Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

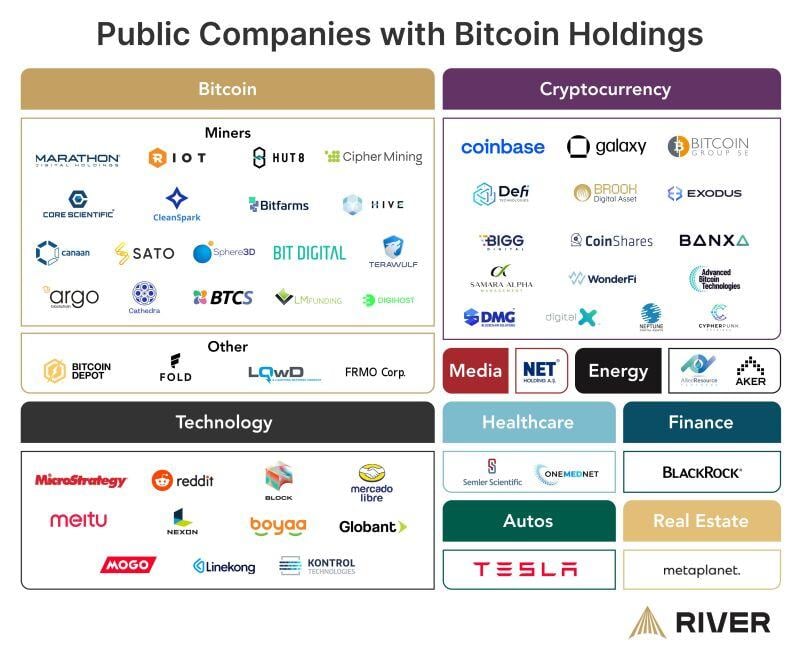

JUST NOW FROM THE WSJ: Donald Trump will be meeting privately with Coinbase $COIN CEO Brian Armstrong to discuss cabinet appointments.

The President of the USA speaking to the CEO of a major crypto exchange to figure out who are the best people to put in position of power that make decisions around crypto? This could be one of the most amazing four years of innovation for crypto with an entire White House ready to support the ecosystem. Source: Anit on X

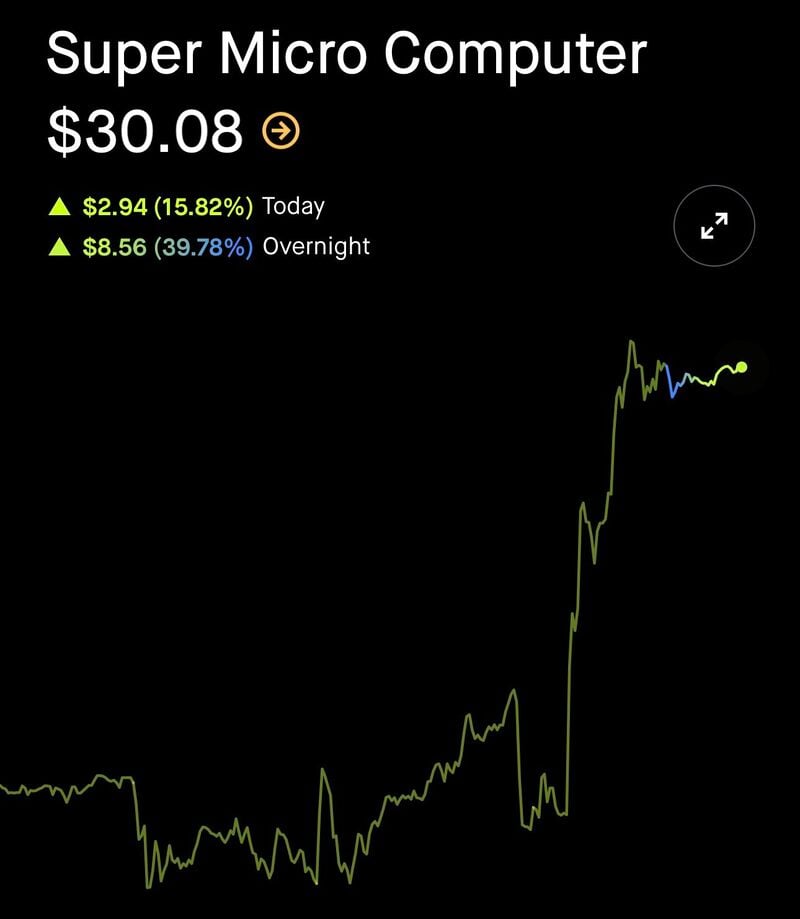

Super Micro Computer $SMCI is up almost 40% overnight 🚀🚀🚀

as the company announced the immediate appointment of BDO USA as its independent auditor and the filing of its compliance plan with Nasdaq !!! Source: Stocktwits @Stocktwits

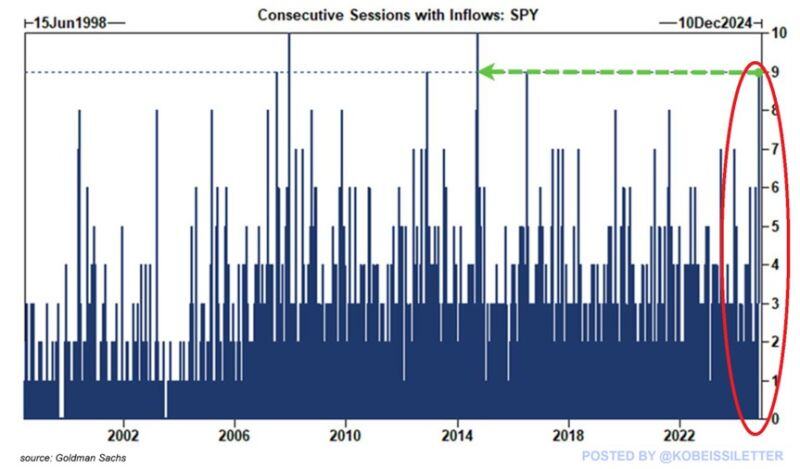

The S&P 500 ETF, $SPY, just saw 9 consecutive days of money inflows, the longest streak since 2014.

Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues. Since 2000, $SPY has only seen 4 streaks with 9 to 10 straight days of inflows: in 2007, 2013, 2014, and 2016. Massive inflows supported the 5%+ run in the S&P 500 following the election. Over the last 13 months, the S&P 500 has now added more than $15 TRILLION of market cap. Source: The Kobeissi Letter, Goldman Sachs

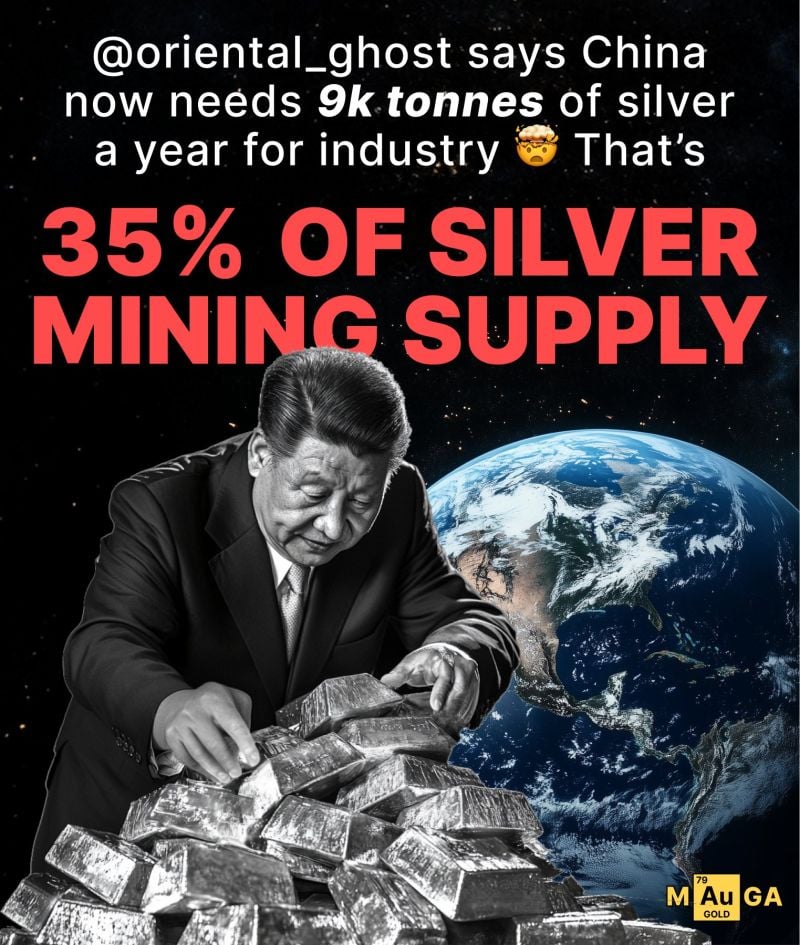

According to the best source of Chinese gold and silver data – @oriental_ghost – China is on a silver consumption BENDER

Source: ale Gold great again

Investing with intelligence

Our latest research, commentary and market outlooks