Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

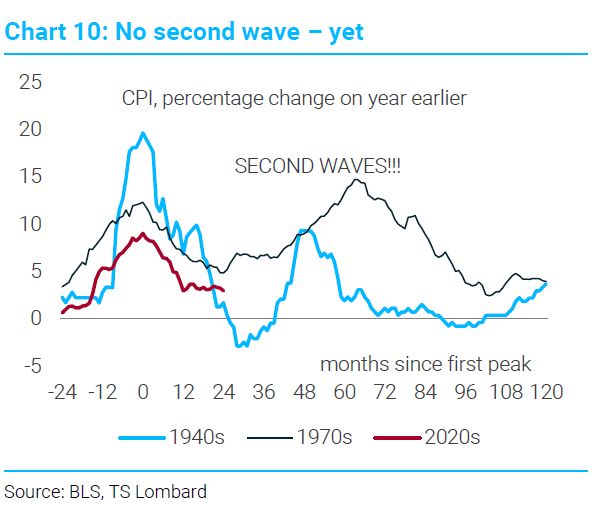

After yesterday jumbo Fed rate cut (days after core CPI MoM reaccelerarting), who doesn't have this chart in mind???

The Second Wave of Inflation. This is what the Fed is thinking but isn't saying out loud. If you expand the dataset to the CPI's of Western economies, 87% of the time there's a second wave. Source. TS Lombard, Eric Hale

The bulls are running WILD pre-market. Thank you Mr Powell...

$DIA +1.18% $SPY +1.61% $QQQ +2.18%

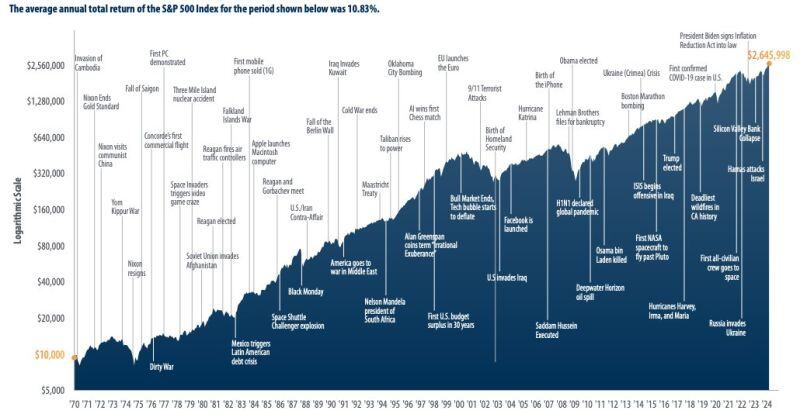

Regardless of what is happening in the world, or who happens to be President, the market finds a way forward.

Source: Peter Mallouk

Utilities Destroying Mag 7 in 2024?

Utilities $XLU +27% Amazon $AMZN +21% QQQ +16% Microsoft $MSFT +15% Apple $AAPL +13% Google $GOOGL +13% Tesla $TSLA -9% Source: Lawrence McDonald @Convertbond, Bloomberg

BlackRock is preparing to launch a more than $30bn artificial intelligence investment fund

With technology giant Microsoft to build data centres and energy projects to meet growing demands stemming from AI, people briefed about the matter said https://on.ft.com/3Bh2aGG Source: FT

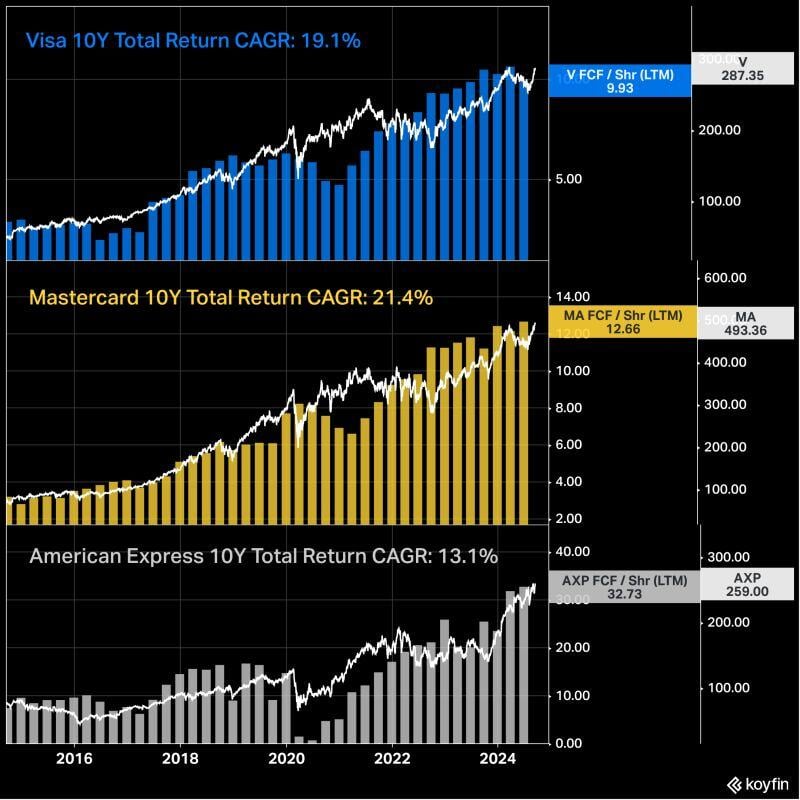

Visa, Mastercard, and American Express' FCF per share and share price over the last decade.

10Y Total Return CAGR: $V Visa: 19.1% $MA Mastercard: 21.4% $AXP American Express: 13.1% Source: @KoyfinCharts

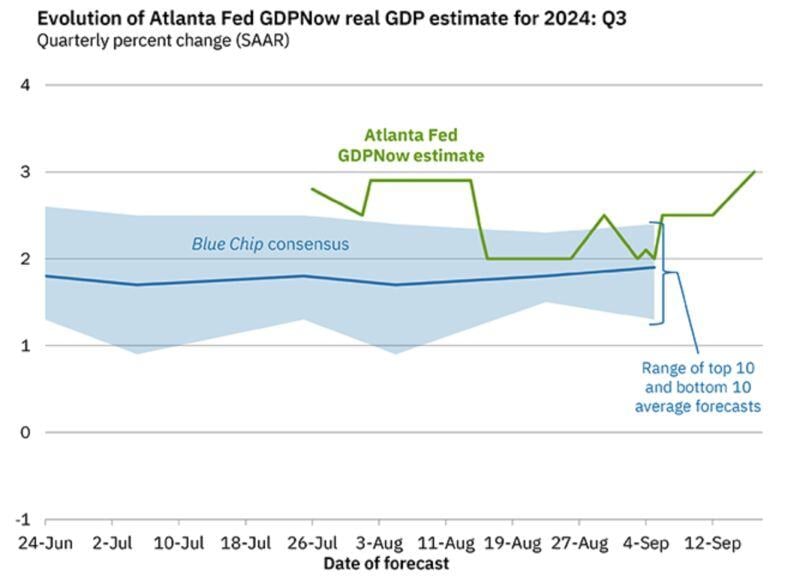

Soft landing? Hard landing? Or no landing?

Atlanta Fed Q3 Real GDP growth Nowcast model just hit 3%...

Investing with intelligence

Our latest research, commentary and market outlooks