Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

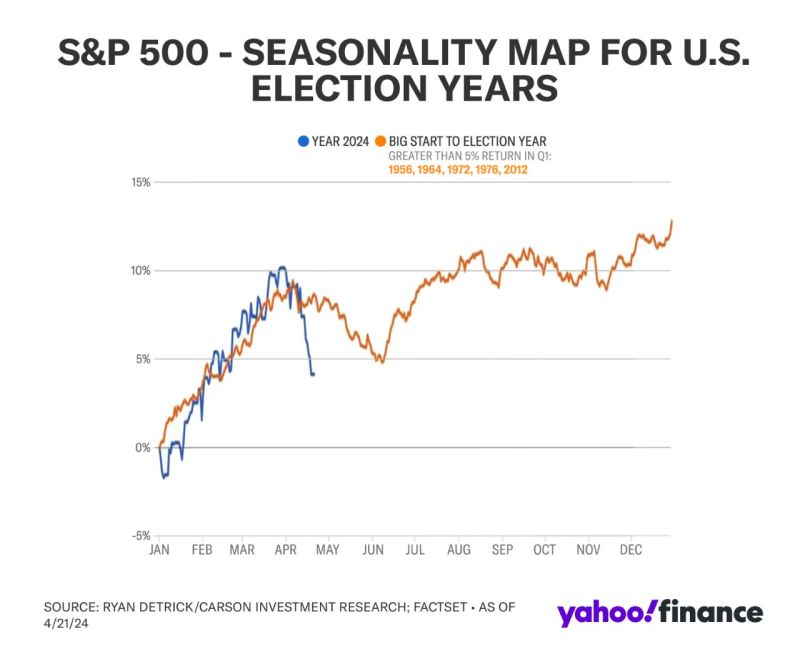

The chart below shared by Yahoo Finance newsletters thru Ryan Detrick, CMT shows that big starts to an election year (like '24) tend to see chop and weakness into June.

https://lnkd.in/eANaDtsN

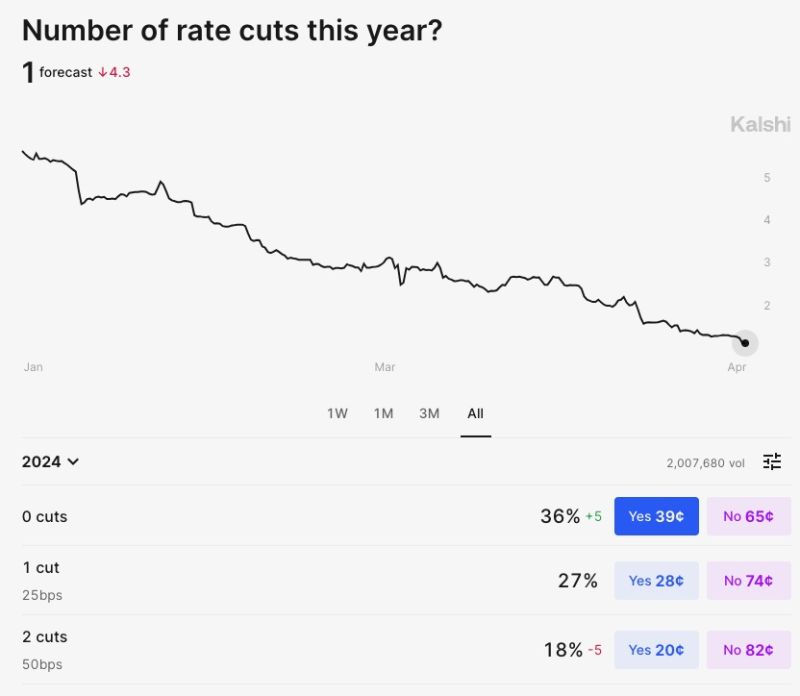

Prediction markets now show a 36% chance of ZERO interest rate cuts in 2024, according to Kalshi.

To put this in perspective, 4 months ago there was a ~3% chance of no rate cuts in 2024. The base case has gone from 6 rate cuts to 1 rate cut this year. There is just a 31% chance of 2 or more interest rate cuts this year. In other words, there is a higher chance of NO cuts than 2 OR MORE cuts. Could it be the fastest shift in Fed expectations of all time? Source: The Kobeissi Letter

OOPS... stagflationary numbers out of US !!!

Real GDP expanded at a 1.6% rate in Q1, trailing all forecasts. Main growth engine – personal spending – rose at a slower-than-forecast 2.5% pace. BUT a closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip... While "soft" macro data in the first 3 months of the year were "goldilocks" for markets (Growth surprising on the upside + disinflation), the effective Q1 print does not look as rosy... Source: HolgerZ, Bloomberg

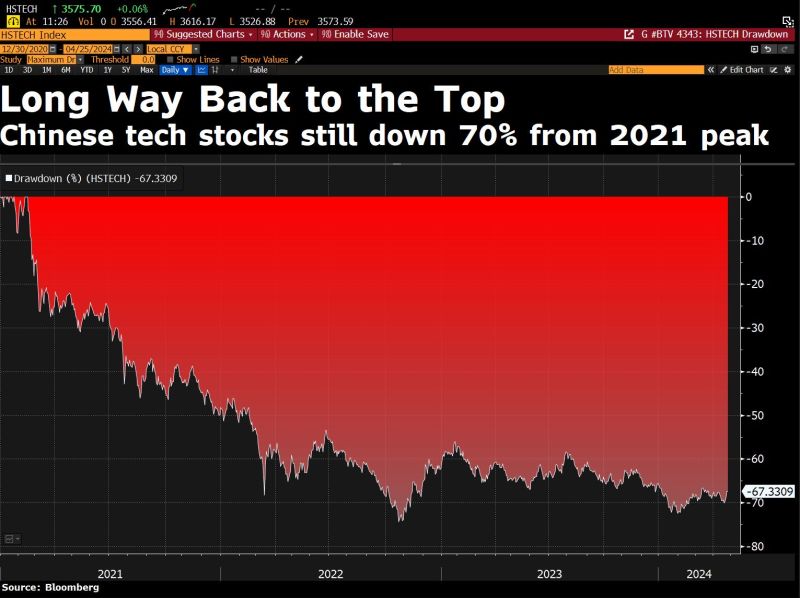

China stocks: still a long way to come back to the top...

Source: Bloomberg

Europeans ‘less hard-working’ than Americans, says Norway oil fund boss Tangen finds US investments more attractive due to weaker regulations and more risk-taking >>>

Europe is less hard-working, less ambitious, more regulated and more risk-averse than the US, according to the boss of Norway’s giant oil fund, with the gap between the two continents only getting wider. Nicolai Tangen, chief executive of the $1.6tn fund, told the Financial Times it was “worrisome” that American companies were outpacing their European rivals on innovation and technology, leading to vast outperformance of US shares in the past decade. His views are significant as the oil fund is one of the largest single investors in the world, owning on average 1.5 per cent of every listed company globally and 2.5 per cent of every European equity. Its US holdings have increased in the past decade while its European ones have declined. US shares account for almost half of all its equities compared with 32 per cent in 2013. The leading European country — the UK — represented 15 per cent of its equity portfolio a decade ago but just 6 per cent last year. Source: FT

Boeing cut to BAA3 from BAA2 by Moody's, outlook negative.

Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks