Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

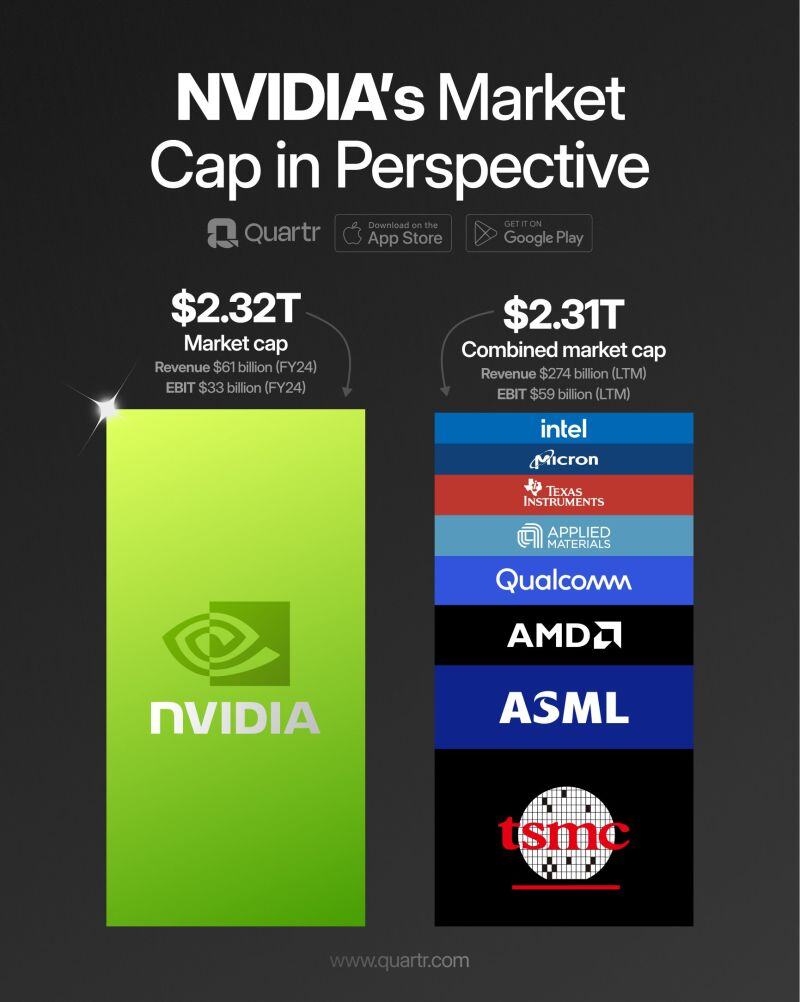

$NVDA publishes its Q1 FY 2025 report today.

The company is now the third-largest in the world, trailing only $MSFT and $AAPL, after seeing its market cap rise by 200% over the last year alone. Will the brutal momentum continue? Source: Quartr

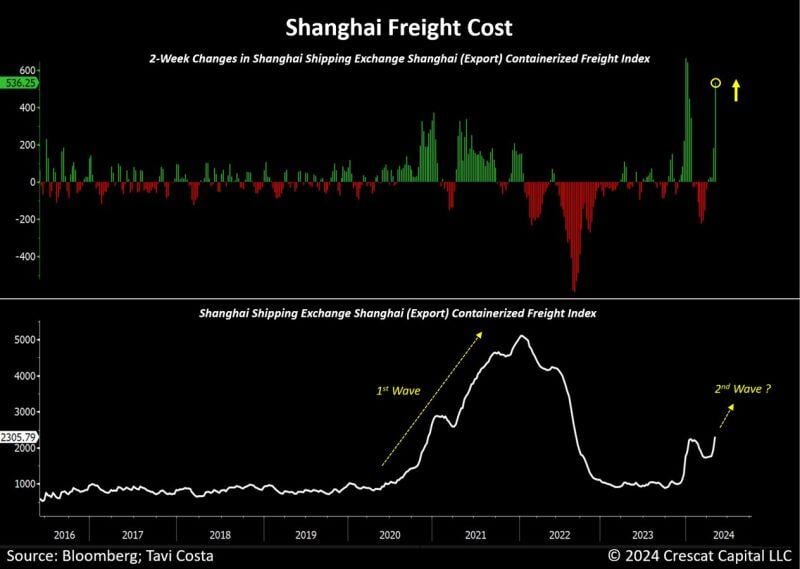

Shanghai and global freight costs are surging again.

We just experienced one of the steepest 2-week changes in history. Source: Tavi Costa, Bloomberg

Top Startup Cities in the World - San Francisco remains #1

Source: Barchart, Visual Capitalist, Pitchbook

JUST IN: The Biden administration announces it is releasing 1 million barrels of gasoline from a Northeast reserve.

These reserves were established to supplement in times of a natural disaster. However, the Biden Administration said this is a move to lower gas prices ahead of the summer. The sale, from storage sites in New Jersey and Maine, will be allocated in increments of 100,000 barrels at a time. Energy Department officials said this should help create lower gas prices by July 4th. Energy inflation is still a major issue. Source: The Kobeissi Letter

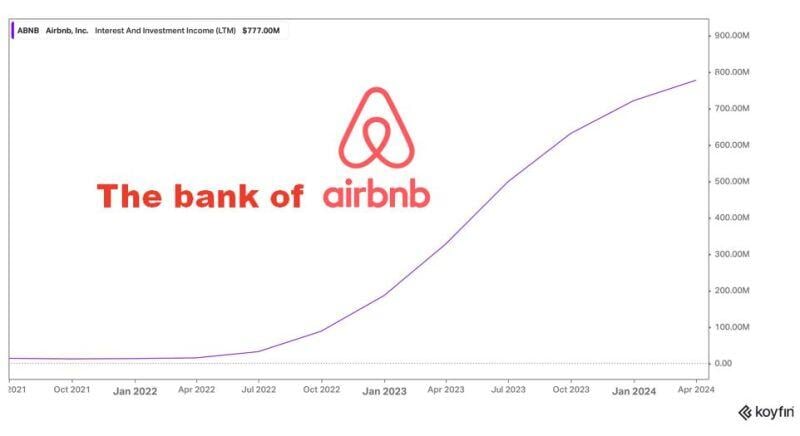

The Bank of Airbnb $ABNB by Wolf of Harcourt Street

ABNB's interest income has skyrocketed to $777 million over the past 12 months. This return is more akin to a bank than a travel company. ABNB benefits from being the Merchant of Record which means that it is the party that processes and distributes the actual payment for a product or service. When a customer makes a booking on Airbnb, Airbnb receives the cash in advance. This cash is held on behalf of the host and paid out once the service has been provided. With the interestrate hikes over the past year, Airbnb was able to benefit from investing the cash in short-term US Treasury bills before paying it out to hosts. Source: Wolf of Harcourt Street

Standard Chartered expects spot Ethereum EF to be approved this week

Source: Radar🚨

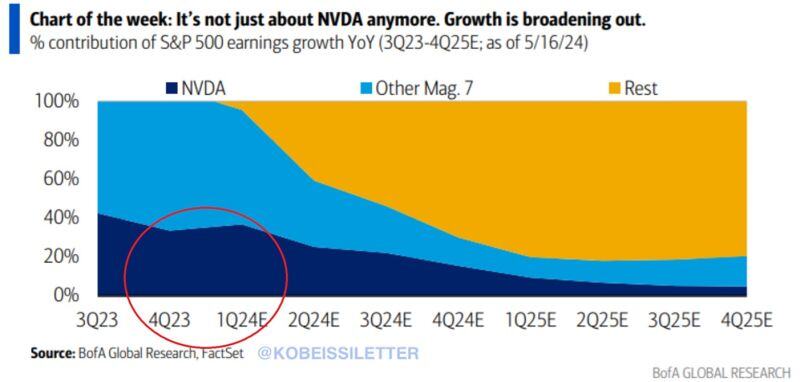

All eyes are on Nvidia this week: Nvidia, $NVDA, earnings alone drove 42% and 37% of the S&P 500 year-over-year EPS growth in Q3 and Q4 2023.

The company also accounted for 11% of the entire S&P 500's return over the last 12 months. In Q1 2024, Nvidia’s contribution to the S&P 500's EPS growth is estimated to reach ~40%. Nvidia's Q1 2024 EPS and revenue are projected to grow by 474% and 241%, respectively. Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks