Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The other "Trump Trade": $DJT vs. $NYT

Trump Media $DJT $10.5B New York Times $NYT $9.2B Source: Lawrence McDonald, Bloomberg data.

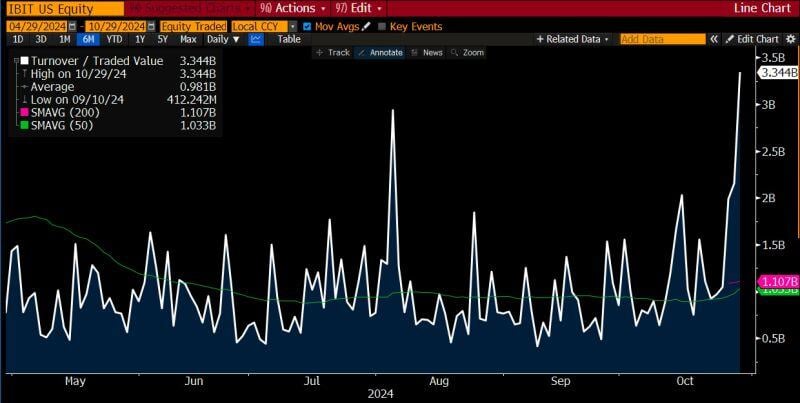

Eric Balchunas on X:

"$IBIT iShares Bitcoin ETF traded $3.3b today, biggest number in 6 months, which is a bit odd because $BTC was up 4% (typically ETF volume spikes in a downturn/crisis). Occasionally though volume can spike if there a FOMO-ing frenzy (a la $ARKK in 2020)". Given the surge in price past few days, his guess is this is latter, which means that inflows could be even bigger this week. Source: Eric Balchunas on X, Bloomberg

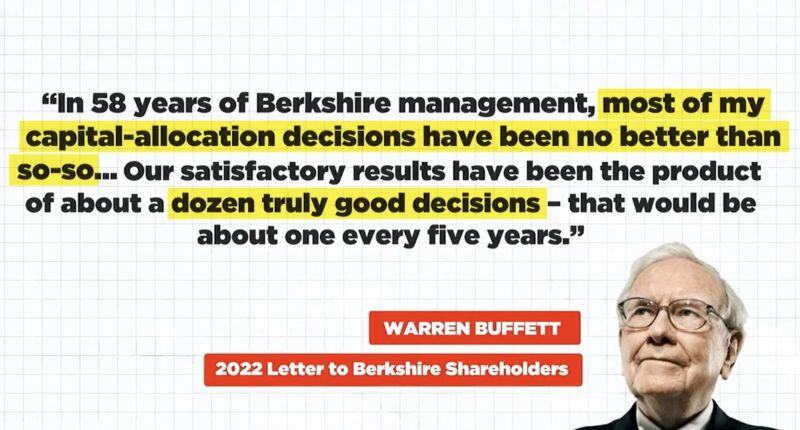

Warren Buffett once said: 'My success over 58 years was mainly the result of “about a dozen truly good decisions."

Source: Compounding Quality

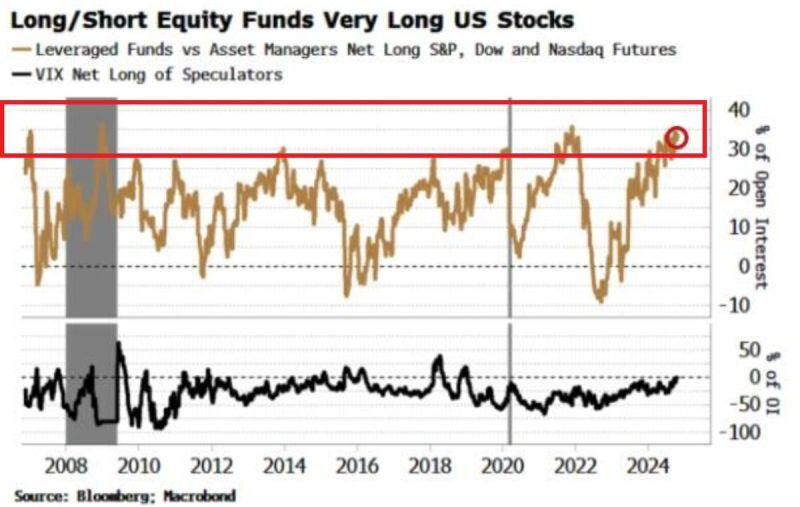

🚨 MARKET EUPHORIA IS AN UNDERSTATEMENT🚨

Asset managers' net long positions on the S&P 500, Dow Jones and Nasdaq futures are now the second-highest in 15 YEARS. They are now only slightly below the 2021 levels seen before the 2022 bear market. Professionals are all in stocks. Source: Global Markets Investor

Saudi Arabia’s Public Investment Fund, which has about $930bn worth of assets, said it intended to cut the proportion of funds invested overseas to between 18 and 20%, down from 30%.

Yasir Al Rumayyan, governor of PIF and chairman of Saudi Aramco and the FII Institute, speaking at the start of FII8 in Riyadh on Tuesday said there needs to be a global shift in focus from short term gains to sustainable growth supported by Artificial Intelligence (AI) that could benefit both economies and societies. The head of the kingdom’s sovereign wealth fund added that in a world marred by uncertainty, countries which can bridge gaps between East and West are essential. He said Saudi Arabia is a “super connector” thanks to its unique resources and strategic geographic location, which enables it to drive investments in infrastructure and technology. Source: FT, Zawya

🥉 Swiss bank UBS smashes third-quarter expectations with $1.4 billion in profit (vs. $667.5 million expected)

👉 Group revenue was $12.33 billion, above analyst expectations near $11.78 billion. Q3 highlights included: - Operating profit before tax of $1.93 billion, up from a loss of 184 million in the same quarter last year. - Return on tangible equity hit 7.3%, compared with 5.9% over the second quarter. - CET 1 capital ratio, a measure of bank solvency, was 14.3%, down from 14.9% in the second quarter. The lender said it expects to complete its planned $1 billion share buyback program in the fourth quarter and intends to continue repurchases in 2025. 💪 UBS Sees Uninterrupted Client Momentum: Switzerland's largest bank reports strong transactional activity in its core business and expects to achieve its objective of $100 billion in net new assets by the end of the year. Source: CNBC

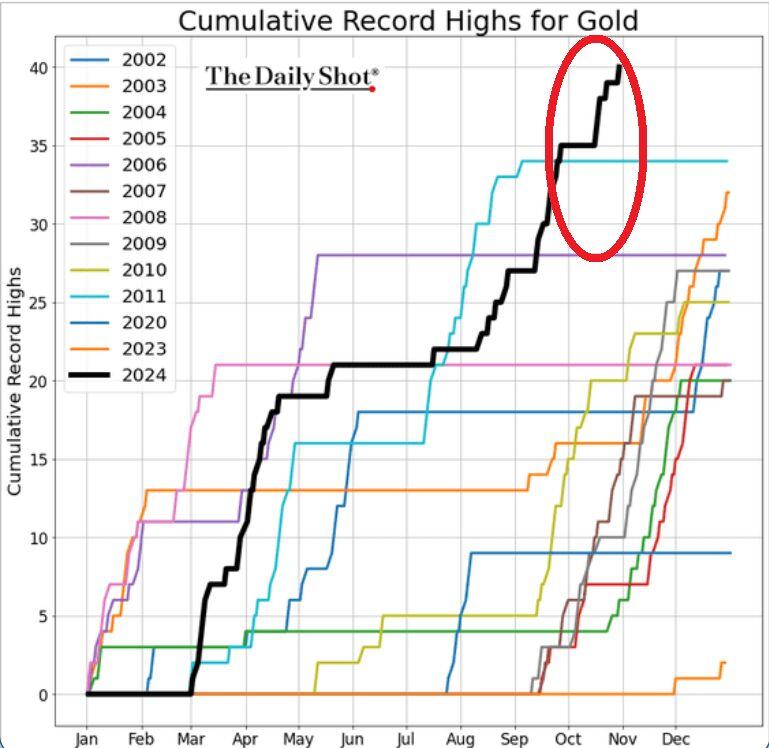

GOLD RALLY HAS BEEN TRULY UNSTOPPABLE

Gold prices have hit 40 all-time highs so far in 2024, marking the best year this century. The so-called barbarous relic has rallied 33% year-to-date and is on track for the best annual performance since 1979. Source: Global Markets Investor, The Daily Shot

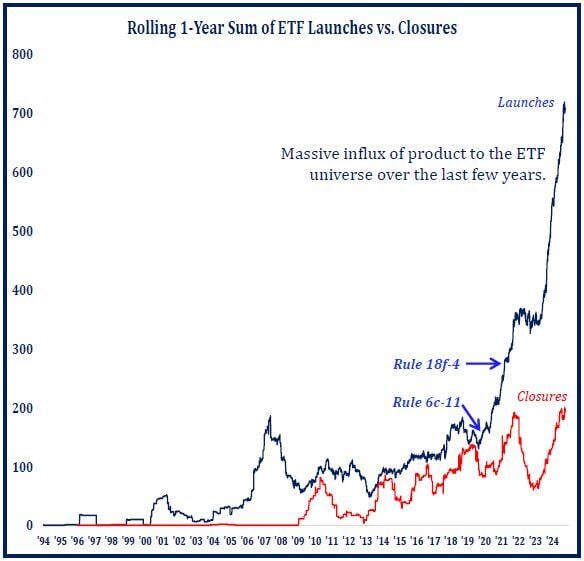

ETF launches have been going vertical over past few years…

700+ new ETFs have been launched just over the trailing 12 months. Source: Nate Geraci @NateGeraci via Todd Sohn

Investing with intelligence

Our latest research, commentary and market outlooks