Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

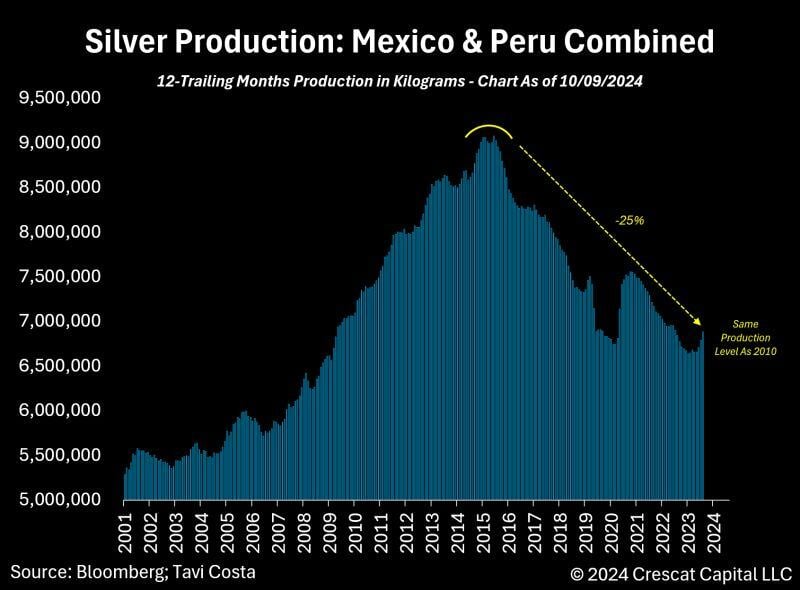

Despite silver prices being close to their highest levels in 13 years, the production from the world's two largest producers of the metal has barely changed.

Silver production is still at the SAME level it was back in 2010. This clearly reflects how constrained new supply remains. According to Tavi Costa, this is likely to continue given the limited capital being invested in developing new mines. Source. Bloomberg, Crescat Capital

Among the best ad ever... Lego KitKat Porsche Nike

Source: Compounding Quality

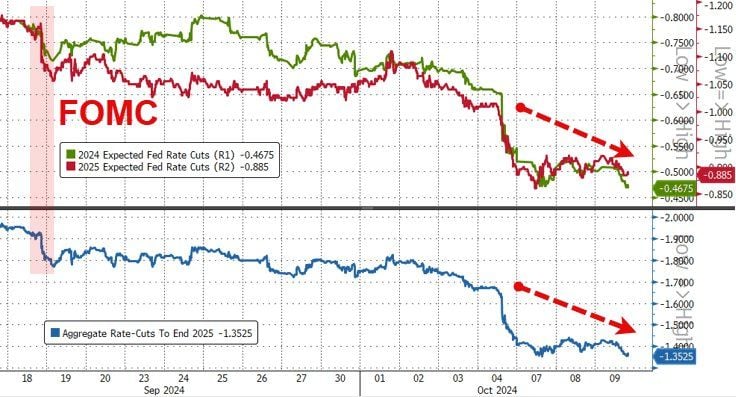

FOMC MINUTES WERE PUBLISHED TODAY, here are the highlights 👇

▪ ‘Substantial majority’ backed half-point rate cut ▪ ‘Some’ officials would have preferred quarter-point cut ▪ ‘Almost all’ officials saw higher risks to labor market ▪ ‘Almost all’ participants saw lower inflation risks The key takeaway >>> FOMC Minutes Show Fed Considerably More Divided Over Size Of Rate Cut While there was only one dissent, the FOMC Minutes show "some" officials preferred a 25bps cut. Despite the apparent dovish pivot, expectations for rate-cuts (this year and next) has plunged dramatically - see chart below Source: Stocktwits, zerohedge

