Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: TANGIBLE SIGN OF US CONSUMER WEAKNESS?

Target stock, $TGT, falls 8% after reporting weaker than expected earnings with a 3% revenue decline due to consumer weakness. Target's CEO said the decline reflects “continued soft trends in discretionary categories.” The company's store traffic fell by 1.9% less quarter and the average amount spent by customer also fell 1.9%. Consumers bought fewer everyday items like groceries along with fewer discretionary goods. Another sign that consumers are struggling. Source: The Kobeissi Letter

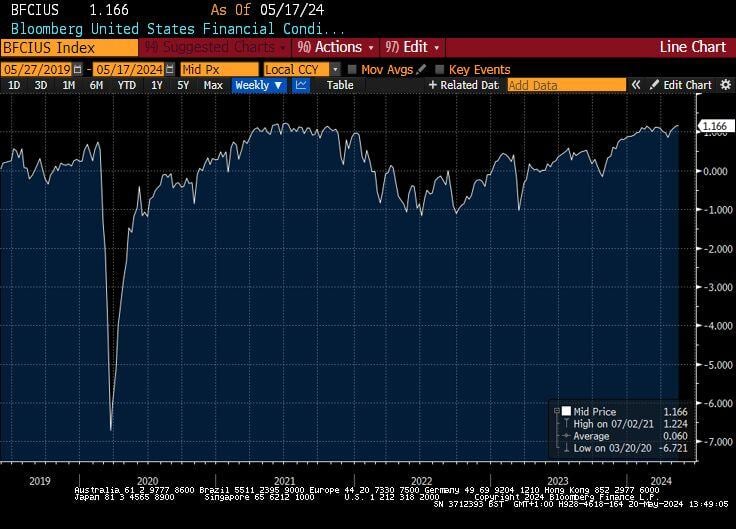

While the FED monetary policy is seen as restrictive, the Bloomberg US Financial Conditions Index is at record highs.

Risk premia in stocks and credit are near all-time tights as commodities are breaking higher. Source: Bloomberg

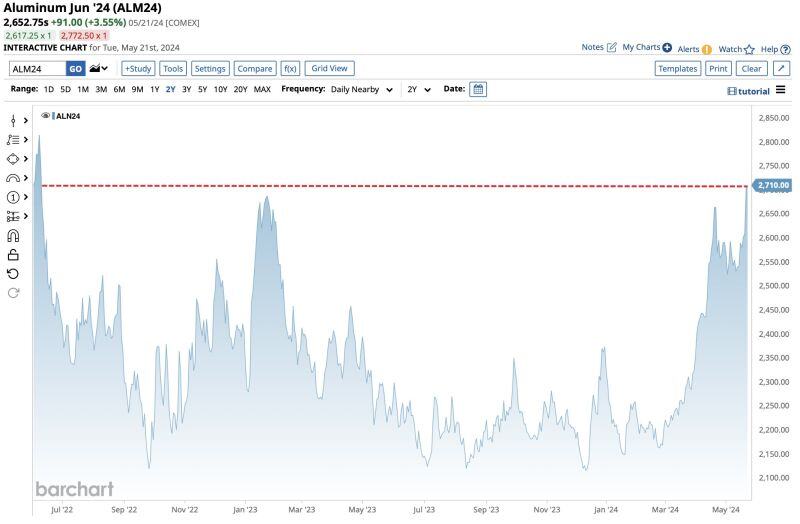

Aluminum appears to be the next metal getting sent as price surges to highest level since June 2022

Source: barchart

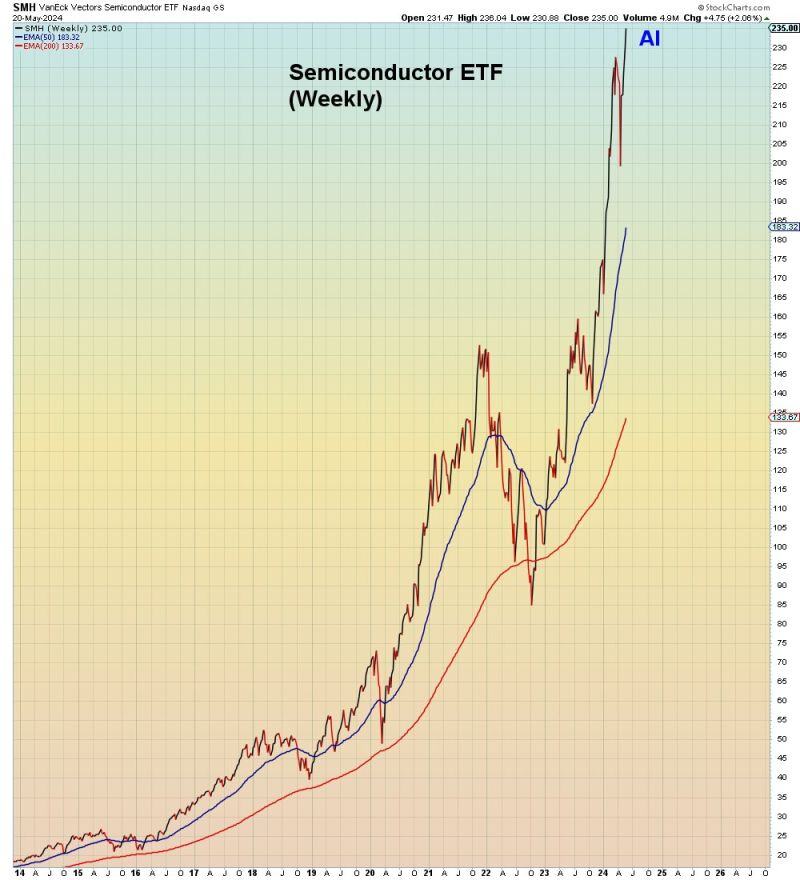

Is this sustainable? Nvidia results tonight might give us a clue...

Source: Mac10

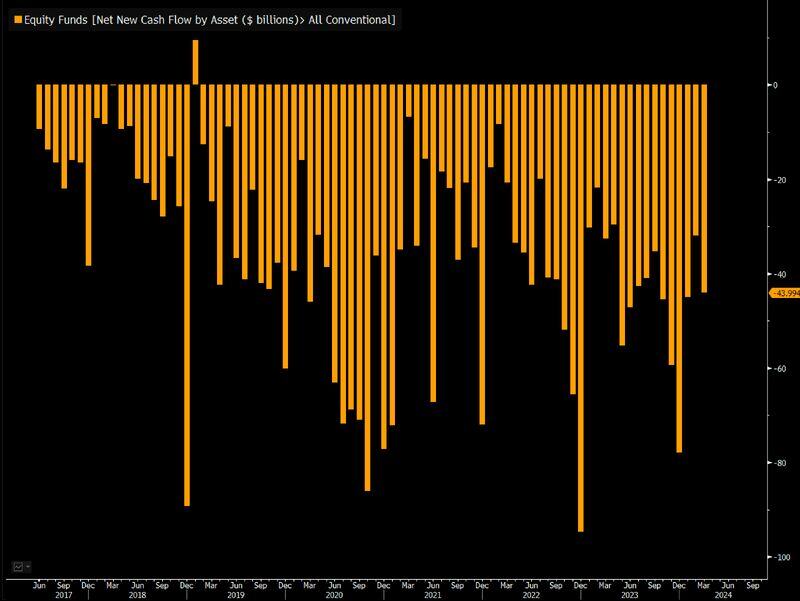

A POSITIVE contrarian signal >>>

EQUITY mutual funds are working on their 82nd straight month of OUTFLOWS. Source: Bloomberg, Eric Balchunas

China may well be the world leader for de-risking trade ties

• Chinese firms have been developing ties with emerging markets over past ten years • This reduces China's reliance on unfriendly markets (🇺🇸🇪🇺), shielding Beijing from geopolitical tensions Source: FT, Agathe Demarais

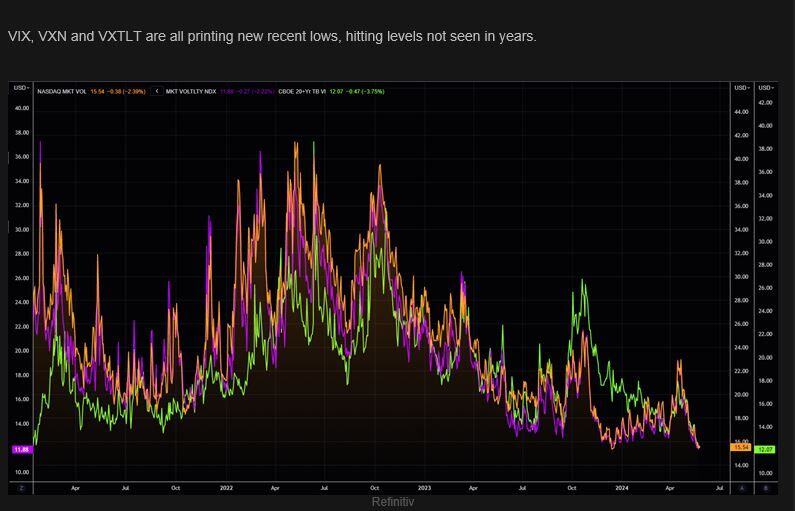

The death of volatility? VIX, VXN and VXTLT are all printing new recent lows, hitting levels not seen in years.

Source: Bloomberg, The Market Ear

Happy Bitcoin Pizza Day, everyone!

14 years ago, Laszlo Hanyecz, a Floridian programmer, bought 2 Papa John's pizzas for 10,000 $BTC. Today, those pizzas would be valued at $700 million.

Investing with intelligence

Our latest research, commentary and market outlooks