Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

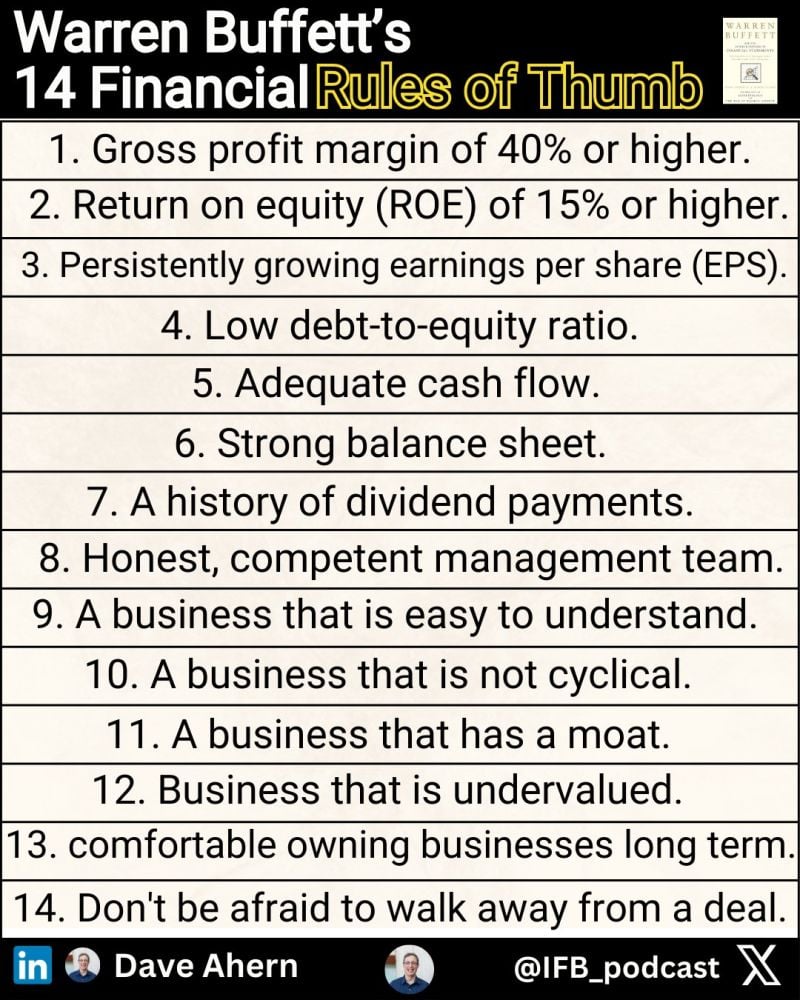

Warren Buffett's 14 Financial Rules of Thumb:

Source: The Investing for Beginners Podcast @IFB_podcast

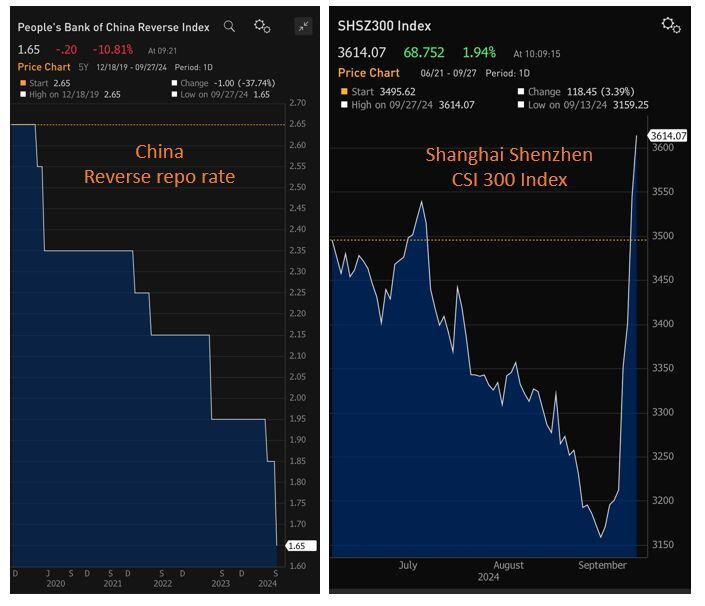

China keeps giving. Another rate cut today >>>

*PBOC CUTS 14-DAY REVERSE REPO RATE TO 1.65% FROM 1.85% Meanwhile, Chinese stocks going vertical Source: Bloomberg, David Ingles

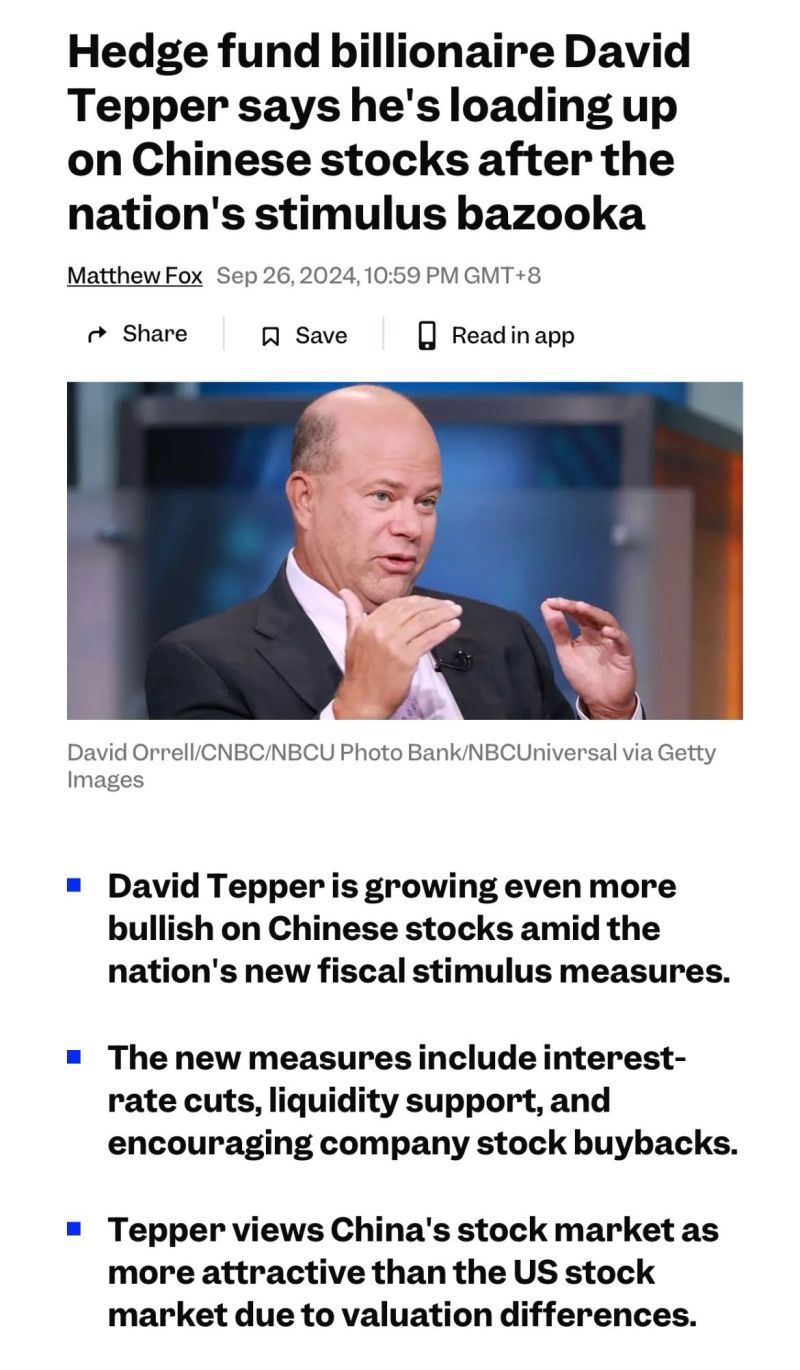

David Tepper, who runs the $6 billion hedge fund Appaloosa Management, is growing even more bullish on Chinese stocks amid the nation's new fiscal stimulus measures.

Tepper views China's stock market as more attractive than the US stock market due to valuation differences. Source: Markets Insider

Former President Donald Trump just called for Nancy Pelosi to be prosecuted for insider trading, citing her recent sale of Visa $V shares right before the DOJ lawsuit. 👀

“Nancy Pelosi has a little problem because her husband sold their Visa stock – they had a lot of Visa stock – one day before it was announced that Visa is being sued by the Department of Justice,” the GOP nominee said during a press conference at Trump Tower in New York. The former House speaker’s husband, Paul Pelosi, unloaded 2,000 shares of Visa stock worth between $500,000 and $1 million on July 1, financial disclosures show. On Tuesday, less than three months after the massive transaction, Visa was hit with a DOJ lawsuit alleging that the company illegally monopolized the debit card market. “Think of that. Nancy Pelosi sold vast amounts of Visa stock one day before the big lawsuit that we all read about a few days ago,” he said. “You think it was luck? I don’t.” “She should be prosecuted,” Trump declared. “Nancy Pelosi should be prosecuted for that.” Source: NY Post

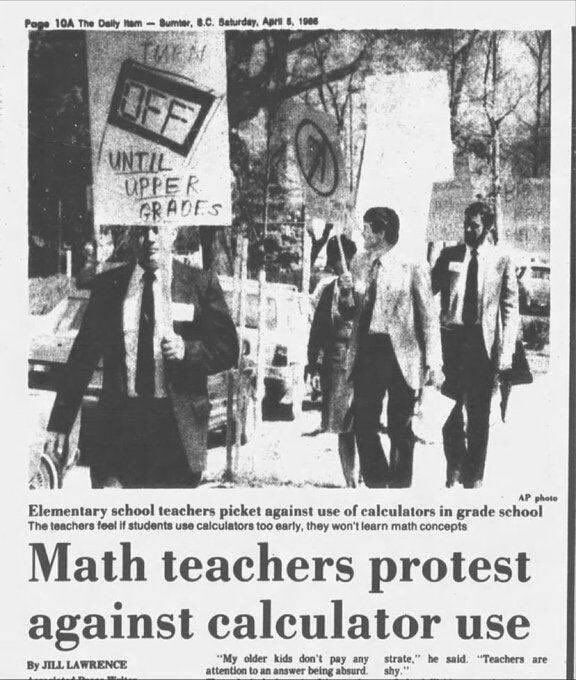

A headline from 1966.

Some school teachers are now protesting against the use of AI... Human being always struggle with innovation. Source: Jon Erlichman on X

Investing with intelligence

Our latest research, commentary and market outlooks