Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

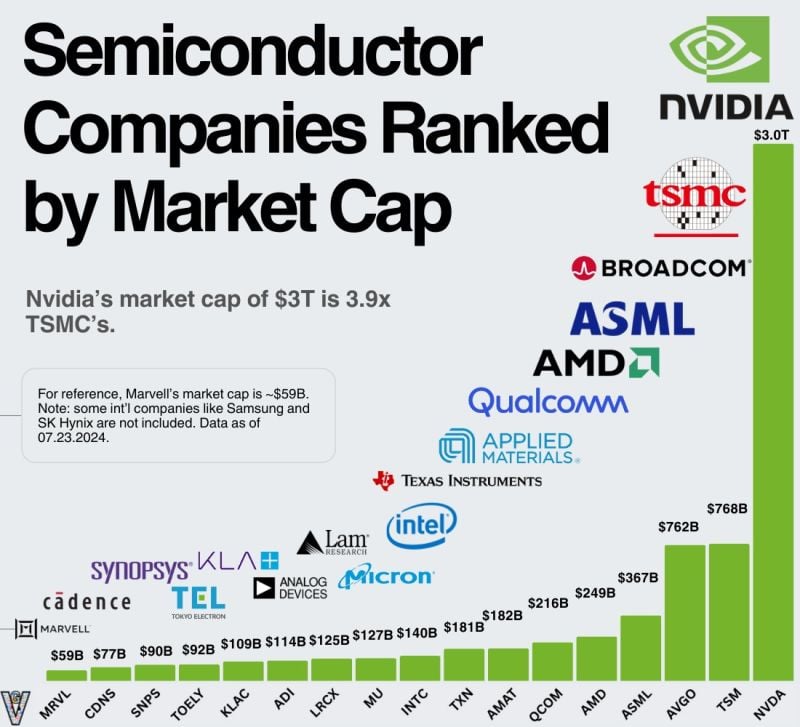

Semi conductors Companies Ranked by Market Cap - @EricFlaningam on X:

1)The scale of the industry is incredible. Many public companies larger than $10B aren’t listed here. 2) $NVDA's performance over the last two years has to be one of the best tech stories ever. Incredible how they built their accelerated computing ecosystem for over a decade before the current infrastructure boom.

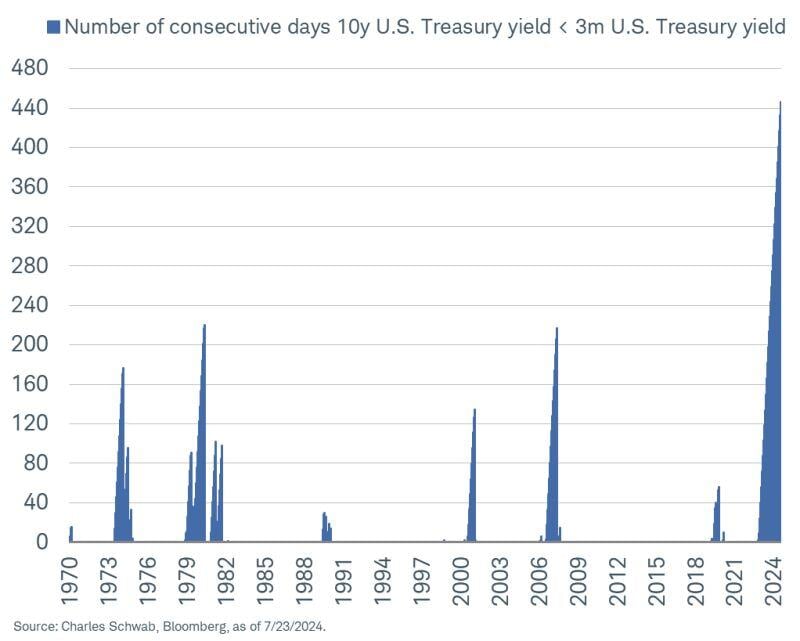

US 10y-3m yield spread has been negative for more than 440 days.

But no recession so far... Source: Kevin Gordon

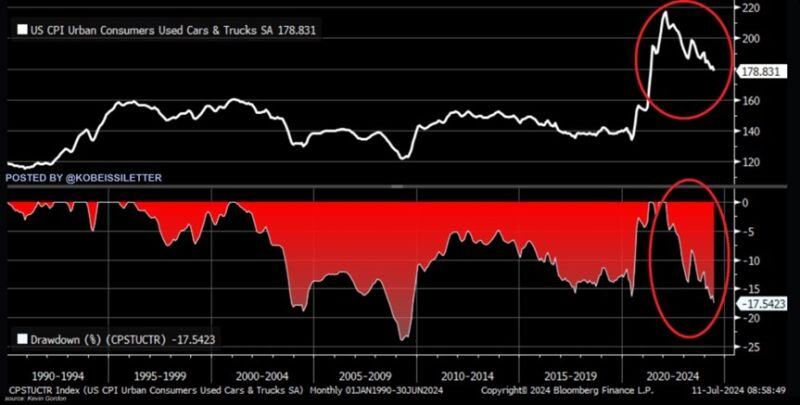

Used car prices are crashing: Used car and truck prices are now down 17.5% since the 2021 peak, the largest decline in 15 years.

