Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The amount raised by the former president is a record second-quarter haul that almost matches the sums raised during his entire 2016 campaign, according to an analysis of federal filings

Fundraising groups aligned with Donald Trump raised more than $400mn for his presidential election campaign between April and June — a record second-quarter haul that almost matches the sums raised during his entire 2016 campaign, according to a Financial Times analysis of federal filings. The figure, which is likely to grow as more of the political action committees that help fund campaigns report this weekend, is three times the first-quarter total and roughly double their contributions from the same period of the 2020 election. The massive windfall, which puts the Republican on track to outpace his Democratic rival President Joe Biden, came from small donors furious at Trump’s criminal conviction in New York and billionaires flocking to his campaign. Source: FT Link >>> https://lnkd.in/eijfGTMR

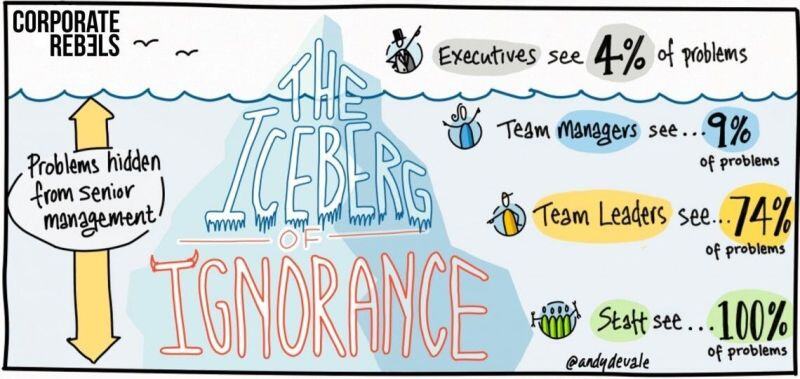

As highlighted by Corporate Rebels >>> In most traditional organizations, managers see only the tip of the iceberg – just a fraction of the issues.

According to Sidney Yoshida, only 4% of problems are known to executives. Being able to "fill thef gap" is key. And this is where smaller and more nimble structure can make a difference.

Speakers at the Bitcoin 2024 Conference in Nashville US

- Donald Trump - Robert F. Kennedy Jr. - Cathie Wood - Michael Saylor - Edward Snowden - Vivek Ramaswamy Source: Bitcoin Magazine

iShares US Treasuries 20y+ $TLT forms a Golden Cross with an upward-sloping 200D moving average for the first time since January 2019!

The last one sent the ETF soaring by almost 50% over the next 2 months. Source: Barchart

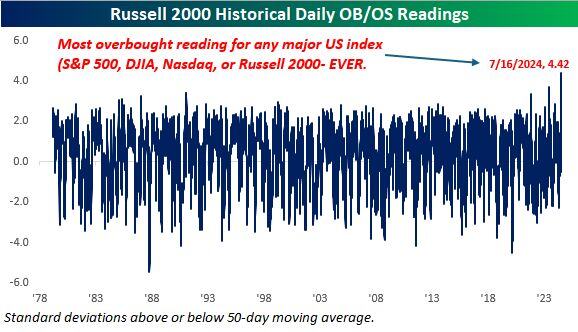

History was made yesterday! The Russell 2000 closed 4.4 standard deviations above its 50-day moving average.

No other major US index (Dow since 1900, S&P 500 since 1928, and Nasdaq since 1971) has ever closed at that much of an extreme. Source: Bespoke

Some good news for Wall Street?

Donald Trump will not seek to remove Federal Reserve Chair Jerome Powell before the central banker’s term ends and would consider JPMorgan CEO Jamie Dimon for Treasury secretary if he won the Nov. 5 election, the former president told Bloomberg in an interview published on Tuesday. JPMorgan declined to comment on Trump’s remarks. Powell’s term as chairman runs through January 2026, and his position as a Fed governor continues until 2028. The interview was conducted in late June, according to Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks