Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Sox plunged 6.8% in semi conductor sector's worst selloff since March 2020

on the prospect of increased export restrictions on advanced semiconductor technology, and by Donald Trump's latest comments on Taiwan. Taiwan "did take about 100% of our chip business" and "should pay us for defense," Trump said in a Bloomberg Businessweek interview. Intel and GlobalFoundries bucked the trend as potential US domestic semi 'winners.' Source: Bloomberg, HolgerZ

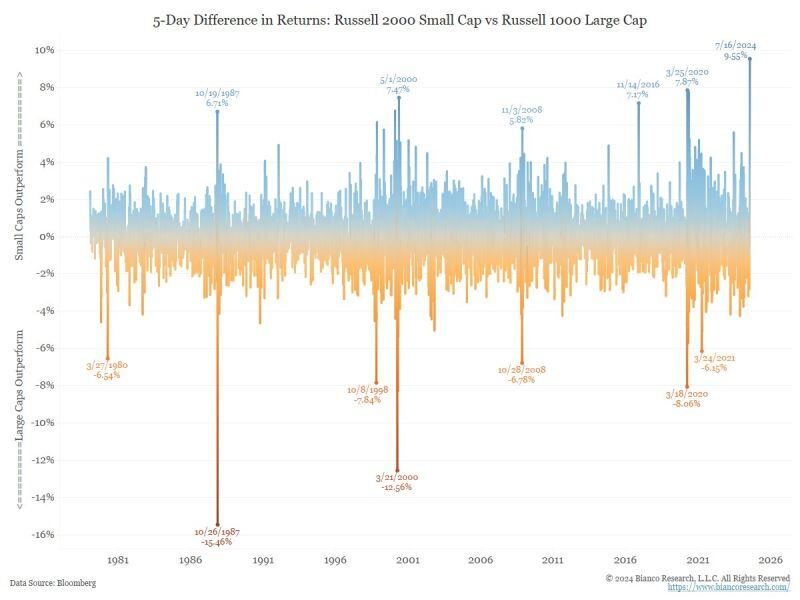

The biggest outperformance of small-cap stocks over large-cap stocks, over a 5-day period, in history.

Data starts in 1978 Source: Jim Bianco

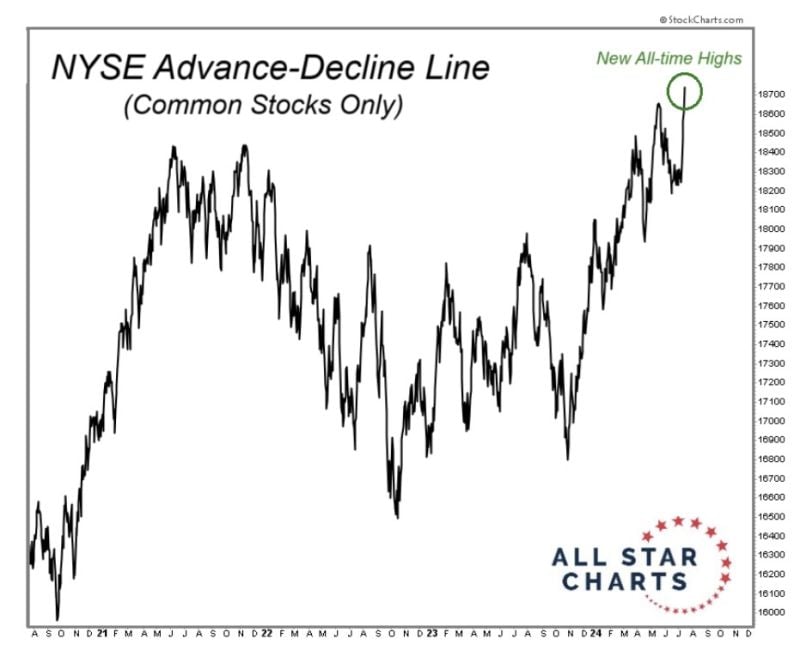

The NYSE A-D Line keeps making new highs. The US equity bull market is not just 7 stocks.

It's not just Tech. And it's not just large-caps. Yes some correction and rotation can take place from time to time. But it remains a bull market until proven otherwise. It's just a bull market... And it has been for over 2 years now. Source: J-C Parets

Global chip stocks from Nvidia to ASML fall on geopolitics, Trump comments.

Global chip stocks fell sharply, with ASML , Nvidia and TSMC posting declines amid reports of tighter export restrictions from the U.S. and a ramp-up of geopolitical tensions fueled by comments from former U.S. President Donald Trump. ASML’s Netherlands-listed shares were down 11%, while Tokyo Electron shares in Japan closed nearly 7.5% lower. The moves came after Bloomberg on Wednesday reported that the Biden administration is considering a wide-sweeping rule to clamp down on companies exporting their critical chipmaking equipment to China. Washington’s foreign direct product rule, or FDPR, allows the U.S. to put controls on foreign-made products even if they use the smallest amount of American technology. This can affect non-U.S. companies. Source: CNBC

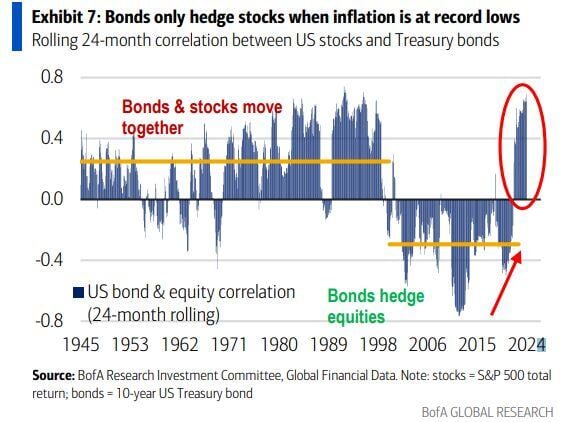

Historically, bonds acted as efficient portfolio hedges only when inflation is <2%.

Below is the rolling 24-month correlation between US stocks and Treasury bonds. Source: Mike Zaccardi

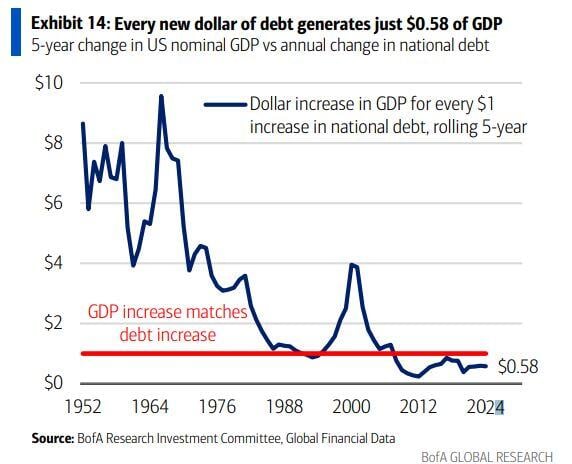

Unproductive debt...

Every new dollar of US debt generates just $0.58 of GDP Source: Mike Zaccardi, BofA

Investing with intelligence

Our latest research, commentary and market outlooks