Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

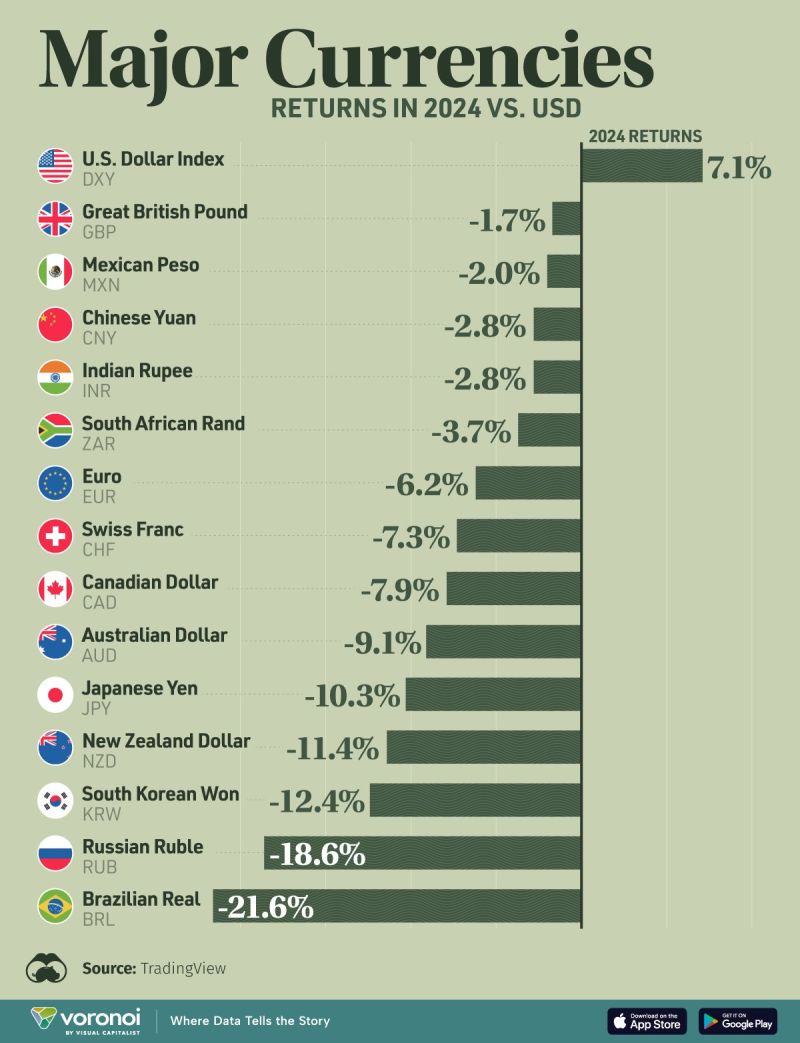

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

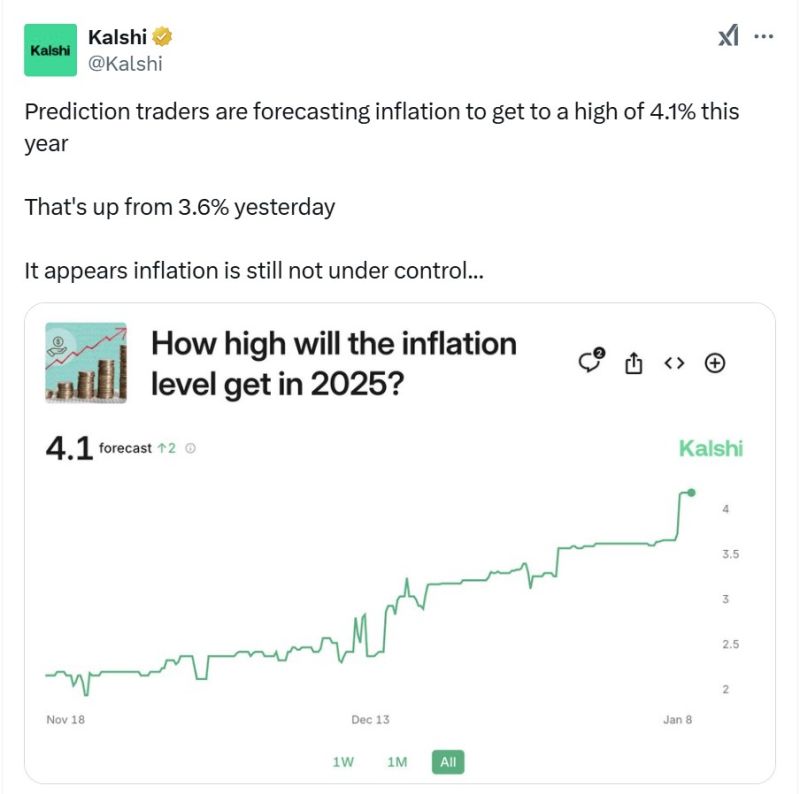

BREAKING: Prediction markets now see inflation rising as high as 4.1% in 2025.

Heading into 2025, expectations showed the inflation rate peaking at 3.6% in 2025. Prediction markets are saying inflation is back. Source: The Kobeissi Letter

YELLEN: "FISCAL POLICY NEEDS TO BE PUT ON A SUSTAINABLE COURSE"

As a reminder, Mrs Yellen was Fed vice chair and chair from 2010 to 2018 and has been treasury secretary since 2021. On an aggregate basis, she has been directly overseeing and presiding over a $15 TRILLION increase in US debt... Source: www.zerohedge.com

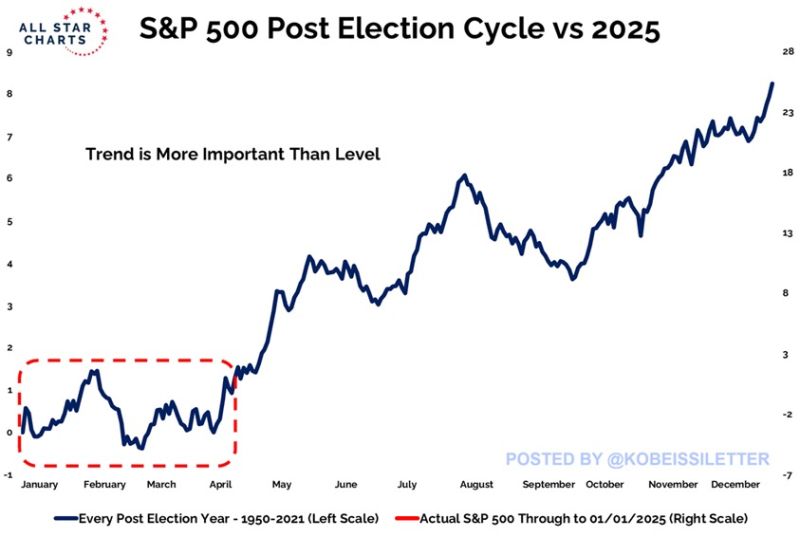

Should we get prepared for a choppy quarter???

The S&P 500 has gained ~1.0% on average in the first quarter after a US presidential election since 1950. It also historically comes with elevated volatility as market swings widen to both directions. On average, the first year of a new presidential cycle has seen an 8.2% average return. Source: The Kobeissi Letter, J-C Parets

President-elect Donald Trump on Tuesday announced a $20 billion FOREIGN investment to build new data centers ACROSS THE UNITED STATES, according to CNBC.

Emirati billionaire Hussain Sajwani, a Trump associate and founder of the property development company DAMAC Properties, is pledging “at least” that amount, the president-elect said at his Florida home Mar-a-Lago. “They may go double, or even somewhat more than double, that amount of money,” Trump said of Sajwani’s company. The “first phase” of the plan will take place in Texas, Arizona, Oklahoma, Louisiana, Ohio, Illinois, Michigan and Indiana, Trump said. Source: Stocktwits, CNBC

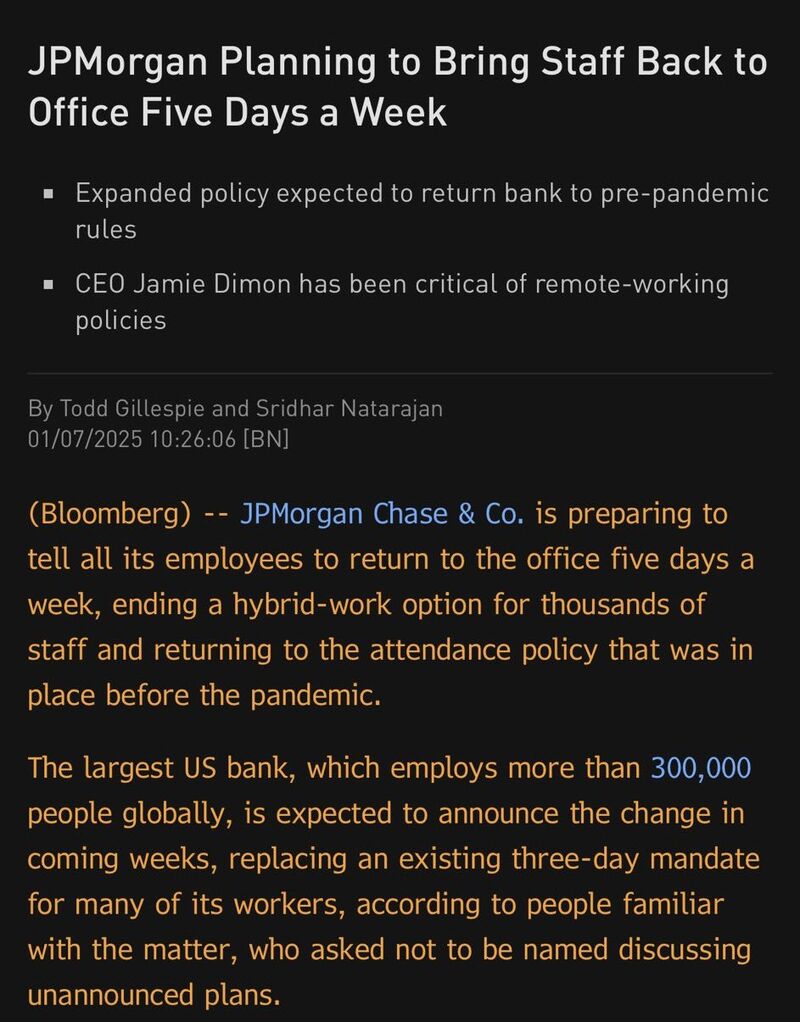

$JPM JPMorgan is preparing to tell all its employees to return to the office 5 days a week

according to Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks