Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

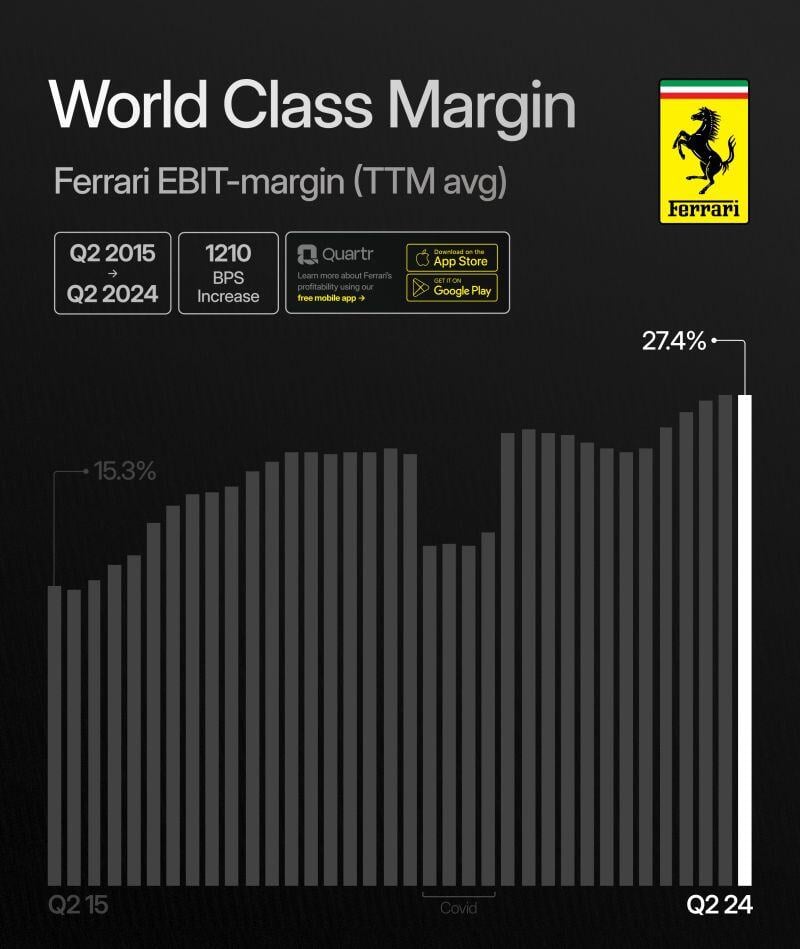

Ferrari (RACE) boosted its full-year guidance when delivering second-quarter results that topped revenue expectations on Thursday.

The Italian automaker now projects 2024 net revenue of more than 6.55 billion euros ($7.07 billion), up from more than EUR6.4 billion, and adjusted earnings per share (EPS) of at least EUR7.90, up from at least EUR7.50. “We are delighted to announce excellent financial results in the second quarter of 2024, which demonstrate again a strong execution and continued growth." – Benedetto Vigna, CEO Ferrari $RACE Q2 2024 in a nutshell: Shipments +3% *EMEA +1% *Americas +13% *Greater China -18% *APAC +4% Revenue +16.2% EBIT +17% *marg 29.9 (29.7) EPS +25% Source: Quartr

