Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

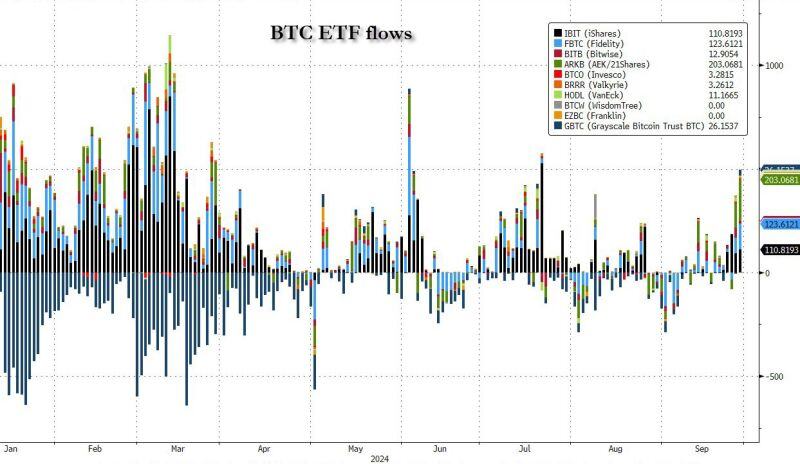

- bitcoin

- Asia

- europe

- geopolitics

- investing

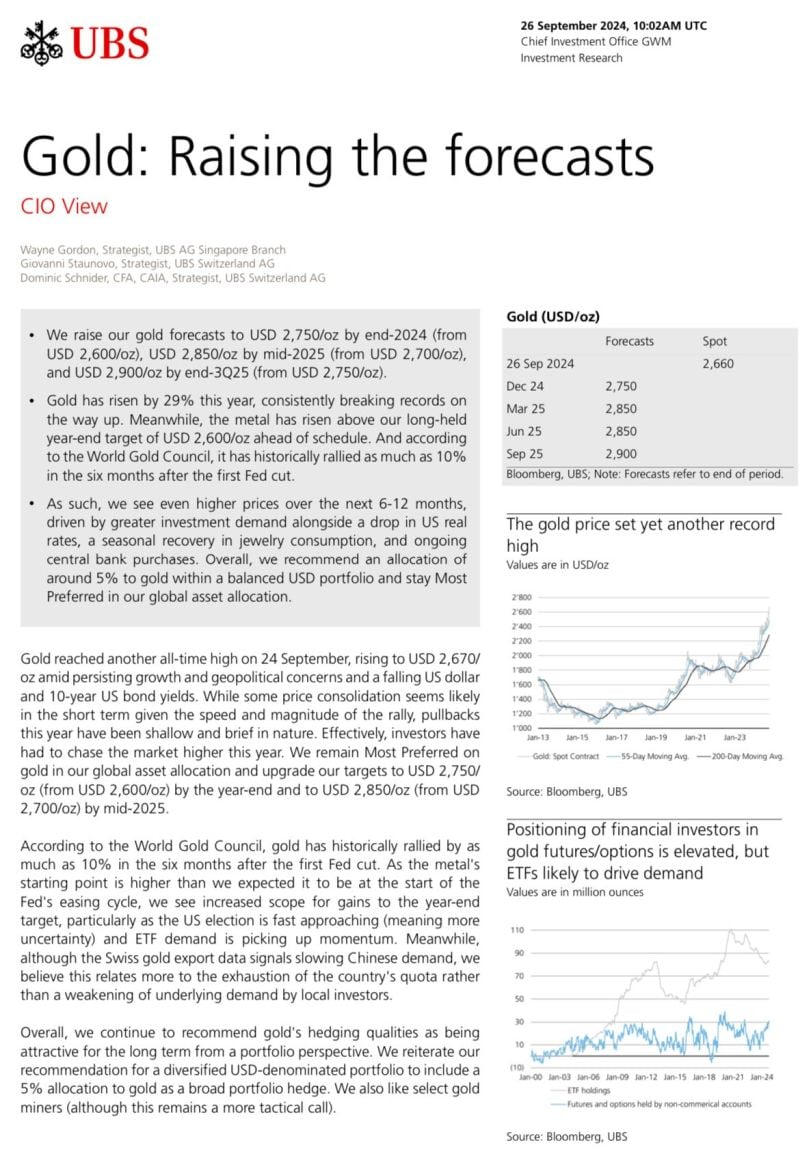

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Global money supply is rising once again, having increased by $7.3 trillion over the past year.

That is the highest growth rate in two years. Source: Bloomberg, Tavi Costa

THE WEEK AHEAD...

👉 In the US >>> 🚨 Fed Chair Powell Speaks - Monday September ISM Manufacturing data - Tuesday JOLTs Jobs data - Tuesday ADP Nonfarm Employment data - Wednesday Initial Jobless Claims - Thursday 🚨 September Jobs Report - Friday 👉 In the rest of the world >>> 🚨 October OPEC Meeting - Wednesday In Europe, the flash CPIs will continue to come in for Germany and the Eurozone. Highlights in Asia include the Tankan survey and industrial production in Japan, as well as PMIs in China.

China's Stock Market Today as China’s factory activity contracts less than expected in September.

1. Chinese stocks up 6% today and 18% in 5 days 2. Beijing 50 index posts RECORD 15% intraday jump 3. RECORD 1 trillion Chinese Yuan traded in 30 minutes 4. Brokerages open 24/7 to accommodate retail traders 5. Commerce Ministry says it will "improve policy effectiveness" 6. Chinese brokerages crashing due to high traffic China up 25% in just over 2 weeks. Source: The Kobeissi Letter, David Ingles, Bloomberg

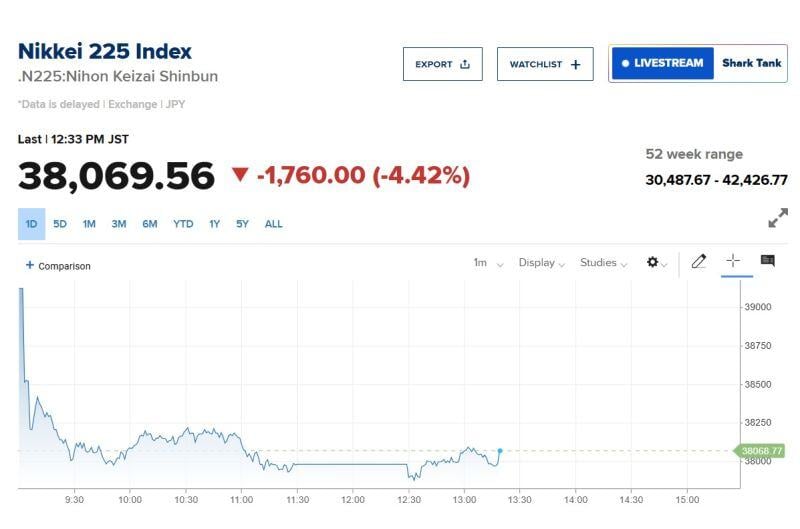

Nikkei is DOWN -4% following Ishiba's victory

The background: On Friday (after the close of Japan's markets) Ishiba, a 67-year-old former defence and agriculture minister, was elected LDP president on his fifth attempt and will succeed Fumio Kishida as Japan’s prime minister after a parliamentary vote on October 1 Immediately after Ishiba’s victory was declared on Friday, the yen surged more than 1 per cent against the dollar on market perceptions that he would not resist efforts by the Bank of Japan to normalise monetary policy and to push ahead with interest rate increases. Japanese equities had risen earlier on Friday amid expectations that one of Ishiba’s more market-friendly rivals would win. But Nikkei 225 now slumps more than 4 per cent as a response to the stronger yen.

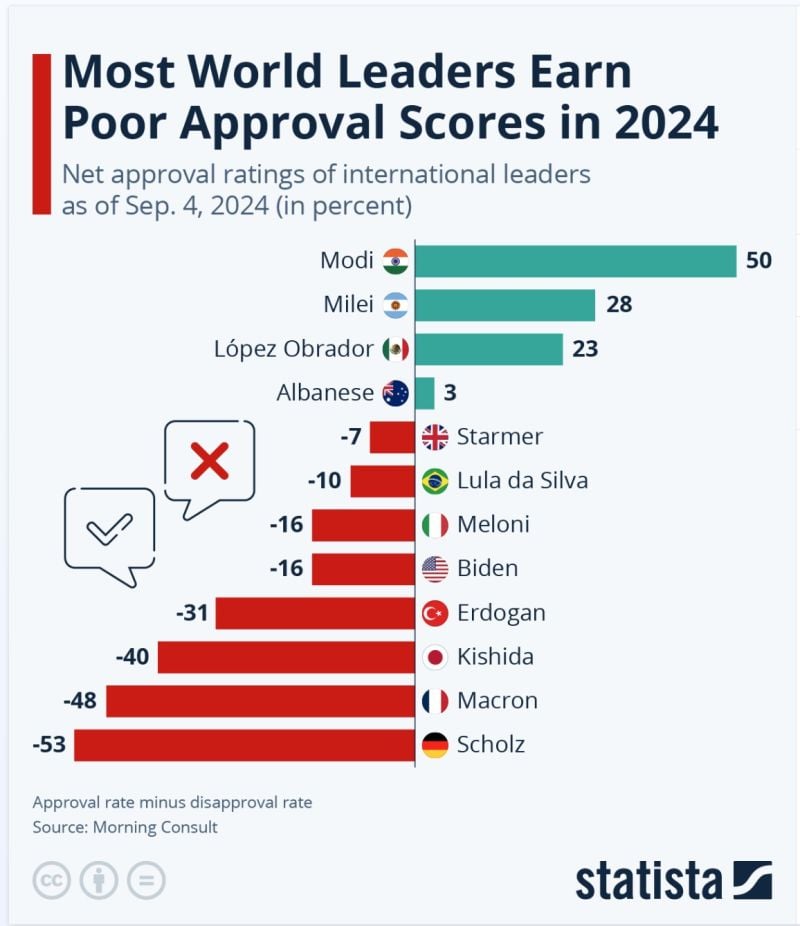

Out of the 25 world leaders included in a release by Morning Consult

Only eight can currently claim positive net approval ratings - meaning that more people in their country approve of them than disapprove. The exceptions are Prime Ministers Narendra Modi, Anthony Albanese, Dick Schoof, Simon Harris and Donald Tusk of India, Australia, the Netherlands, Ireland and Poland, respectively, as well as the presidents of Mexico, Argentina and Switzerland, Andrés Manuel López Obrador, Javier Milei and Viola Amherd. Source: Statista

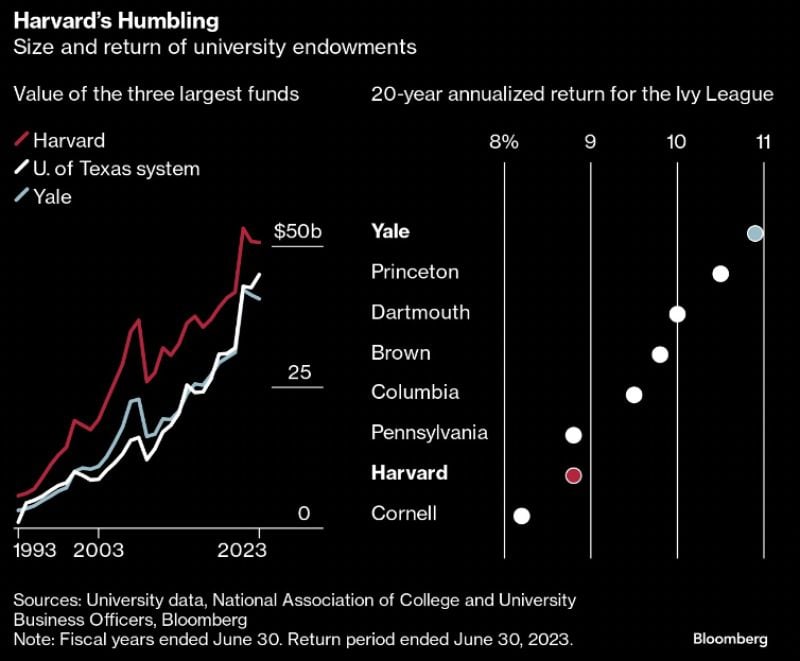

OUCH! Harvard's once-leading endowment fund has become not-so-smart money, as two decades of poor returns leave it firmly behind peers.

Over the past 20yrs, the 8.8% annualized return for Harvard’s endowment ranked 7th of the 8 Ivy League universities and lagged 60% of university funds w/>$5bn under management. Harvard’s 10 year return trailed 80%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks