Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

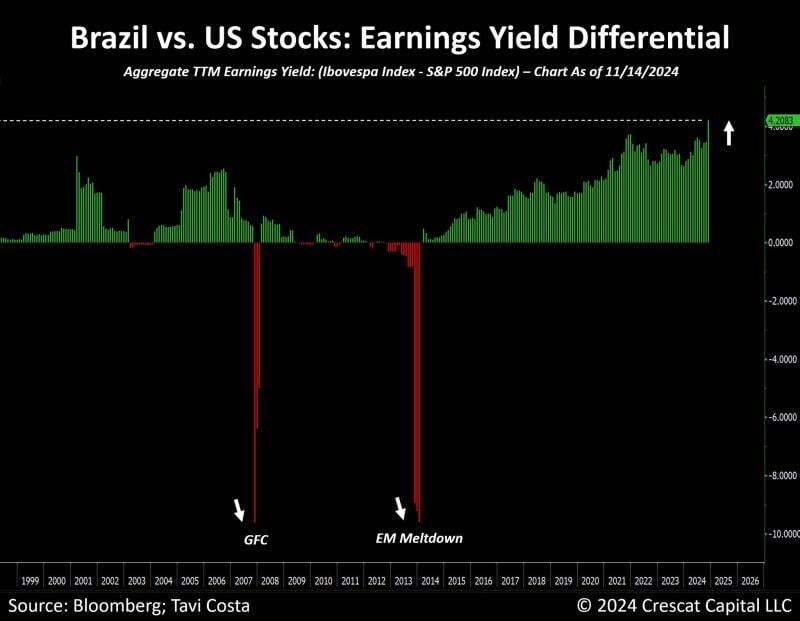

Based on earnings yield, Brazilian equities have never been cheaper relative to US stocks.

Source: Bloomberg, Tavi Costa

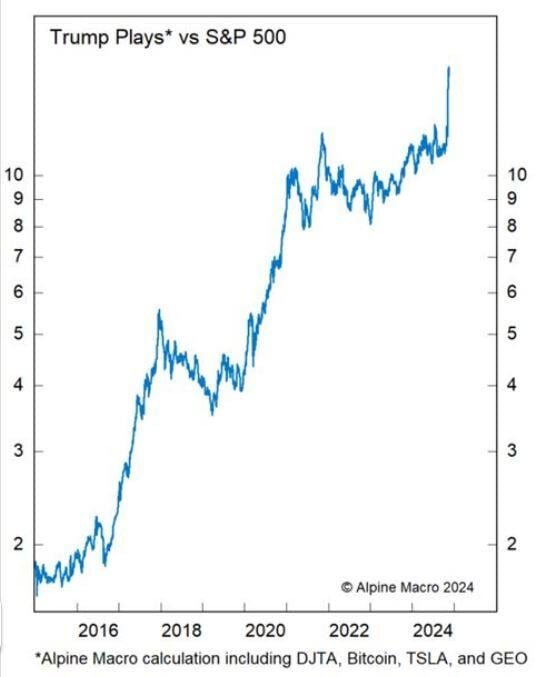

Here's the outperformance (vs. S&P 500) of a pure play Trump index created by Alpine Macro.

It owns DJTA, Bitcoin, Tesla and GEO equally-weighted

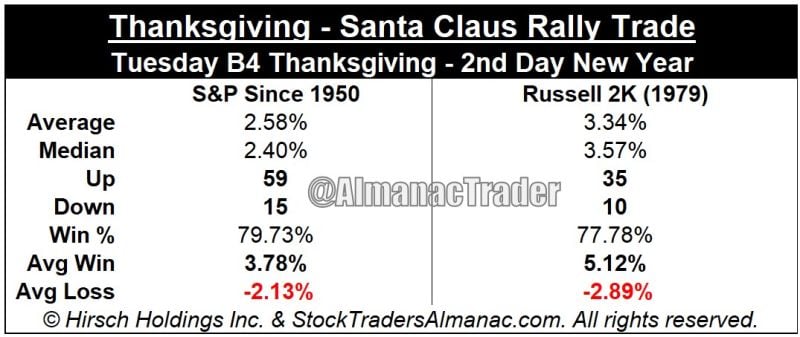

Feast on Small Caps?

The "Thanksgiving/Santa Claus rally trade" starts next Tuesday. Based on historical data, the S&P 500 up 79.73% of times since 1950. Average return is 2.58%. Since 19790, the Russell 2,000 is up 77.78% of times during this period, with an average return of 3.34%. We are supposed to enter the 3 months of the year: Santa Claus Rally + January effect. Source: Jeffrey A. Hirsch @AlmanacTrader

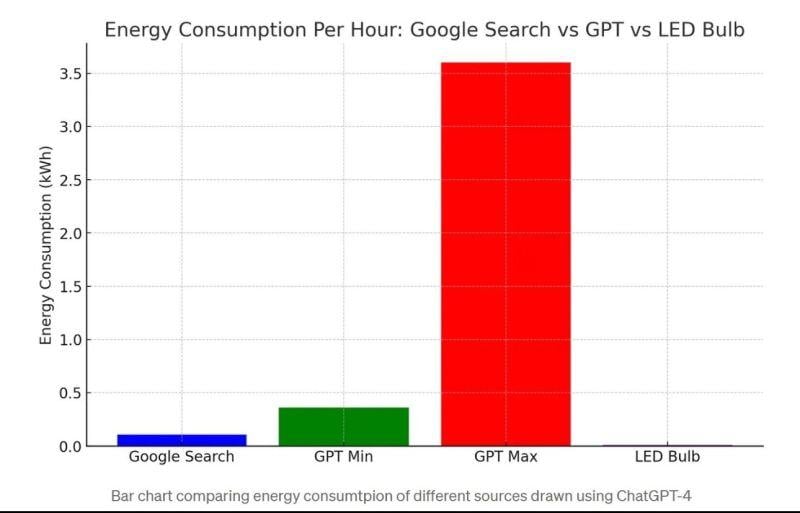

As highlighted by Andrea Lisi, CFA on X, market participants and policymakers have not fully understood the heavy toll artificial intelligence will take on our Electrical grid.

As shown on the chart below, a single Google search query typically uses about 0.3 watt-hours (Wh) of electricity. On the other hand, each ChatGPT query is estimated to consume around 2.9 watt-hours of electricity, which means 9.66 times more energy than a Google query! To run AI at scale, both the private and public sectors will have to invest a significant amount of money to strengthen the electricity grid.

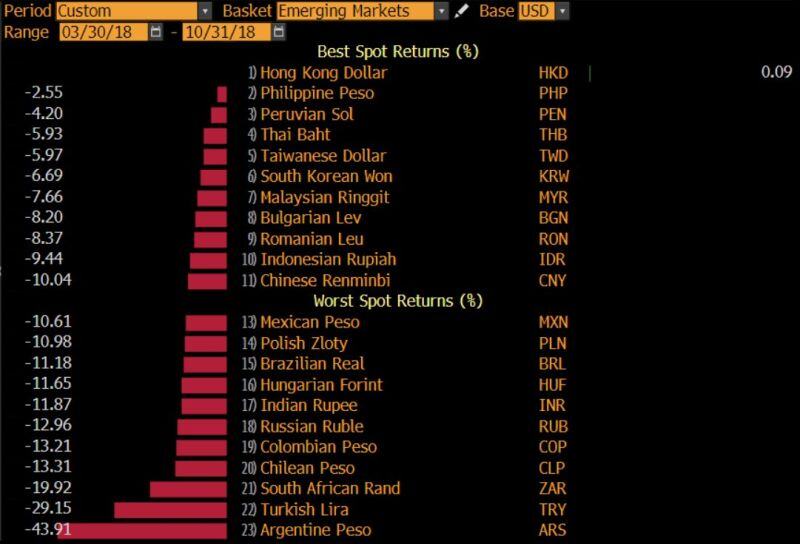

As a reminder... From April to October 2018, the US announced tariffs on half of all imports from China at 25%.

The Yuan fell 10% in an almost full offset. Turkey and Argentina had their own crises at the time and were blowing up constantly. But all of EM got hammered. Brazil was down 11%... History doesn't repeat but often rhymes... Source: Robin Brook, Bloomberg

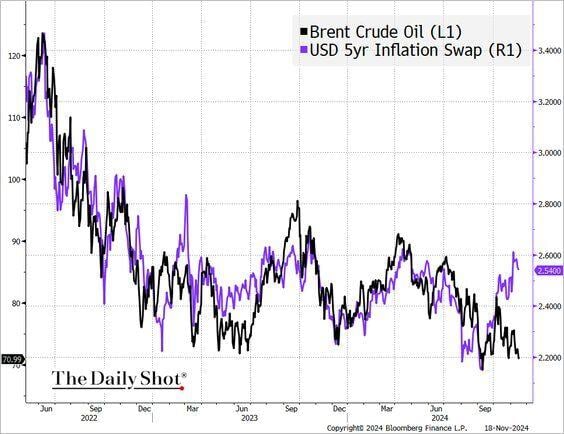

Inflation expectations have diverged from crude oil prices.

Source: The Daily Shot

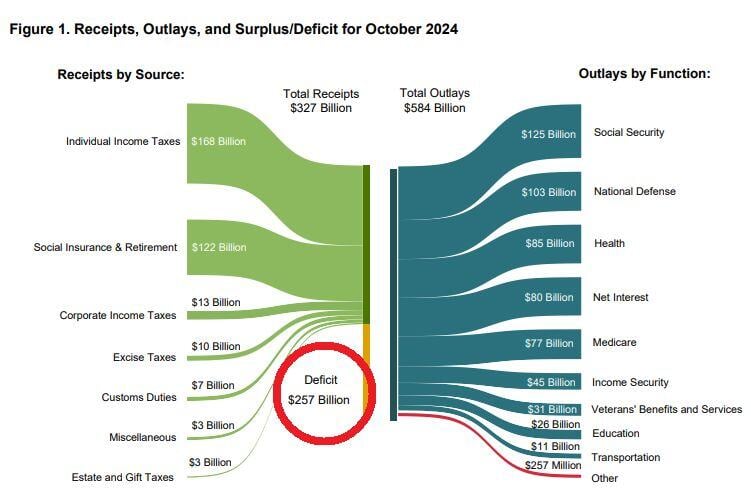

US GOVERNMENT BORROWING EXPLODED IN OCTOBER

US budget deficit hit a STAGGERING $257.5 BILLION in October. This is up nearly 400% year-over-year versus $66.6 BILLION last year. This was also the 2nd highest deficit in the entire US history. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks