Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Small Cap Stocks $IWM have now traded green for 7 consecutive days, their longest winning streak since November 2022

Souce: Barchart

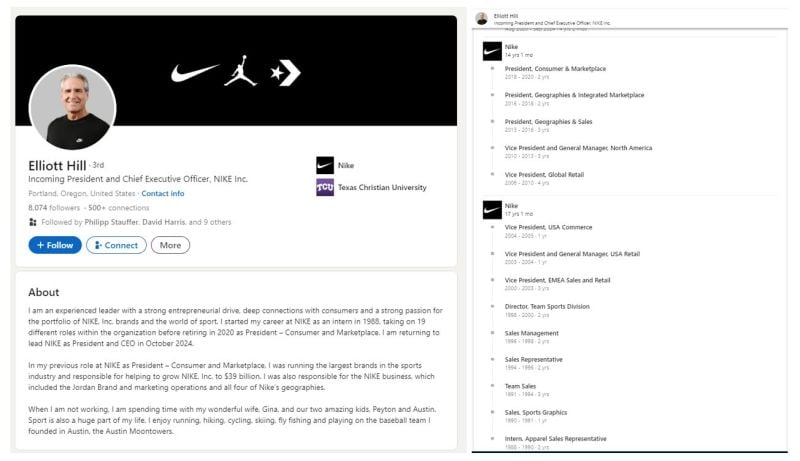

Watch out the Linkedin profile of Nike’s new CEO ...

32 years with the same company, from intern to CEO! https://lnkd.in/e-WA6aaK

Jim Cramer is simply the best...

a pristine track-record...

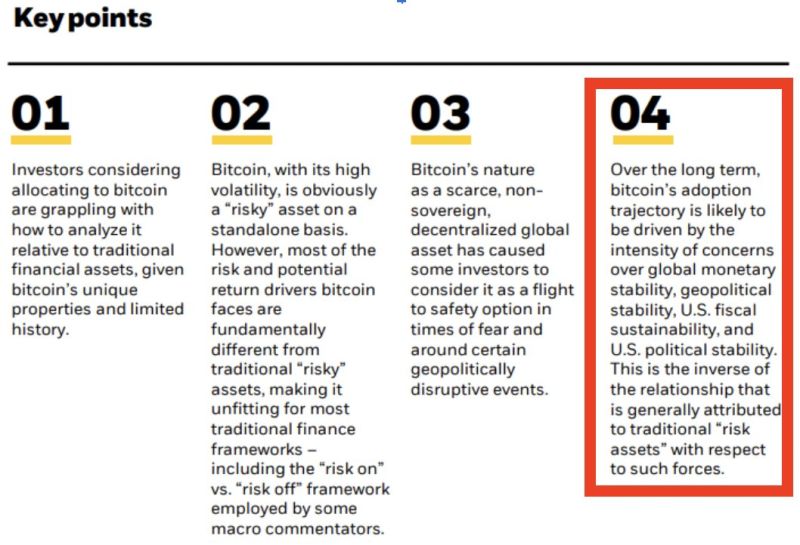

BlackRock is now saying the quiet parts out loud!

“Over the long term, bitcoin’s adoption trajectory is likely to be driven by the intensity of concerns over global monetary stability, geopolitical stability, U.S. fiscal sustainability, and U.S. political stability.” Source: Blackrock, Luke Mikic on X

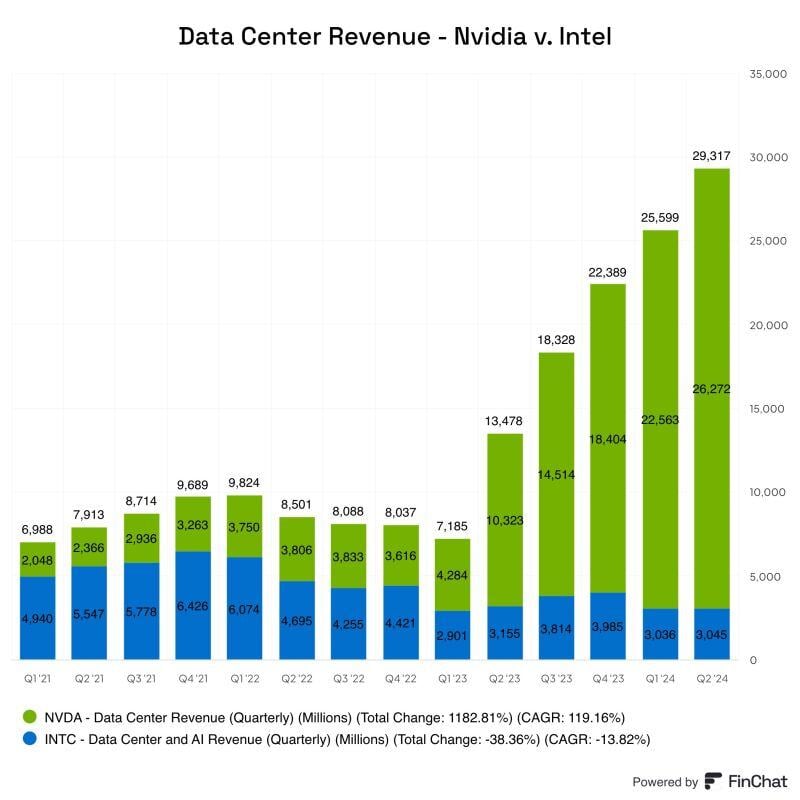

2 years ago, Intel had a bigger data center business than Nvidia.

$NVDA $INTC Source: FinChat @finchat_io

BREAKING 🚨 The Federal Reserve has cut interest rates by 50 basis points in their first rate cut since March 2020

The long awaited "Fed pivot" has officially begun... By starting their monetarypolicy easing cycle with an aggressive 50 basis points rate cut it seems that the fed decided to focus on the labor market part of their dual mandate rather than the inflation one... Here's a summary of Fed decision: 1. Fed cuts interest rates by 50 bps for first time since 2020 2. Fed sees 2 more 25 basis point rate cuts in 2024 3.Fed governor Miki Bowman dissented in favour of a smaller 25 bps cut. It's the first dissent by a *governor* since 2005. 4. Fed gained "greater confidence" that inflation is moving to 2% 5. Fed will "carefully asses incoming data" and evolve outlook 6. Fed sees 100 bps of rate cuts in 2025 and 50 bps of cuts in 2026 This is a CLEAR Fed pivot and the Fed is signaling that they believe the disinflation trend remains in place but also that they now see making unemployment their top priority as the labor market has weakened. Their decision sounds almost like a risk management one. (Initial) Market reaction >>> -> The SP500 rises to a new all time high but the equity market reaction is rather mixed so far -> Yield curve steepens with a modest yield rise on the long-end -> The dollar weakens Gold and bitcoin slightly rise

Investing with intelligence

Our latest research, commentary and market outlooks