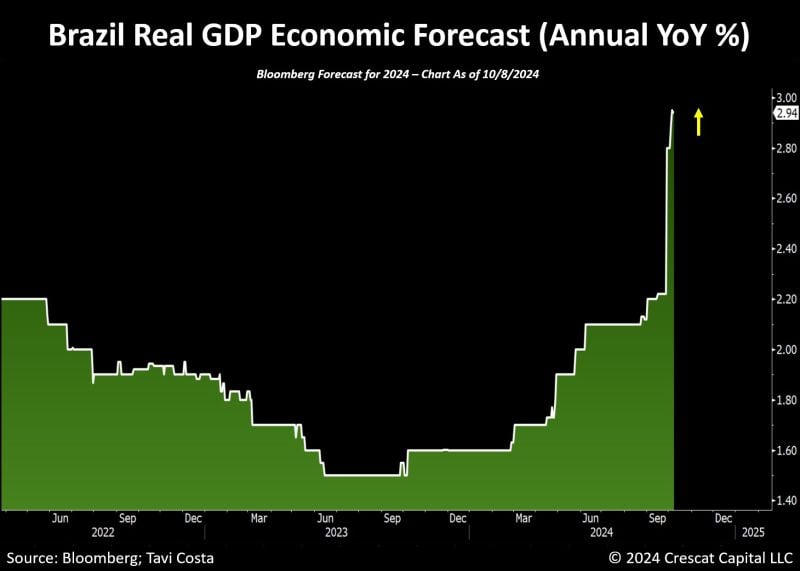

Meanwhile: Very significant upward revision in the real GDP forecast for Brazil this last month.

Source: Tavi Costa, Bloomberg

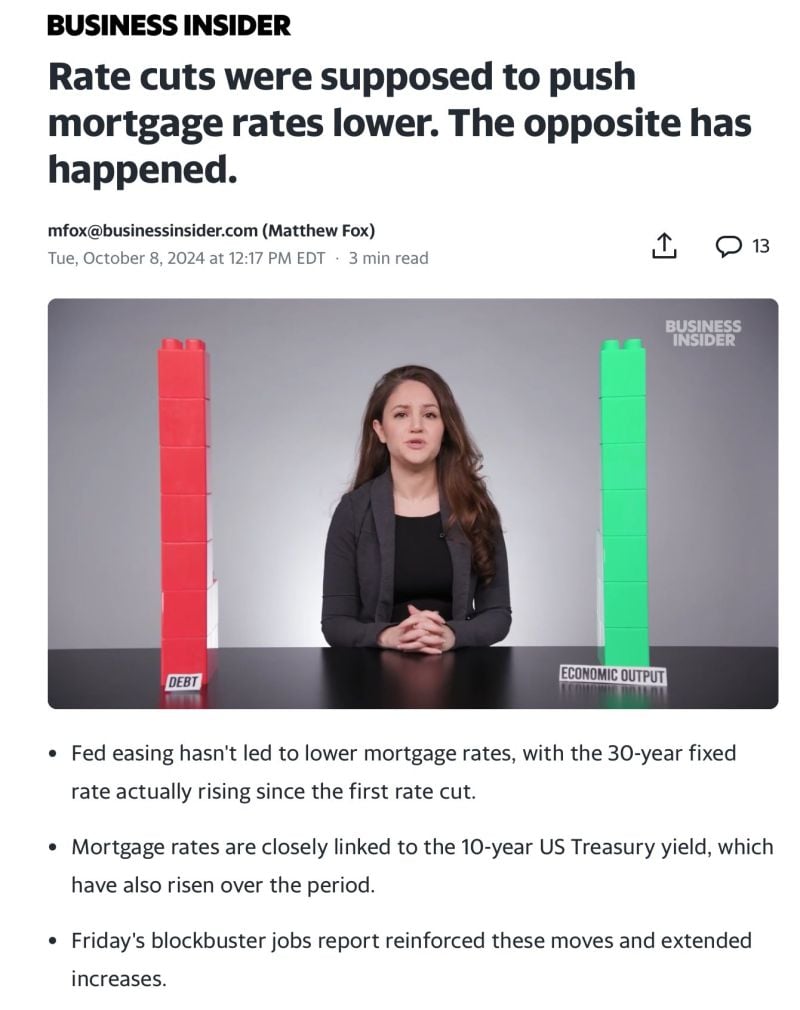

One of the reasons mentioned by many analysts to explain the aggressive rate cut (50bps) by the Fed in September was the following:macr

Shelter is the sticky component of inflation. If the Fed cut rates, we should see a drop in the mortgage rate which will enable more real estate supply and thus lower shelter inflation. Well, the Fed cut rates but mortgage rates are not declining. They are even moving higher? Has the Fed lost control of the bond market?