Over the last 35 years, there were only two times when prices of used vehicles saw a bigger drawdown: in 2004 and 2009. Overall, US wholesale prices of used vehicles have declined for 22 consecutive months. In June, average wholesale prices decreased by 8.9% year-over-year to $17,934. EV makers have been hit the hardest, with some EV prices falling over 40% since last year. The car market bubble has popped. Source: The Kobeissi Letter, Bloomberg

"The H1 results reflect LVMH's remarkable resilience, backed by the strength of its Maisons and the responsiveness of its teams in a climate of economic and geopolitical uncertainty."

Bernard Arnault Below $LVMH Q2 2024 organic revenue growth by business group by Quartr.

Apple Maps has just been updated for Paris2024 Summer Olympics.

New update includes stunning 3D models of Olympic venues, including temporary ones. Source: Nikias Molina

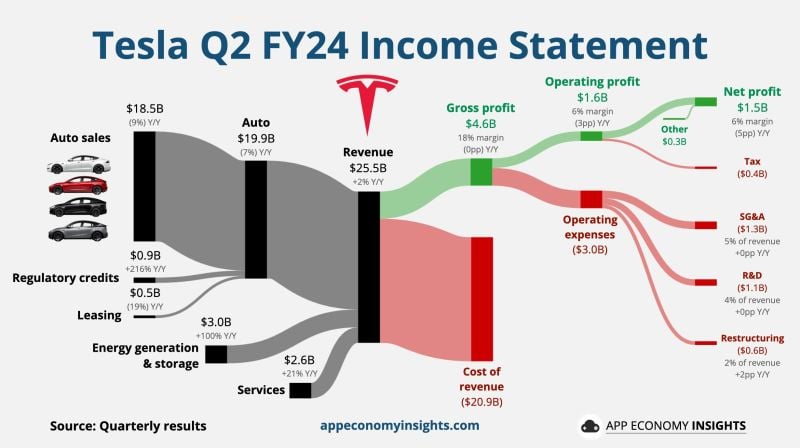

Tesla reports disappointing earnings for second quarter as revenue rises 2%

Tesla reported weaker-than-expected earnings for the second quarter as automotive sales dropped for a second straight period. The stock slid more than 2% in extended trading. $TSLA Tesla Q2 FY24 by App Economy Insights: • Revenue +2% Y/Y to $25.5B ($0.8B beat). • Gross margin 18% (-0.2pp Y/Y). • Operating margin 6% (-3pp Y/Y). • Capex +10% Y/Y to $2.3B. • Free cash flow +34% Y/Y to $1.3B. • Non-GAAP EPS $0.52 ($0.10 miss).

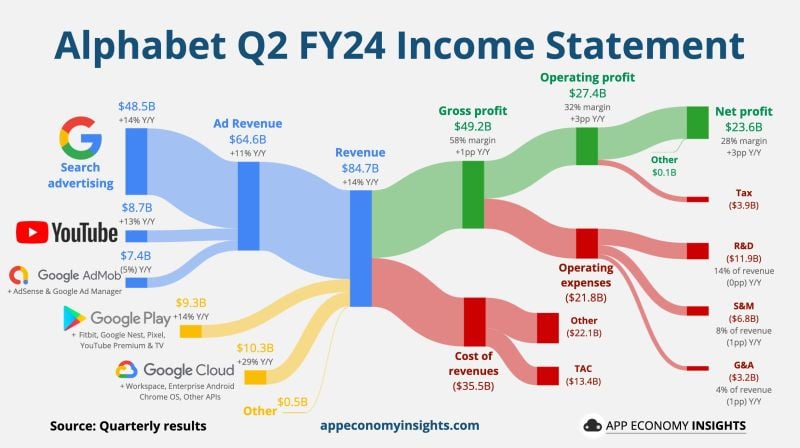

Alphabet slipped 1% after-hours in spite of a beat on both top and bottom lines in the second quarter.

Alphabet earned $1.89 per share on $84.74 billion in revenue. Consensus estimates had called for earnings of $1.84 per share on $84.19 billion in revenue. However, revenue at its Youtube advertising segment missed forecasts. $GOOG Alphabet Q2 FY24 by App Economy Insights: • Revenue +14% Y/Y to $84.7B ($0.5B beat). • Operating margin 32% (+3pp Y/Y). • EPS $1.89 ($0.04 beat). ☁️ Google Cloud: • Revenue +29% Y/Y to $10.3B. • Operating margin 11% (+6pp Y/Y). ▶️ YouTube ads +13% to $8.7B.

Investing with intelligence

Our latest research, commentary and market outlooks