Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

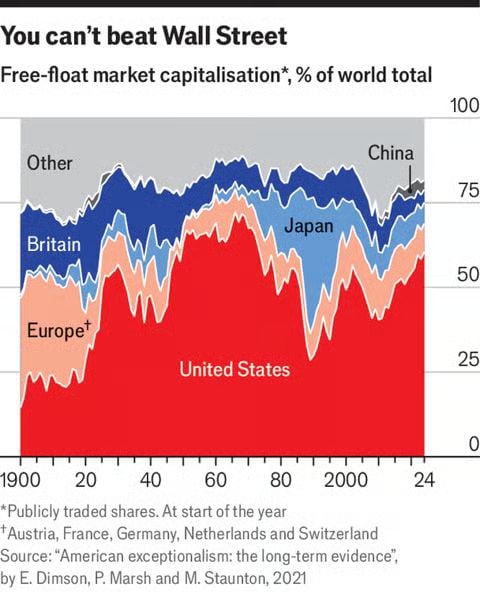

Despite talks of de-dollarisation, America dominance has never been that strong:

• US stock exchanges capture more than half of global free-float market capitalisation • US share of global stock market is 2.3 times its share of global GDP — the highest-ever ratio Source: Agathe Demarais @AgatheDemarais

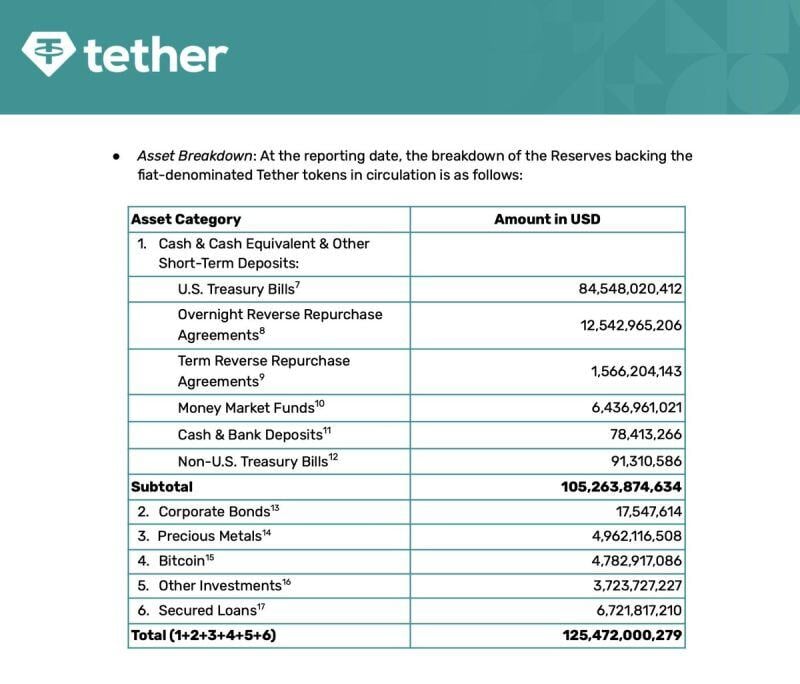

Tether's latest Q3 attestation reports $4.78 billion worth of Bitcoin when BTC was $63,473

At today's prices, that same amount of Bitcoin is worth $5.3 billion. In total, the value of their assets is over $6 billion more than the value of their liabilities. Source: Bitcoin News BitcoinNewsCom

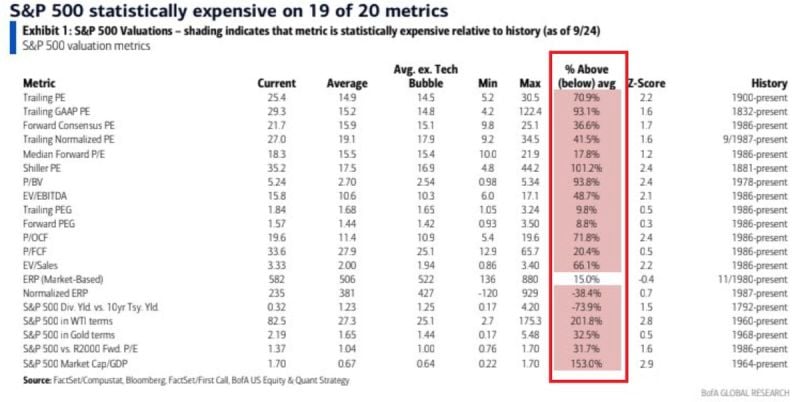

🚨THIS IS ONE OF THE MOST OVERVALUED MARKETS IN HISTORY🚨

S&P 500 is expensive on 19 out of 20 metrics, according to the Bank of America analysis. Some metrics such as Shiller Price to Earnings ratio (CAPE) are over 100% above historical averages Source: Global Markets Investor

MicroStrategy just unveiled its bold new "21/21 Plan" to raise $42 billion in capital over the next 3 years.

The strategy includes $21 billion from equity and $21 billion from fixed income. With this capital injection, MicroStrategy aims to boost its Bitcoin holdings and enhance BTC yield, solidifying its commitment to Bitcoin as a core treasury reserve asset.

The share of US consumers expecting higher stock prices over the next 12 months hit 51.4%, the highest on record.

This is even higher than the previous records seen in 2018 and 2000 before the Dot-Com bubble peaked. The percentage has more than DOUBLED over the last 2 years as the stock market has seen one of the largest gains this century. The S&P 500 is now up 40% over the last 12 months marking its 4th best performance since 2000. Stock market sentiment has never been so euphoric. Source: The Kobeissi letter

"Buy Waste Management first thing in the morning"

Source: Not Jerome Powell on X

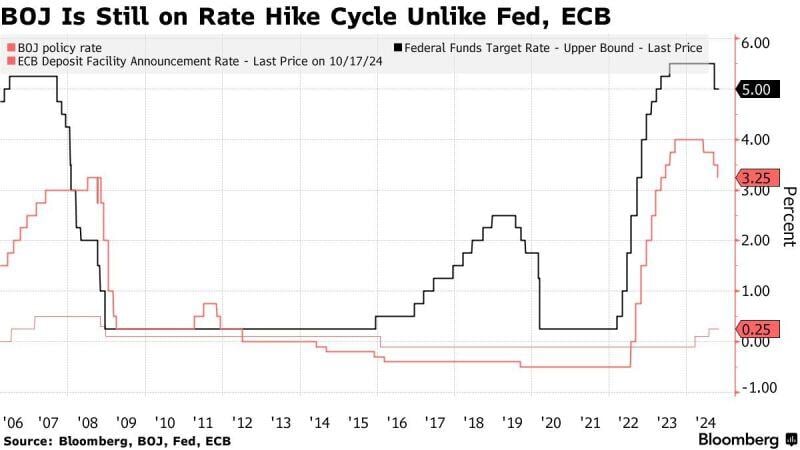

The BOJ kept interest rates steady on Thursday

The BOJ roughly maintained its forecast that inflation will hover near its 2% inflation target in coming years, signaling its readiness to continue rolling back its massive monetary stimulus. The Yen climbed as much as 0.9% on Ueda comments.

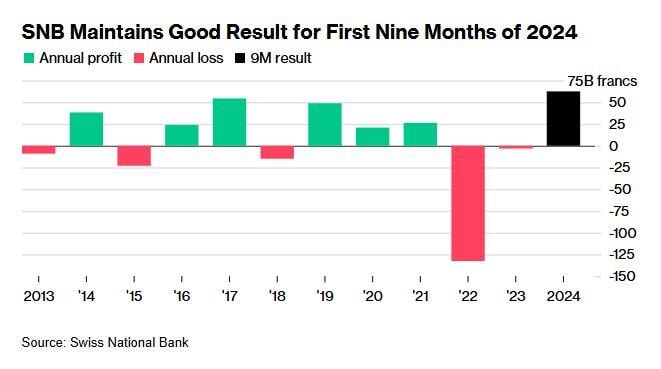

The Swiss National Bank made a solid nine-month profit on rising equities, bonds and gold prices, increasing the chances for a restart of profit distributions after a two-year break.

Switzerland’s central bank notched up a gain of 62.5 billion francs ($72 billion) for the first nine months of the year, it said on Thursday. Although the strong franc ate into the results, the SNB extended its profit during the July-September period. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks