Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

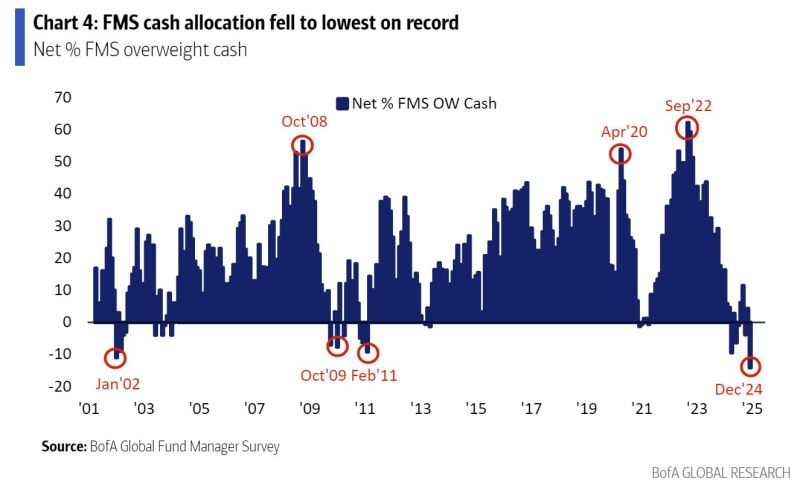

"Cash is trash"

Fund Manager cash allocations at a record low... Source: Callum Thomas, BofA

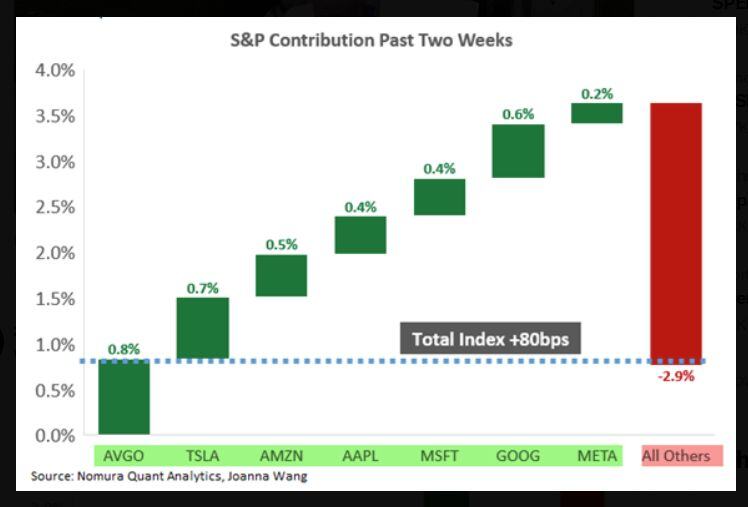

Why the S&P is up past two weeks

Source: Nomura thru zerohedge

According to Goldman, China Secretly Buying Up Massive Amounts Of Gold, 10x More Than Officially

👉According to the Goldman Sachs nowcast of central bank and other institutional gold buying on the London OTC market, October saw central banks buy a whopping 64 tonnes in October (vs. pre-2022 average of 17 tonnes), with China once again the largest buyer adding 55 tonnes, which is striking since the official number reported by the PBOC was one-tenth that, or just 5 tonnes. In other words, China is secretly buying up ~10x more gold than it admits. 👉Commenting on the surge in purchases, the Goldman analyst writes that "surveys and history suggest that EM central banks buy gold as a hedge against financial and geopolitical shocks" and adds that "central bank purchases will remain elevated because fears about geopolitical shocks have structurally risen since the freezing of Russian reserves in 2022, and because relatively low gold shares in EM central banks reserves vs. DMs leaves room for growth." In fact, 81% of the central banks surveyed by the World Gold Council expect global central bank gold holdings to rise over the next 12 months, with none anticipating a decline. 🚨 As shown on the chart below, what is far more striking is the staggering (and growing) divergence between the modest amounts of gold purchases reported by the hashtag#PBOC and the far greater amount China has actually purchased on the London OTC market, in a clear attempt to mask its staggering demand for the precious metal, and be extension, its diversification away from the dollar... Source; www.zerohedge.com

Santa Powell is coming to town.

Last FOMC interest rate decision of 2024 is today at 2PM ET, followed by the usual press conference. A 25bps rate cut looks like a done deal. Key questions:1) Why is he cutting while stocks are ATH and Core CPI above 3% 43 months in a row= 2) Will it be a "hawkish cut" with significant upside revisions to growth and inflation forecasts + downward revision to the dot plot? Merry Christmas Mr Powell Source image: TrendSpider

The stat of the day >>>

Yes, the Fed has already cut near all-time-highs and you know what ❓ The Bulls 🐮 Liked it 👍 The S&P 500 is less than 2% away from all-time highs the day before a Fed decision. Since 1980, there were 20 other times they cut rates within 2% of ATHs. The S&P 500 was higher a year later 20 times 🚀 Source: Ryan Detrick, CMT @RyanDetrick

Investing with intelligence

Our latest research, commentary and market outlooks