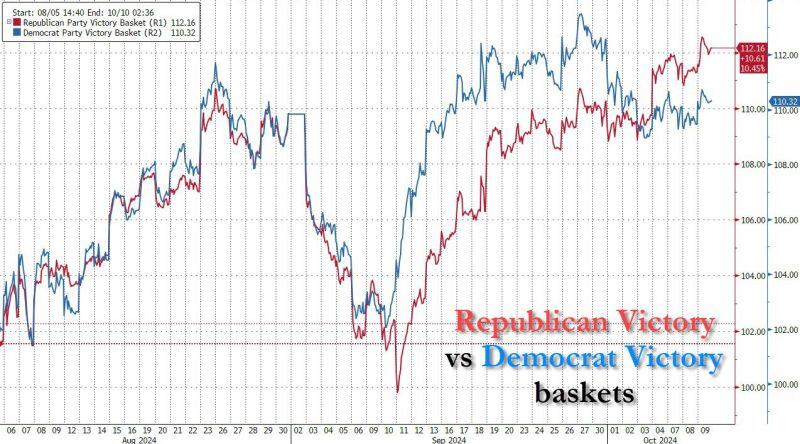

It's not just online betting markets:

Goldman's "Republican Victory" basket surged today and has taken the lead over "Democrat Victory" for the first time since the debate. Source: Bloomberg, www.zerohedge.com

Is this market unbreakable?

The S&P 500 is about to hit $50 TRILLION in market cap for the first time in history. It's now up +22% this year and over +40% since the October 2023 low. Despite many headwinds (Middle east tensions, US elections uncertainties, etc.), even a pullback of 5% is barely able to hold... How far can this bull market go without any correction??? Source: The Kobeissi Letter

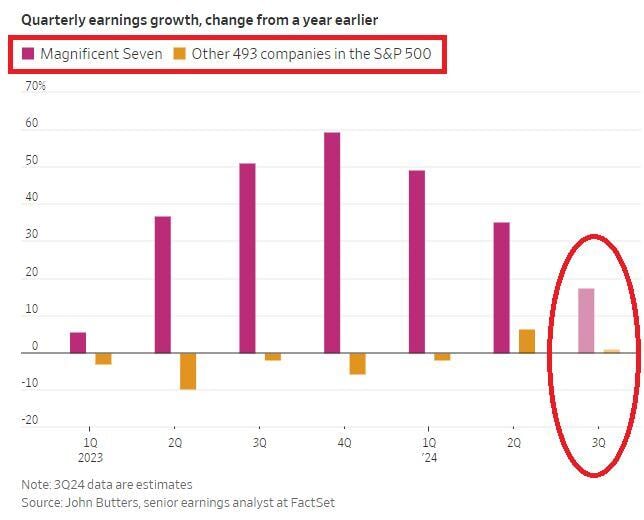

😱 The shocking chart of the day >>> S&P 500 COMPANIES EARNINGS GROWTH DOES NOT EXIST WITHOUT MAGNIFICENT 7😱

In 5 out of the last 6 quarters, the S&P 500 excluding Magnificent 7 profit growth has been negative. It is estimated the Mag 7 net income will grow by 18% in Q3 2024 while the other 493 firms by 1%. Note however 2 changes in trend: 1) The Mag 7 eps growth is slowing down (from a high base); The non-Mag 7 EPS growth is picking up (and turning slightly positive) from a low base. Sometimes the second derivative is more important than the absolute number. Time will tell... Source: The Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks