Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

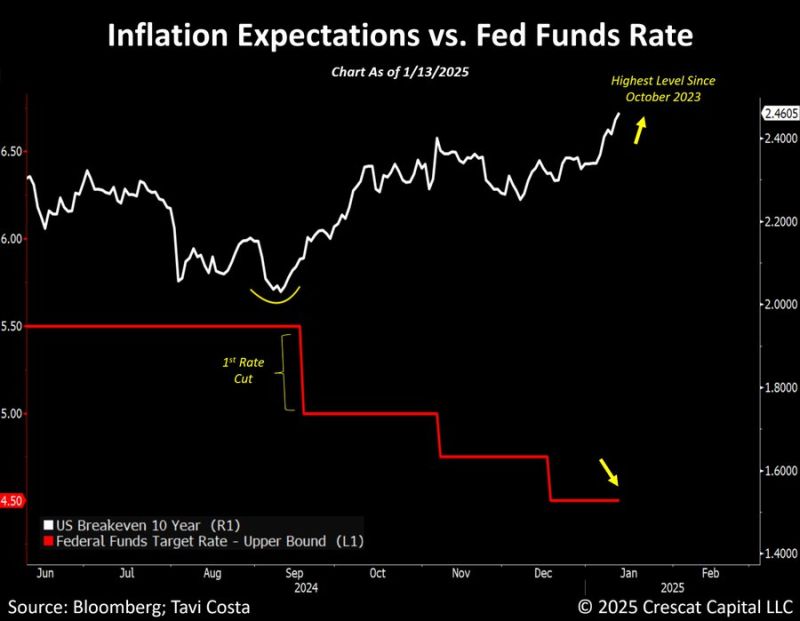

Inflation expectations have almost perfectly bottomed exactly when the Fed started to cut rates.

10-year breakeven rates are now at its highest level since October 2023. As highlighted by Tavi Costa, this is a reminder that when debt limits a monetary authorities actions, inflation becomes the path of least resistance. Source: Tavi Costa, Bloomberg

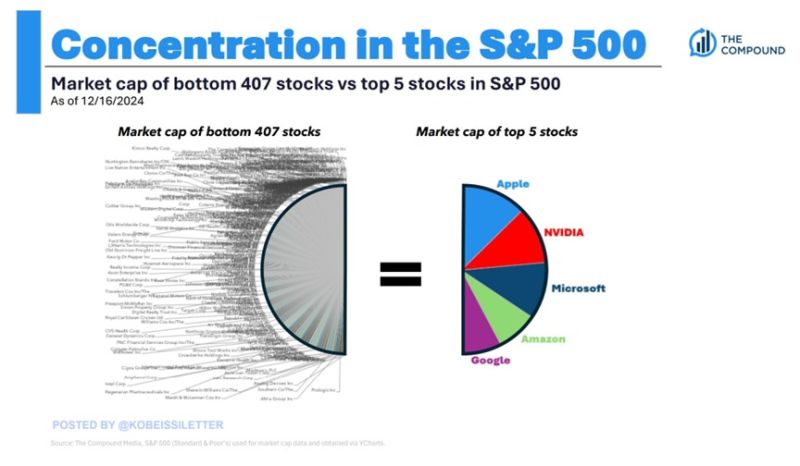

Shocking stat of the day: The market cap of the SP500’s top 5 stocks is now equal to the size of the bottom 407 stocks.

Apple, $AAPL, Nvidia, $NVDA, Microsoft, $MSFT, Google, $GOOGL, and Amazon, $AMZN are worth now a combined $15.3 trillion. These companies have added $5 TRILLION in market value since the beginning of last year. To put this into perspective, these 5 stocks are worth now nearly as much as China and Hong Kong's stock markets COMBINED. The top 5 companies reflect a record 24% of the entire US stock market cap. Source: Compound, The Kobeissi Letter

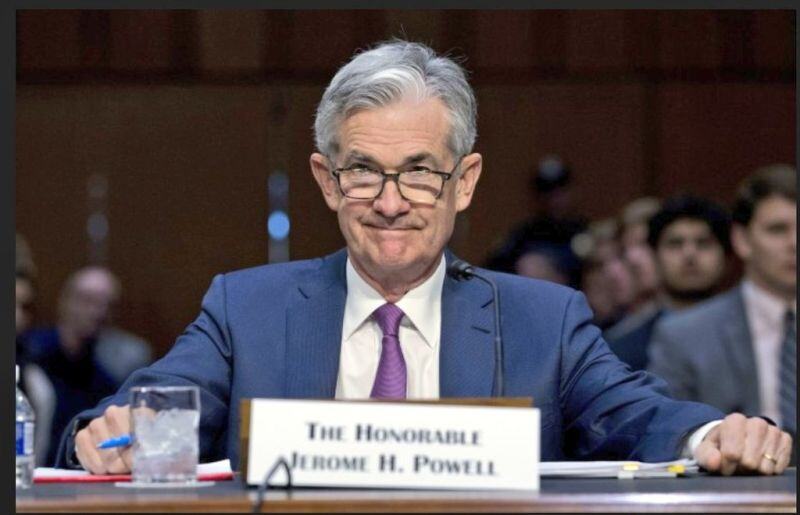

🚨US PPI DATA SHOULD PLEASE POWELL! December US PPI annual inflation rises 3.3%, below expectations for 3.5%.

vCore PPI inflation increased 3.5% Y/Y, compared to forecasts for a gain of 3.8%. BULLISH🚀 YoY Growth: 🇺🇸 PPI (Dec), 3.3% Vs. 3.5% Est. (prev. 3.0%) 🇺🇸 Core PPI, 3.5% Vs. 3.8% Est. (prev. 3.4%) MoM Growth: 🇺🇸 PPI (Dec), 0.2% Vs. 0.4% Est. (prev. 0.4%) 🇺🇸 Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.2%)

Real yields on 30-year US treasury bonds are now at 2008 levels.

It seems that bond markets are worried about much more than just inflation... Source: Adam Kobeissi, Bloomberg

⚠️Bank of Japan is getting closer to deliver another rate hike:

Inflation has picked up while wages have jumped to the highest level in at least 3 DECADES. The market is pricing in about a 60% probability of a hike next week, and an 82% chance by March. Remember when in August 2024 the market flash crashed by suddenly waking up to BOJ's rate hikes? This is key to watch. Source: The Kobeissi Letter, The Daily Shot

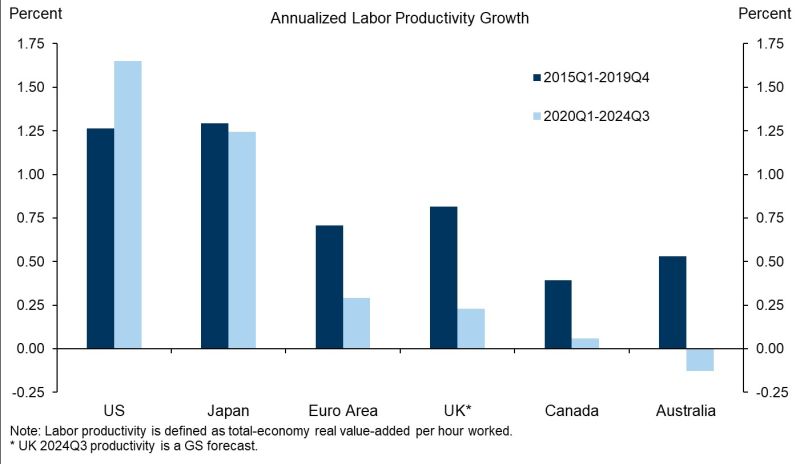

A stunning chart by Goldman: the outperformance of US productivity growth is remarkable, particularly in the COVID/post-COVID era.

Source: GS, Tony Pasquariello, Giovanni Pierdomenico

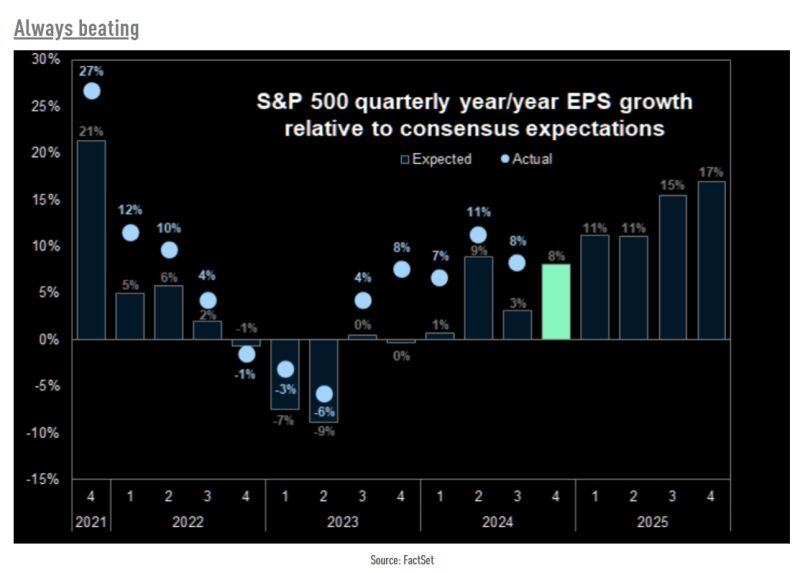

Actual S&P 500 earnings growth has exceeded expectations during the last few years.

Will it be the case again this quarter? Source: The Market Ear, Factset

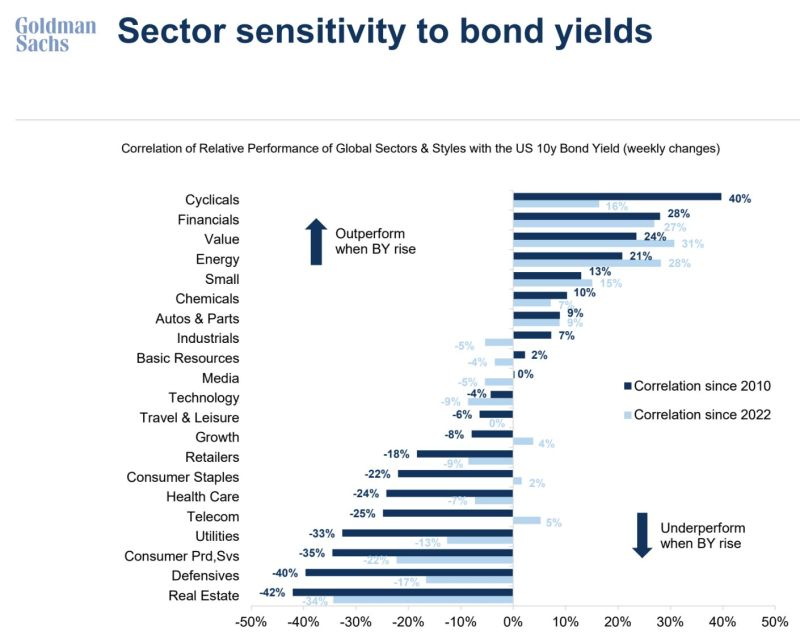

A good chart from GS that shows how sectors & factors may react to change in 10Y bond yields.

Source: Ayesha Tariq, CFA, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks