Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- amazon

- Middle East

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This may be the most perfect photo ever taken during trump inauguration.

The longer you stare at it, the more fascinating and remarkable it becomes. Source: Benny Johnson on X

US President Donald Trump issued an immigration directive to withhold birthright citizenship from children born in the US to parents who are illegally residing or hold temporary visas.

This order, effective in 30 days, faced immediate legal challenges from civil rights organizations and advocacy groups, questioning its constitutional validity. Source: Times of India

Elon Musk just shared his thoughts on the TikTok ban

Source: Evan

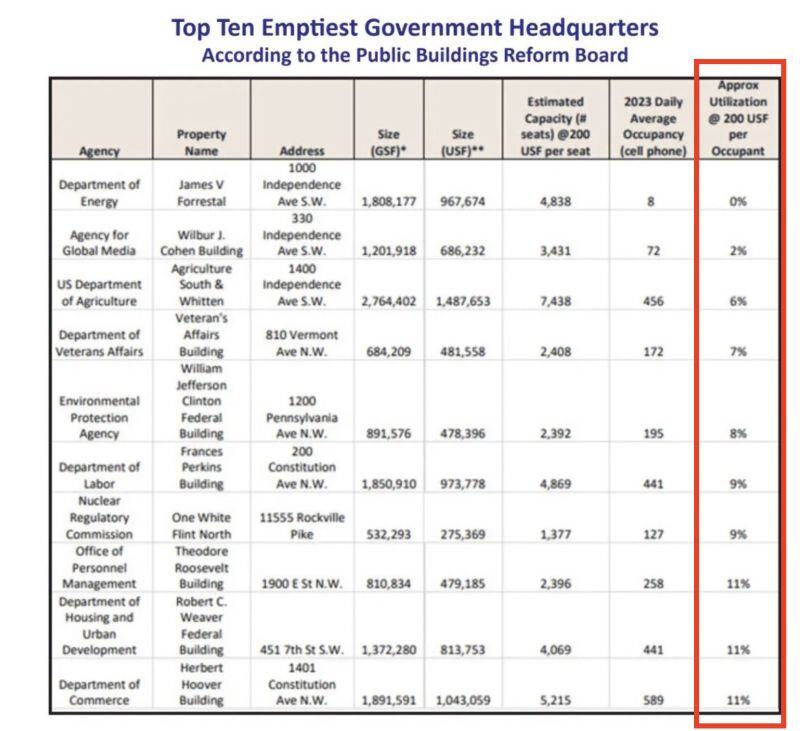

Shocking stat of the day: Not a single major US government agency is occupying even 50% of their office space.

As a result, the Trump Administration is reportedly considering selling TWO-THIRDS of US government office buildings, per WSJ. This comes at a time when office building prices have already fallen 30%+ from their highs. A mass liquidation of US government office buildings would flood the already weak commercial real estate sector with more supply... Source: The Kobeissi Letter

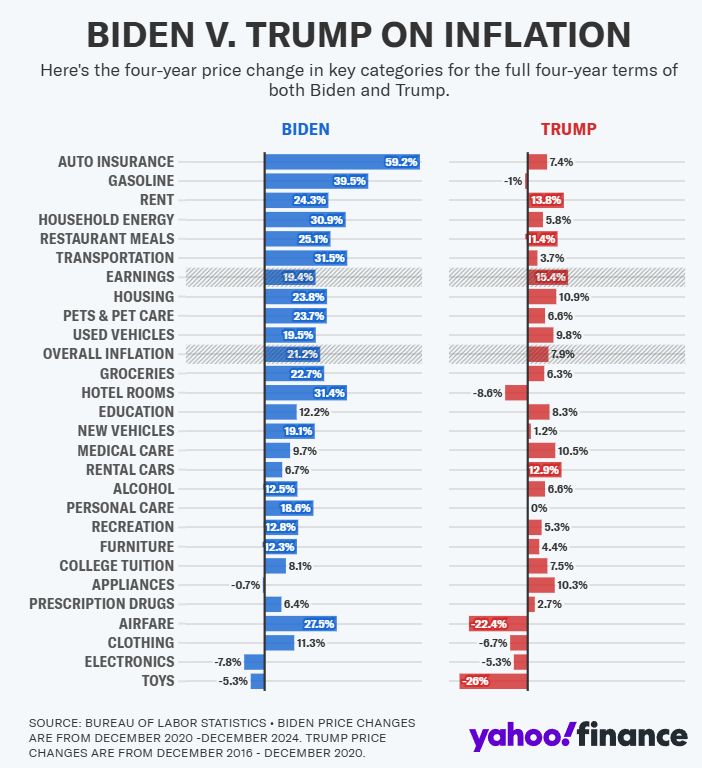

Biden vs Trump on Inflation

During Biden’s presidency, Yahoo Finance tracked inflation in 26 categories that account for most of the things people spend money on. In 12 of those categories, prices rose by more than incomes during Biden’s four years overall. That included housing, transportation, and food, the three things the typical family spends the most on. During Trump’s four years, earnings rose by more than prices in every single one of those 26 categories. source : yahoo!finance

This billionaire can predict the future

He was an early investor in Facebook, Uber & Airbnb. And he just said, "AI will create more billionaires than the internet.” David Sacks’ 5 predictions on the future of wealth creation and why you should care (a thread on X by EmperorDino): 👉"The AI Gold Rush": AI will create more billionaires than the internet. Why? AI is not just a new technology, it's a force multiplier for every industry. The numbers back this up: NVIDIA's value jumped $1.5T in 12 months. AMD stock surged 400% since 2022. Sacks predicts: "The next trillion-dollar company will be an AI infrastructure play.” 👉 "The Rise of AI-First Startups": By 2025, most successful startup will be AI-native. Just like mobile killed web-only companies in 2010. AI will kill traditional software companies by 2026. 👉"AI Models Reaching PhD-Level Reasoning". Sacks recently revealed that OpenAI's AI models will soon achieve PhD-level reasoning abilities. This would be huge for the AI world. 👉 "The Death of Traditional VC": AI will revolutionize startup funding. Smart contracts + AI agents will: • Evaluate startups • Structure deals • Monitor performance Traditional VCs will become obsolete by 2027. 👉 "The Great Wealth Transfer" AI will create two classes: • Those who leverage AI • Those who compete with AI The wealth gap between these groups will be larger than the internet created. Time to pick a side. 🚀 Here's what Sacks is personally investing in: • AI agent platforms • AI infrastructure companies • Industry-specific AI solutions • Computing hardware startups His Craft Ventures fund deployed $850M in these sectors since 2023. Your action plan: 1. Build for the AI-first world 2. Learn AI infrastructure fundamentals 3. Focus on industry-specific problems 4. Learn skills that can't be replaced or automated The next decade of wealth creation starts now. Source: EmperorDino on X

Investing with intelligence

Our latest research, commentary and market outlooks