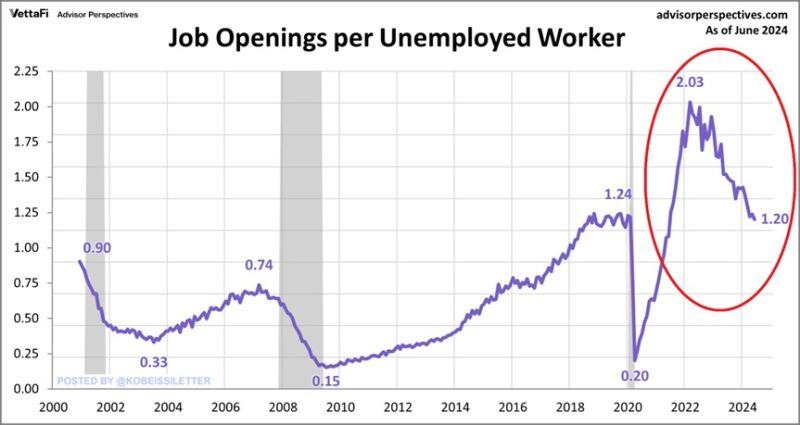

BREAKING: US job openings declined to 8.18 million in June, down from 8.23 million in May, near their lowest level since 2021.

Year-over-year, job openings fell 10.3%, marking the 23rd consecutive monthly decrease, the longest streak since the 2008 Financial Crisis. The ratio of vacancies per unemployed worker, a metric the Fed follows closely, fell to 1.20, the lowest since June 2021. At the same time, the private sector hiring rate declined to 3.7%, the lowest level since April 2020. The private quits rate, measuring the number of people who voluntarily leave their jobs, fell to 2.3%, the lowest since August 2020. This means that Americans are the least confident that they will find a new job since the 2020 Pandemic. => The US labor market is weakening. Source: The Kobeissi Letter

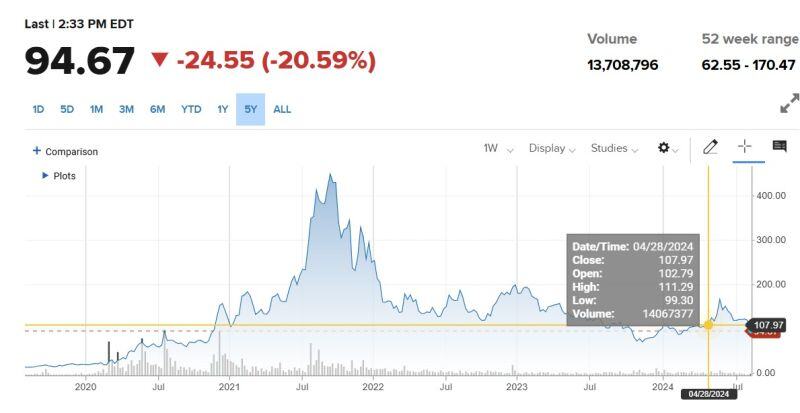

Do you remember Moderna $MRNA ???

Moderna beats estimates but slashes guidance on low EU sales, competitive U.S. vaccine market. It is down -20% today and -79% from its covid all-time-high. Moderna: "Net product sales for Q2 24 were $184M, reflecting a 37% YoY decrease. This reduction aligns with the expected shift to a seasonal COVID-19 vaccine market.." Moderna had $241M in total sales in Q2 and $1.6B in total operating expenses. Adding interest income, they burned $1.27B in one quarter. Cash on balance sheet is down to $2.47B. I fully expect expect them to do large capital raise to dilute shareholders. Source: JaguarAnalytics, The Transcript

ISM PMI Employment came in at 43.4.

Only time lower: 1) the internet bubble popping. 2) the GFC. 3) Covid-19. Source: James E. Thorne, Bloomberg

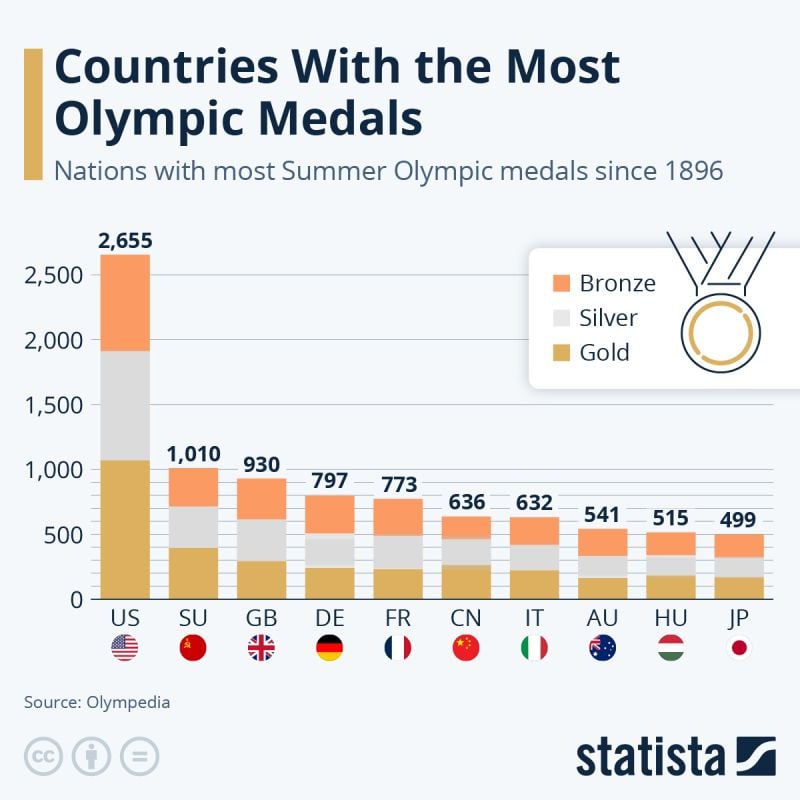

As data compiled by the Olympedia website shows, The United States has won the most medals in the Summer Olympics since 1896.

U.S. athletes have won a total of 2,655 medals - 1,070 gold, 841 silver and 744 bronze. Source: Statista

Since its after hours low seen just 18 hours ago, Nvidia has added $380 BILLION of market cap.

In other words, Nvidia has added as much market cap as the entire value of Costco, $COST, in 18 hours. This comes after the stock erased $1 TRILLION of market cap over the last 5 weeks. Source: The Kobeissi Letter

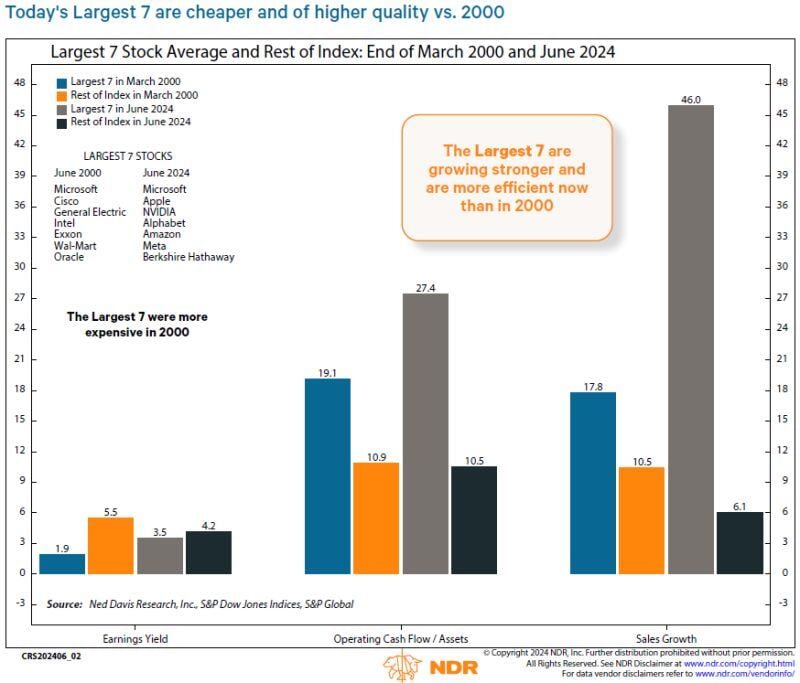

"The Largest stocks today have cheaper valuations compared to the Largest 7 in 2000"

@NDR_Research thru Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks