Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

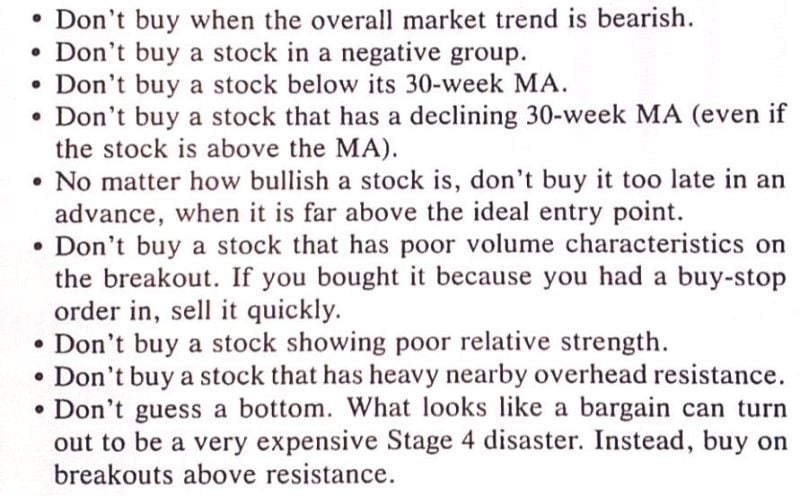

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it: US September CPI inflation falls to 2.4%, ABOVE expectations of 2.3%.

Core CPI inflation RISES to 3.3%, above expectations of 3.2%. For the first time since March 2023, Core CPI inflation is officially back on the rise. Same story on CPI as previous month: Total is “ok” at +2.4% because energy is collapsing, but core is still +3.3% and Services remain HOT & STICKY at +4.7%. Transport +8.5% Indeed, while September CPI inflation is at 2.4%, inflation is much higher in many basic necessities: 1. Car Insurance Inflation: 16.3% 2. Transportation Inflation: 8.5% 3. Homeowner Inflation: 4.9% 4. Car Repair Inflation: 4.9% 5. Rent Inflation: 4.8% 6. Hospital Services Inflation: 4.5% 7. Food Away From Home Inflation: 3.9% 8. Electricity Inflation: 3.7% Source: Bloomberg, HolgerZ, The Kobeissi Letter

JUST IN : UK'S GOVERNMENT IS CONSIDERING RAISING CAPITAL GAINS TAX TO AS HIGH AS 39% PER THE GUARDIAN

Source: @gurgavin

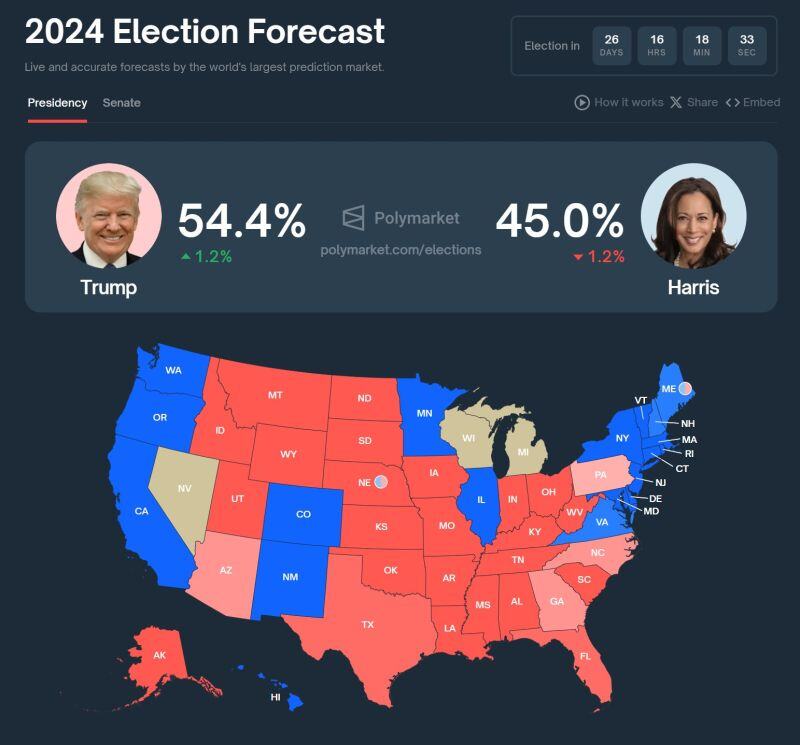

Trump is leading Kamala by 9.4% on Polymarket, the widest gap since Biden dropped out.

Trump is even leading in Wisconsin and Michigan. 26 days remain. Source: Joe Consorti, Polymarket

JUST IN 🚨 : China expected to announce a new stimulus package of $283 Billion

Investors are on tenterhooks as Beijing prepares to deliver fresh policies over the weekend that could jumpstart its economy. China’s Finance Minister Lan Fo’an is set to hold a press conference at 10 a.m. on Saturday local time on “intensifying” fiscal stimulus policies, the country’s State Council Information Office said. With Beijing at risk of missing its full year economic growth target of 5%, some analysts are confident that authorities are ready to deliver major fiscal stimulus at the highly anticipated event, while others remain skeptical. Most economists expect some sort of additional stimulus, but there are many differing views on its size as well as the priorities of the package. Some have floated a figure between two and three trillion yuan (the equivalent of $282.8 billion to $424.2 billion), while others have suggested 10 trillion yuan ($1.4 trillion). Source: Barchart, CNBC

In case you missed it... Atlanta Fed President Raphael Bostic is okay with skipping rate cut in November 🚨

Source: Barchart

Elon Musk has shown off his “Cybercab” in an eagerly anticipated event for Tesla investors

But was vague on crucial details as he predicted that its self-driving taxi would be available for less than $30,000. Musk said production of the robotaxis was likely to start before 2027, with the caveat that the service needed to be approved by regulators. He also unveiled a prototype for a 20-person autonomous vehicle called “the Robovan”. Since Tesla announced a “robotaxi day” on April 5, its shares have risen 45 per cent in anticipation of the unveiling. Musk has said the new electric vehicles could take the company’s valuation as high as $5tn, about seven times its current market value. Musk has repeatedly missed his own targets to roll out self-driving taxis, first promising fully autonomous rides from Los Angeles to New York by the end of 2017. In 2019, he predicted that 1mn robotaxis would be on the road by the following year. On Thursday, he said unsupervised rides using its self-driving software could be available in Texas and California from next year. Source: FT >>> https://lnkd.in/esX_w5P2

Investing with intelligence

Our latest research, commentary and market outlooks