Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

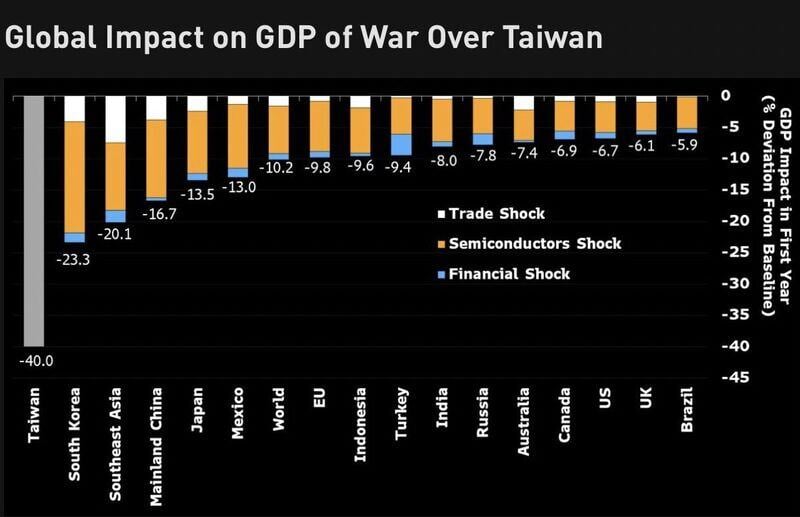

A scary chart... the global impact on GDP of a war in Taiwan...

Source: Bloomberg, Michel A.Arouet

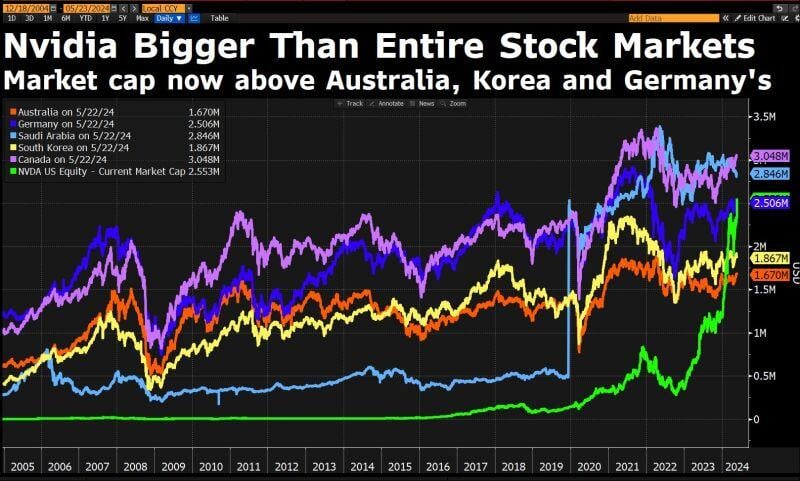

Nvidia is bigger than entire German stock market, the entire Australian market or the entire Korean market.

Canada and Saudi are within reach. Source: Bloomberg

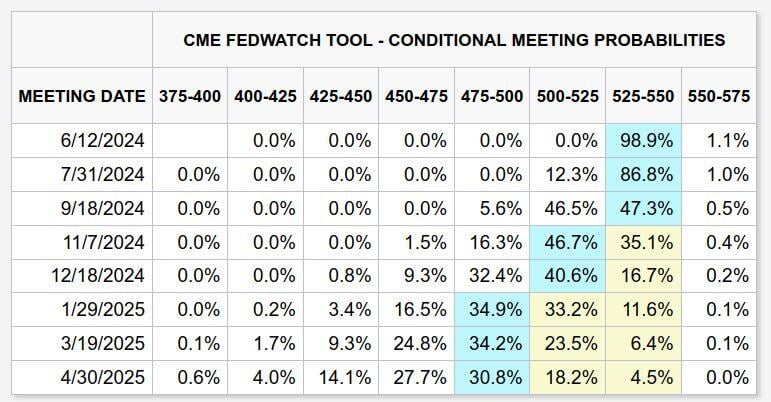

After the hotter than expected Flash PMI prints yesterday, the market is pricing in one cut for this year to occur in November or December, and another in early 2025.

Source: Markets & Mayhem

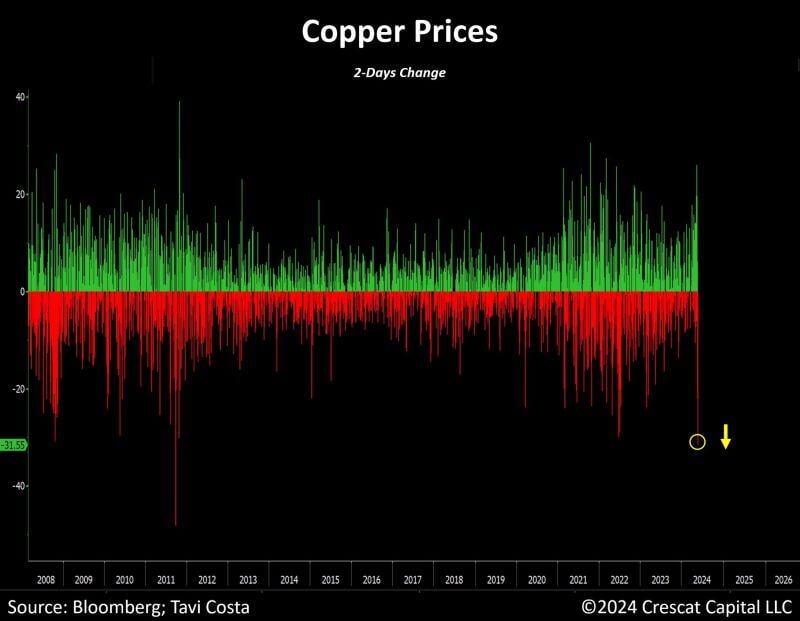

Copper just had its worst 2-day decline in 13 years.

A much-needed shake out to reset the sentiment. Source: Bloomberg, Tavi Costa, Crescat Capital

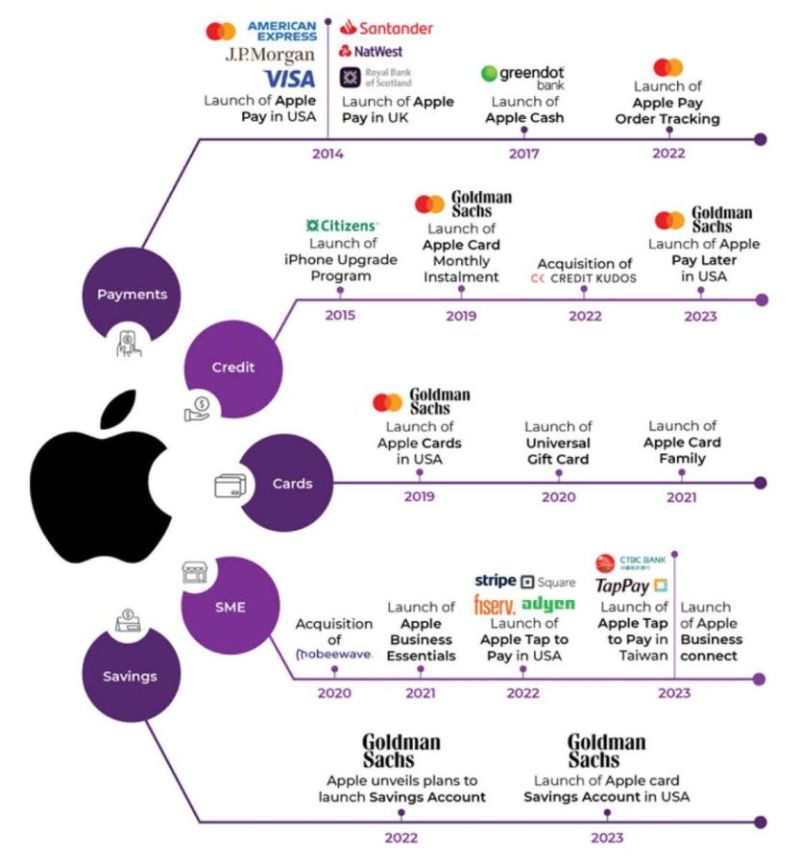

$AAPL is bigger into financial services than many realize:

