Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

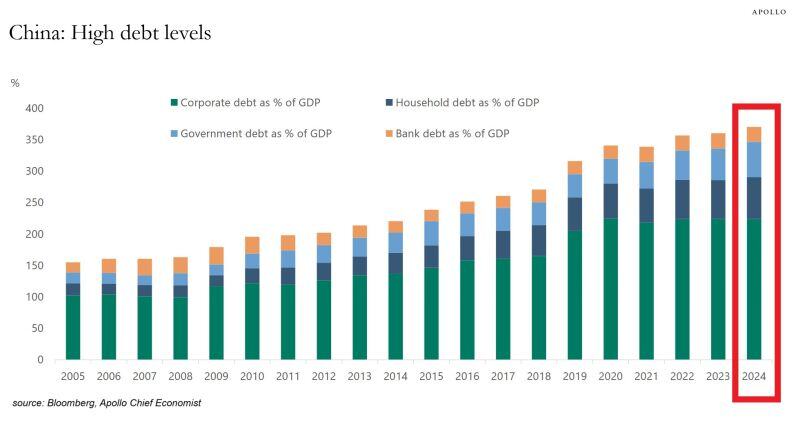

Chinese debt pile is GIGANTIC: China's total debt to GDP rose to a RECORD of ~370%.

The share has DOUBLED over the last 14 years. This does not include shadow banking (outside traditional banking sector). China has a massive debt problem and it will not go away soon. Source: Apollo, Bloomberg, Global Markets Investor

CBOE Volatility Index $VIX dropped to its lowest level this year, even with stocks declining on Friday

No fear left in the market except by Bears. Today might be another story… Source: Barchart

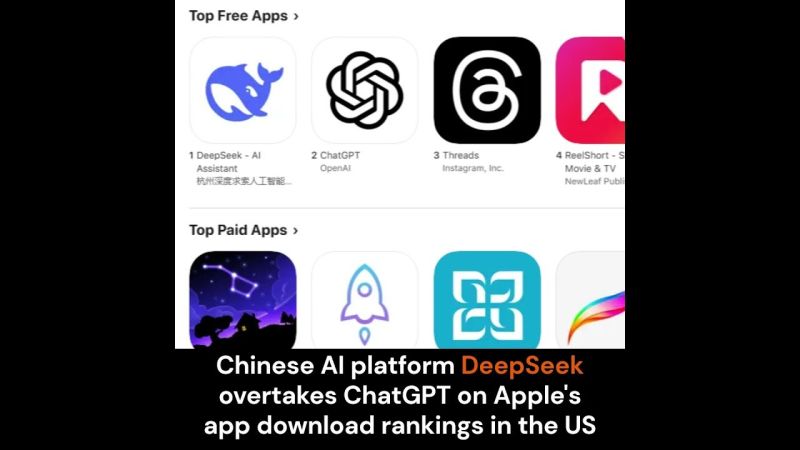

About DeepSeek founder Liang Wenfeng

>> Studies machine vision at Zhejiang University >> At 30 in 2015, launches High-Flyer quant hedge fund >> Makes a fortune (now $8B AUM) >> Wants to build “human” level AI as side hustle and pitches partners but they initially sceptical >> Buys 10,000 H800 chips in 2021 and brings over his top hedge fund employees (all have tons of experience squeezing juice out of Nvidia GPUs for the fund) >> Launched DeepSeek in 2023 and hires dozens of PhDs from top Chinese universities (Peking, Tsinghua and Beihang) >> Pays top top top salary for tech talent only matched by Bytedance in China…wants DeepSeek to be leading “local” company >> US export restrictions force DeepSeek team to get creative and they do, finding new training methods to make LLM models (V3, r1) competitive with OpenAI, Anthropic, Gemini, Grok, LLama etc at ~1/20th the cost >> Training costs not exactly apples-to-apples but novel methods and clear improvements in efficiency (also questions around copying other models, larger H-100 clusters they maybe can’t talk about and/or CCP support) >> Open sources and publishes methods (r1 reasoning paper has 200+ authors) >> DeepSeek just hit top of App Store *** FT: https://lnkd.in/e96ffxmU Source: Trung Phan @TrungTPhan on X, FT

DEEPSEEK OVERTAKES CHATGPT IN APP STORE RANKINGS IN THE U.S.

👉 Chinese AI platform DeepSeek has reportedly surpassed OpenAI’s ChatGPT on Apple’s App Store rankings just a week after launch. 👉DeepSeek popularity stems from its competitive pricing, and its superior performance, reportedly achieving a higher success rate in coding tasks and outpacing OpenAI in benchmarks. Source: @spectatorindex MoneyControl thru Mario Nawfal on X

🚨 Goldman Asks If China's DeepSeek is AI's Sputnik Moment 🚨

You've heard of DeepSeek's R1. But have you heard of Bytedance's Doubao-1.5 or Moonshot's Kimi k1.5? The race to the price bottom is just starting and nobody does it like China. Still, we need to keep in mind that LLM commoditization was inevitable, but the Mag 7 are focused on the Artificial general intelligence (AGI) endgame -- building trust, infrastructure & ecosystems that China can’t match. It might just end up being noise - not a real game changer. Source. www.zerohedge.com, Goldman Sachs

Semiconductor fund managers after seeing 4 memes about DeepSeek on X.

Chip stocks are plunging overnight on the back of the DeepSeek story: 1. Arm, $ARM: -5.5% 2. Nvidia, $NVDA: -5.3% 3. Broadcom, $AVGO: -4.9% 4. Super Micro, $SMCI: -4.6% 5. Taiwan Semi, $TSM: -4.5% 6. Micron, $MU: -4.3% 7. Qualcomm, $QCOM: -2.8% 8. AMD, $AMD: -2.5% 9. Intel, $INTC: -2.0% DeepSeek is only story in town and it’s showing up in global markets this Monday

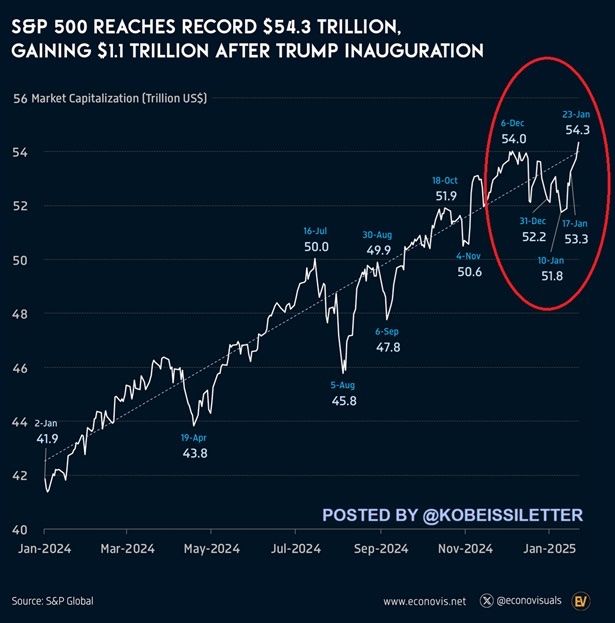

The S&P 500 reached a record $54.3 trillion in market cap last week, adding $1.1 trillion in 1 week.

Since the August low, the index's market cap is up a massive $8.5 trillion. Furthermore, the index has added $12.4 trillion in value since the beginning of 2024. The S&P 500 has added 78% of Europe's market cap and DOUBLE the size of the Japanese market in 1 year. As a result, the US market cap to GDP ratio has reached an all-time high of 209%. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks