Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

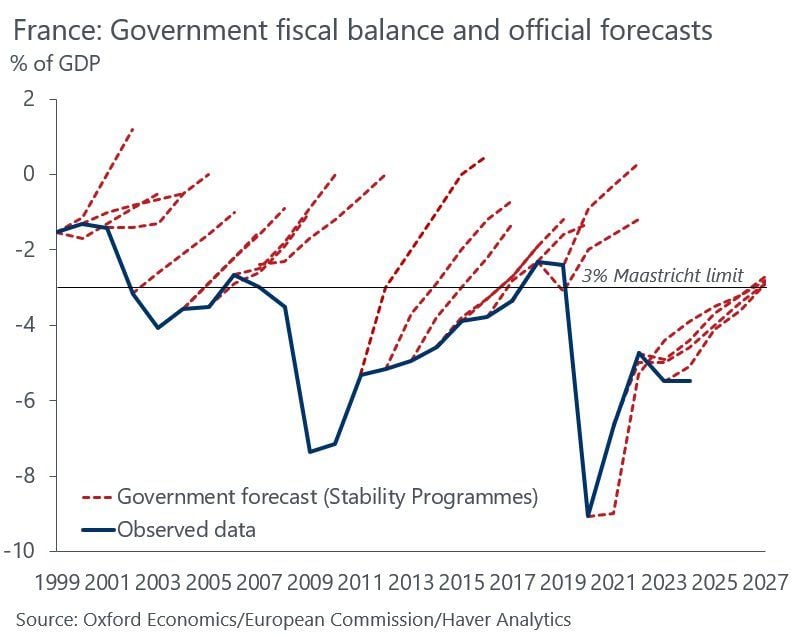

France has always missed its fiscal deficit forecasts

France has the highest tax burden in Europe, so cannot increase taxes without throttling growth. Spend is mostly pensions & local governments And with political paralysis there won’t be any structural reforms. Is a fiscal crisis looming? Source: Michel A.Arouet, Oxford Economics

HedgeFunds are buying Chinese Stocks at the fastest speed in history

Source: Barchart

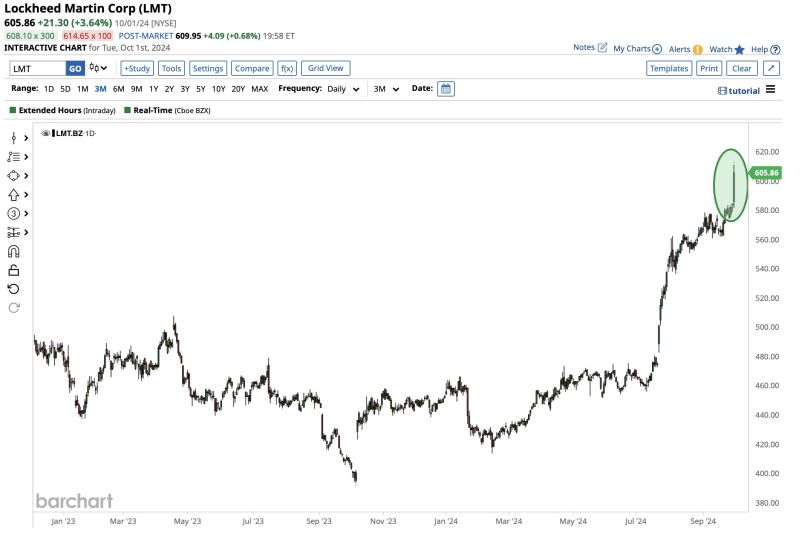

geopolitical risks are not going away anytime soon...

Lockheed Martin $LMT soars to all-time high 📈 Source: Barchart

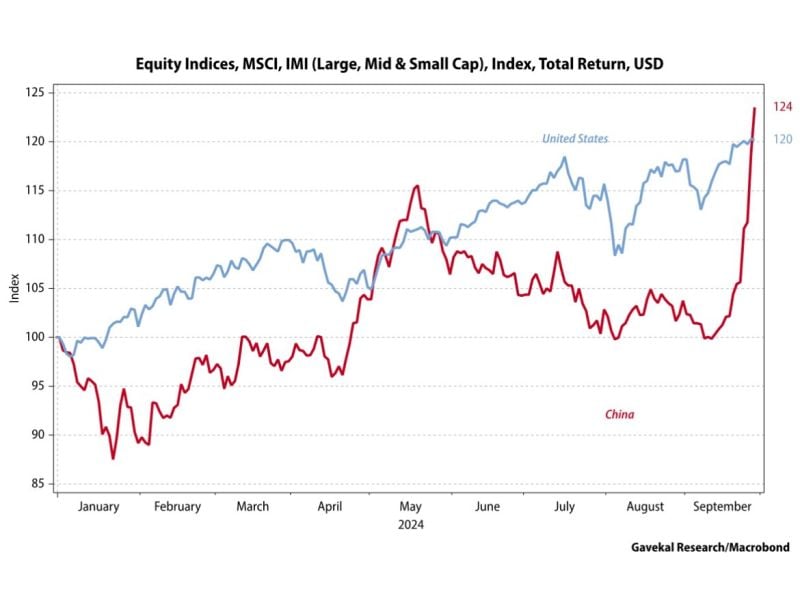

Sometimes things come at you fast: MSCI China now outperforming MSCI USA year to date

Source: Louis-Vincent Gave, Gavekal

😱Yesterday's China equity market performance in one chart !!!

Below is a heat map of today's returns of the 2,230 stocks which belong to the Shanghai Composite index... Not a single one was down (the worst one was actually flat). And 10 stocks gained more than 20%... Source: Oktay Kavrak, CFA

STILL BREAKING 🚨 China Short Sellers

This just got exponentially worse for Hedge Funds shorting Chinese stocks! Source: Barchart

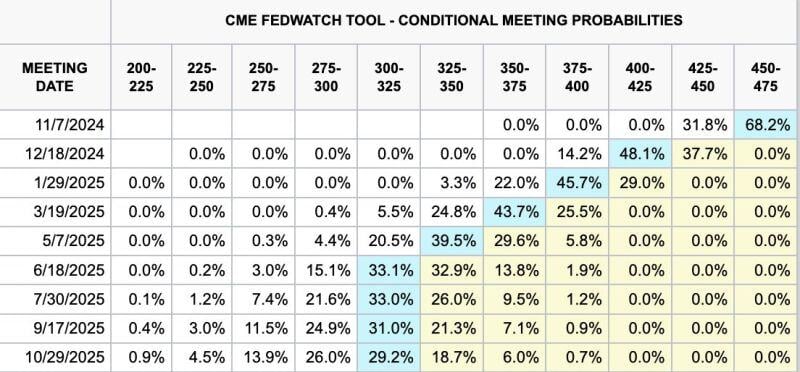

Fed Chair Jerome Powell just said the recent 50BPs interest rate cut shouldn’t be interpreted as a sign that future moves will be as aggressive - CNBC

“Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course,” he told the National Association for Business Economics in prepared remarks. “The risks are two-sided, and we will continue to make our decisions meeting by meeting” The market currently thinks there's a 68.2% chance Jerome Powell and the Fed cut rates by 25BPs at the next FOMC meeting Source: CME FedWatch Tool

Investing with intelligence

Our latest research, commentary and market outlooks