Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Will the Presidential race be a tighter one than currently predicted?

Watch out

Forward P/E Ratios of Key Global Stock Markets - Clad Bastion research on X

India: 24 Denmark: 23 United States: 21 Taiwan: 18 Switzerland: 17 Netherlands: 17 Australia: 17 Saudi Arabia: 16 Sweden: 16 Japan: 15 Canada: 14 France: 14 Germany: 12 Mexico: 12 United Kingdom: 12 Spain: 11 South Korea: 10 Hong Kong: 10 South Africa: 9 Italy: 9 Brazil: 7 China: 6 Turkey: 5

ETF YTD net flows ranking... iShares Bitcoin spot ETF $IBIT has passed Invesco Nasdaq 100 $QQQ into YTD net flows.

And could pass Vanguard's Total Stock Market ETF very soon too. Compare the net sizes of these ETF's vs. net inflows. Demand for Bitcoin via ETF has been relentless. Unprecedented really. Source: SpencerHakimian, Bloomberg

Ethereum spot ETF to start trading today (TUESDAY)

The United States Securities and Exchange Commission (SEC) has given final approvals to spot Ethereum ETFs, clearing the way for the funds to begin trading as soon as Tuesday, July 23. Such funds received initial approval in May in a surprise regulatory shift by the SEC, and have spent recent weeks sending in updated and finalized forms. Now, 424(b) approvals are coming in and spot Ethereum ETFs have been made effective by the SEC, which means they can begin trading. July 23 emerged as the likely target for the trading start early last week, as sources connected to fund providers told Decrypt that they were told to expect approvals ahead of that date, barring unexpected delays. "It’s official: Spot ETH ETFs have been made effective by the SEC," tweeted Bloomberg Senior ETF Analyst Eric Balchunas on Monday afternoon. "The 424(b) forms are rolling in now, the last step = all systems go for tomorrow’s 930am launch. Game on." Source: Decrypt

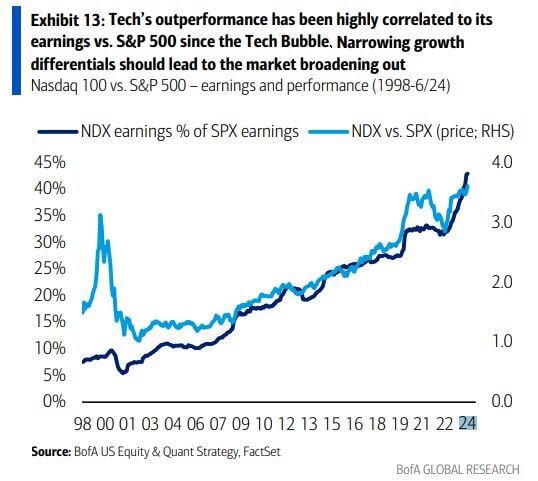

Tech’s outperformance has been highly correlated to its earnings vs. S&P 500 since the Tech Bubble

Source: BofA, Mike Z.

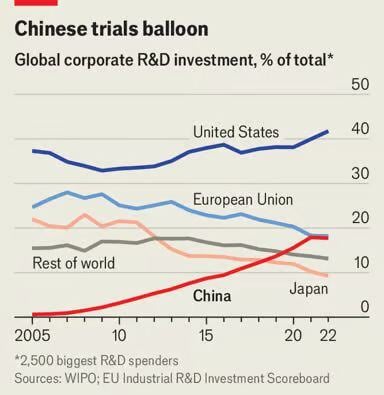

The US remains (by far) the world leader for corporate R&D, accounting for ~40% of global total

• China and EU are competing for second place in global league table • Japan has been in free fall over past two decades, now accounting for only 10% of global private R&D Source: Agathe Demarais

Investing with intelligence

Our latest research, commentary and market outlooks