Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: The Richmond Fed Manufacturing Employment Index plummeted to 21 points in September, its lowest level since April 2009.

The index has been in contraction for the majority of 2024 and even sits below pandemic lows. Furthermore, employment expectations for the next 6 months fell to -12 points, the lowest since April 2020. Overall business conditions are now at their worst since May 2020 and second-worst since 2008. Source: The Kobeissi Letter, Bloomberg

😱 The shocking chart of the day: The 5Y yield of Greek government bonds is now BELOW (!!!) the French ones 😱

🔊 French Prime Minister Michel Barnier announced his new government on Saturday, ending months of political uncertainty after snap elections left the country with a hung parliament. The new cabinet takes a noticeable shift to the right. But this announcement does not seem to convince markets. 🚨 Indeed, for the first time since 2007, the yield on French 10-year government bonds (2.95%) exceeded that of Spanish and Portuguese bonds. And for the first time ever, the French OAT 5Y yield is now ABOVE the 5y Greek government bonds yield. Meanwhile, the spread with the German Bund has widened to 82bps (vs. 50 at the beginning of June), and the risk of political instability accentuates this trend. 🔔 These are clear signals that markets doubt the French government's ability to reduce its public deficit. The latter stands at 5.5% of GDP in 2023, well above the EU's target of 3% by 2027. ⚠ France is just unable to convince and reassure people of its ability to maintain a budget and a sustainable financial situation in the medium to long term. Source: Bloomberg

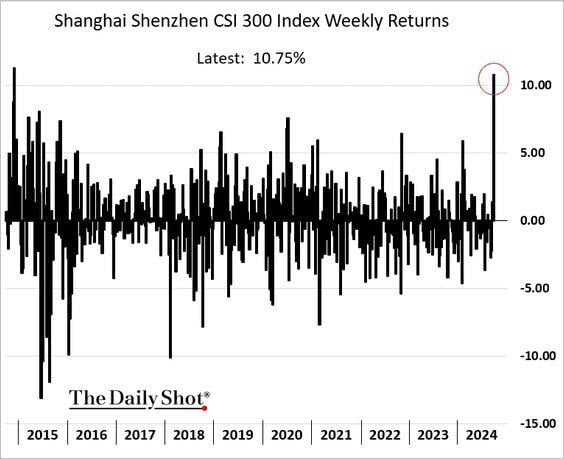

China's stock market is having its best week in nearly a decade.

Source: (((The Daily Shot))) @SoberLook

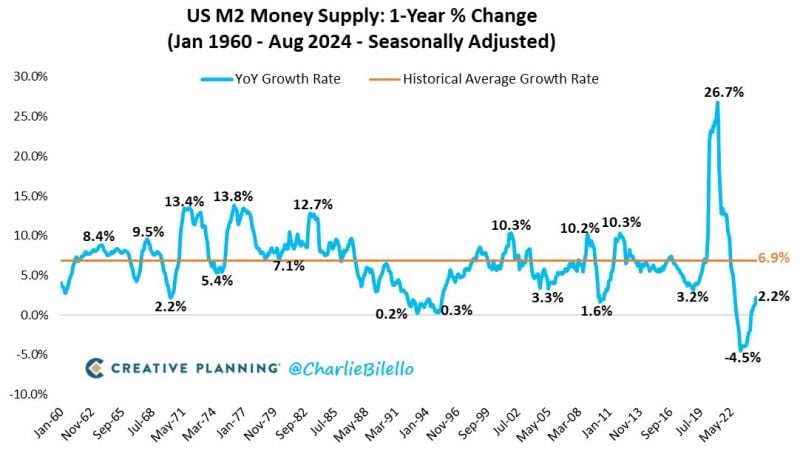

The US Money Supply grew 2.2% over the last year, the biggest YoY increase since September 2022.

The return of money printing? Source: Charlie Bilello

📢 CHINESE INVESTMENT FIRMS CAN NOW BORROW FROM CENTRAL BANK TO BUY STOCKS.

WILL WE SEE A TRUE RECOVERY OF CHINESE STOCKS OR WILL IT BE ANOTHER FALSE START? Source: Radar

Not a bad week for Dr Burry who is heavily invested in China stocks Alibaba $BABA, Bidu $BIDU and JD.com $JD...

Note that another big bet from Burry - Shift4 payments $FOUR - has also been doing great recently... Source: Guru Focus, Yahoo Finance

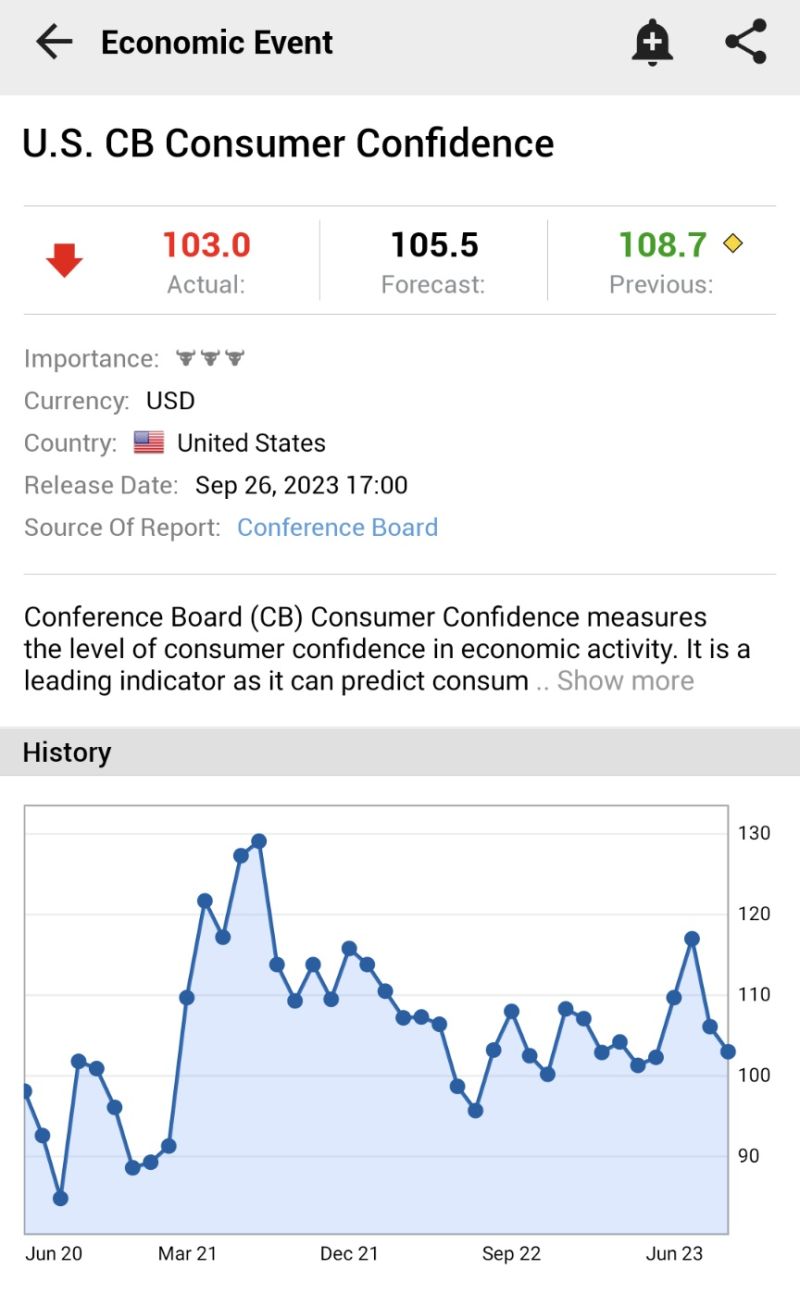

US stocks recorded only small gains yesterday as investors were cold feet by weak consumer confidence numbers

*U.S. SEPTEMBER CB CONSUMER CONFIDENCE SINKS TO 103.0; EST. 105.5; PREV. 108.7 *THIS WAS THE LOWEST LEVEL SINCE MAY 2023 Source: www.investing.com

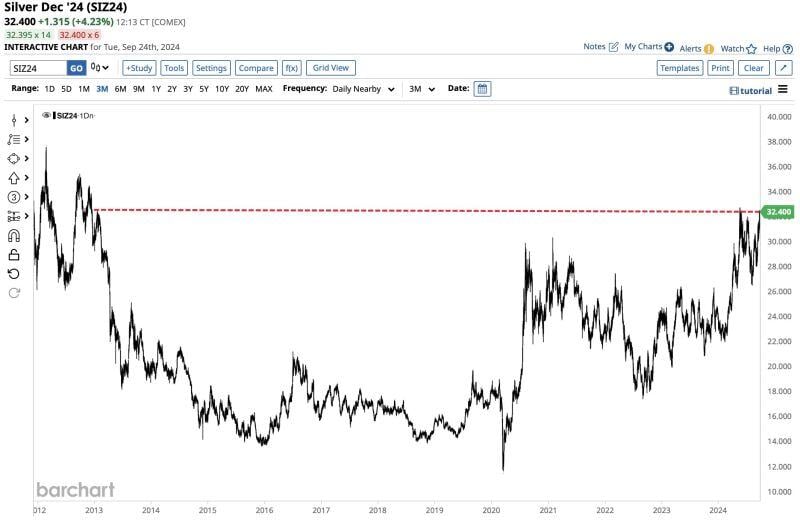

UPDATE 🚨: Silver hit the highest price in more than a decade

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks