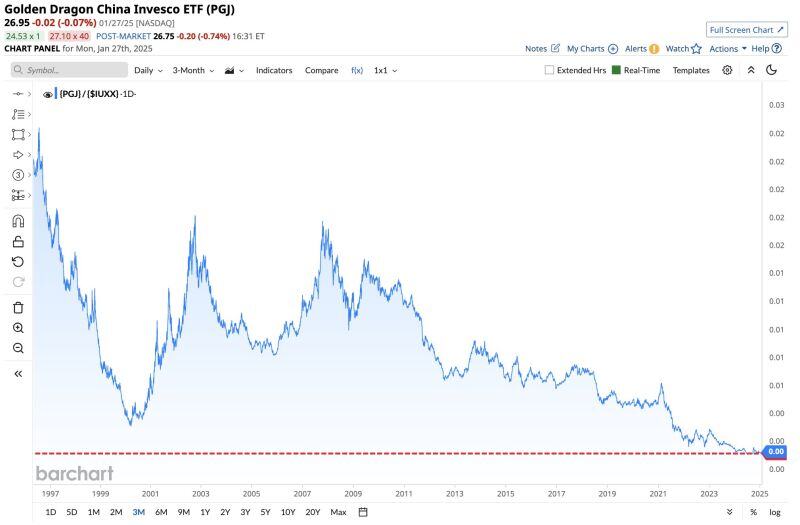

BREAKING 🚨: Chinese tech stocks are underperforming US Tech Stocks by the largest margin in history

Can it last? Source: Barchart

Nvdia closed at $118 yesterday,

below its 200-day Moving average yesterday. The last time it happened the stock was trading at... $16 Source: Trend Spider

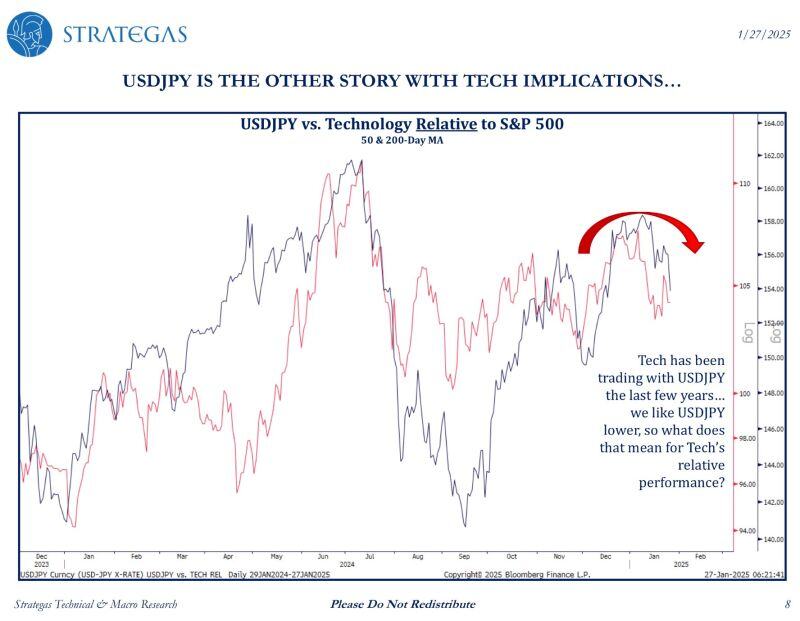

Is it DeepSeek or $USDJPY?

… a reminder that Tech’s relative performance peaked all the way back in July when Yen first strengthened. USDJPY < 155 today is important - perhaps more so than the unknowable impact of China AI Model. @StrategasRP

These past few weeks have been interesting:

- Trump talks about taking over Greenland/Canada/Panama - The first crypto-friendly White House aims to create a strategic bitcoin reserve - DeepSeek undermined the belief in US tech supremacy and triggered the biggest 1-day drop in a stock in history

Why did $META and $AAPL stocks go up yesterday?

DeepSeek is open source which means everyone can see exactly how it was done. The coding etc. tech companies can thus study AI now and get a much cheaper price.

DeepSeek V3 ‘bullish’ for Nvidia, would buy on weakness, says Cantor Fitzgerald - Would you agree???

DeepSeek’s V3 large language model is “actually very bullish” for Nvidia (NVDA) and compute, despite “great angst” around the impact for compute demand and fears of peak spending on GPUs, Cantor Fitzgerald tells investors. The firm says DeepSeek’s advances mean artificial general intelligence is closer, and that work will continue on pre-training, post-training, and time-based inference/reasoning, and future investments in large-scale clusters will only accelerate, all of which is bullish for AI. The firm would buy shares of Nvidia on any potential weakness. Cantor has an Overweight rating and $200 price target on the shares. Source: Markets Insider

Investing with intelligence

Our latest research, commentary and market outlooks