- payments - savings - credit cards - BNPL Services now make up 22% of AAPL's revenues, with payments hitting all time revenue highs. Fun fact, in 2022, Apple Pay processed over $6T in payments, and is #1 mobile wallet Source: The Investing for Beginners Podcast @IFB_podcast

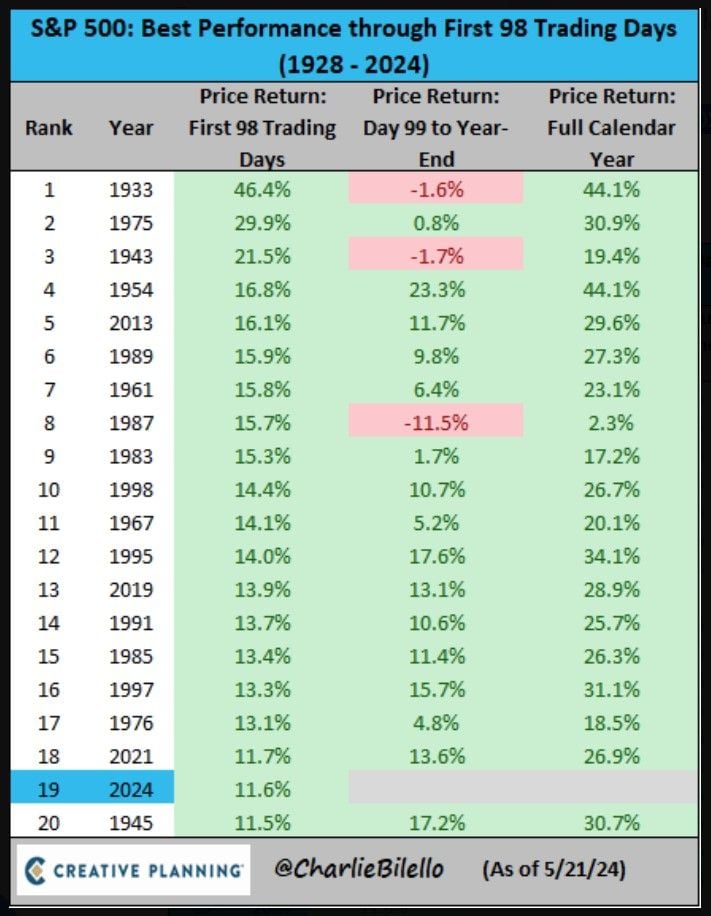

S&P 500 is up 11.6% in the first 98 trading days of 2024, the 19th best start to a year going back to 1928.

$SPX Source: Charlie Bilello

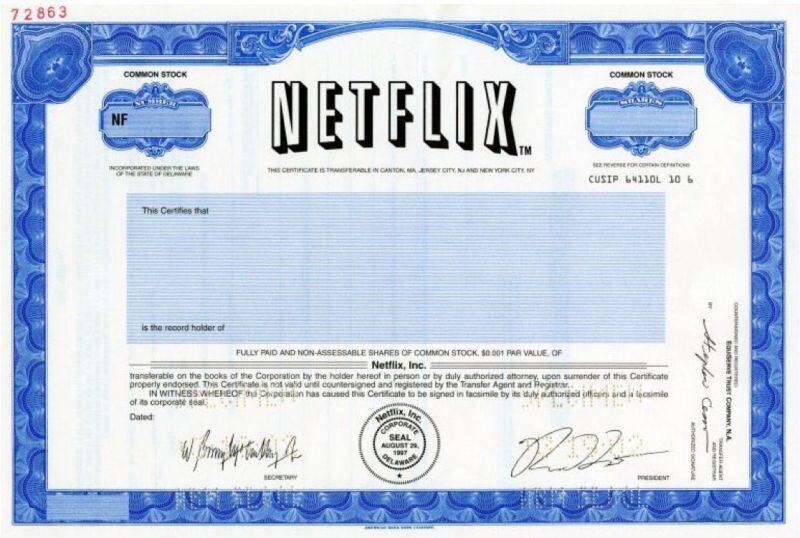

On this day in 2002: Netflix went public.

$2,000 invested in the IPO would be worth $1 million today. Source: Jon Erlichman

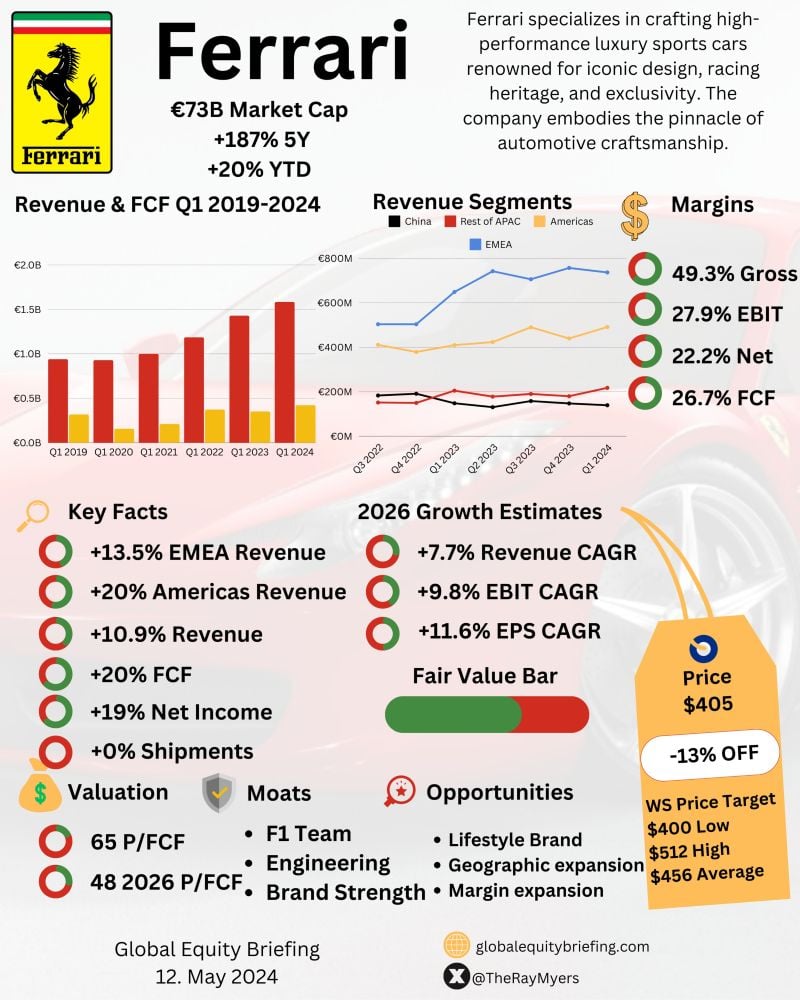

Some great one pager on stocks by The Ray Myers!

📉 $RACE -6% Since earnings 🎯Ferrari Q1 One Pager🧐 by @TheRayMyers 🚨Ferrari pricing power in play🚨 0% Shipment Growth +20% Americas Revenue +13.5% EMEA Revenue +10.9% Total Revenue +19% Net Income +20% FCF €1.58B Revenue €352M Net Income €423M FCF Here is the Ferrari Bull Case in4⃣sentences! 🛍️Lifestyle brand attracts new younger fans, amplifying brand power and customer loyalty! 💰Exclusivity allows for higher prices thus enhancing profitability! 🗺️Geographic expansion to India and the rest of APAC supports a slow volume growth! 🚗Strong brand power will support growth for decades! Would you rather have a Ferrari or $RACE stock? NB: This is NOT an investemnt recommendation

Investing with intelligence

Our latest research, commentary and market outlooks