Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

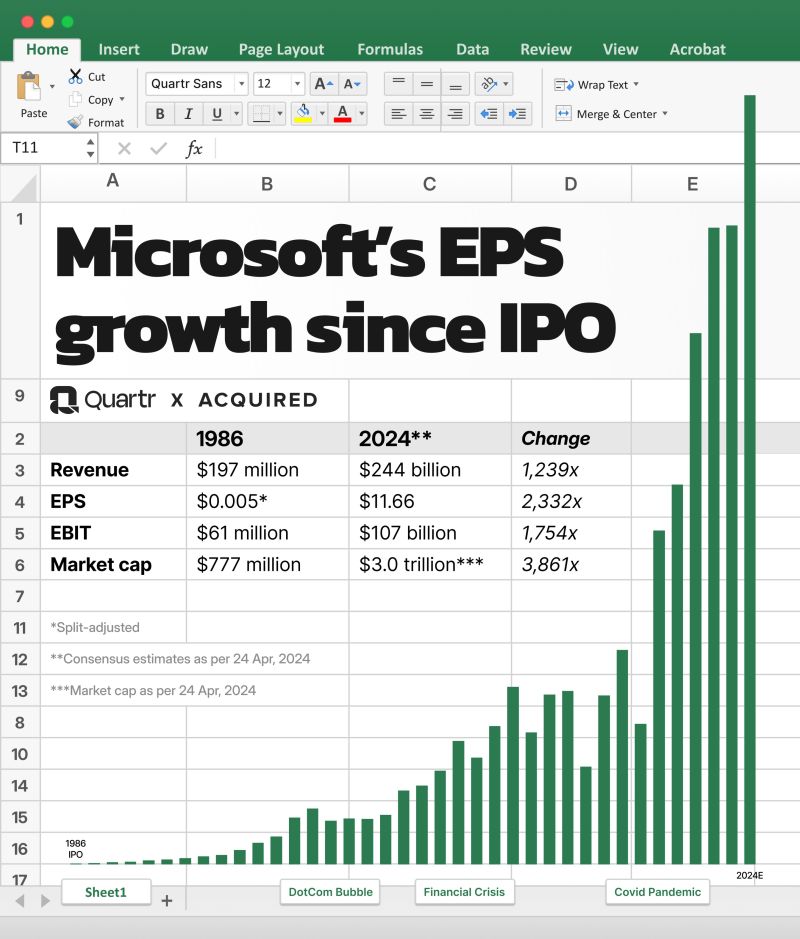

Amazing, isn’t it? No wonder Ferrari stock has been going parabolic since IPO

Source: Michel A.Arouet

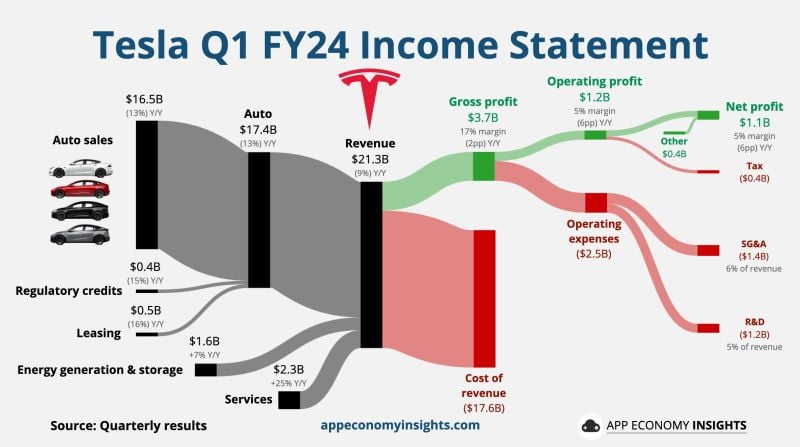

BREAKING: Tesla stock, $TSLA, surges over 8% after releasing Q1 2024 earnings results despite missing by nearly $1B on the top line and missing on EPS

Tesla Q1 revenues fell 8.7% over the last year, the biggest decline since 2012. Net Income fell 55% YoY to $1.1 billion. Gross margins moved down to 17.4% in Q1 from 19.3% a year ago and 29.1% two years ago The company said in the deck that it’s accelerating the launch of “new vehicles, including more affordable models,” that will “be able to be produced on the same manufacturing lines” as Tesla’s current lineup. Tesla is aiming to “fully utilize” its current production capacity and to achieve “more than 50% growth over 2023 production” before investing in new manufacturing lines. NB: The company also revealed that NONE of their Bitcoin was sold despite recent speculation. Source: The Kobeissi Letter, CNBC

$TSLA Tesla Q1 FY24:

• Deliveries -9% Y/Y to 386K. • Revenue -9% Y/Y to $21.3B ($1.0B miss). *Automotive -13% *Energy Gen. & Storage +7% • Gross margin 17% (-2pp Y/Y). • Operating margin 5% (-6pp Y/Y). • Capex +34% Y/Y to $2.8B. • Free cash flow (outflow) ($2.5B). • Non-GAAP EPS $0.45 ($0.05 miss) and -53% yoy Source: App Economy Insights

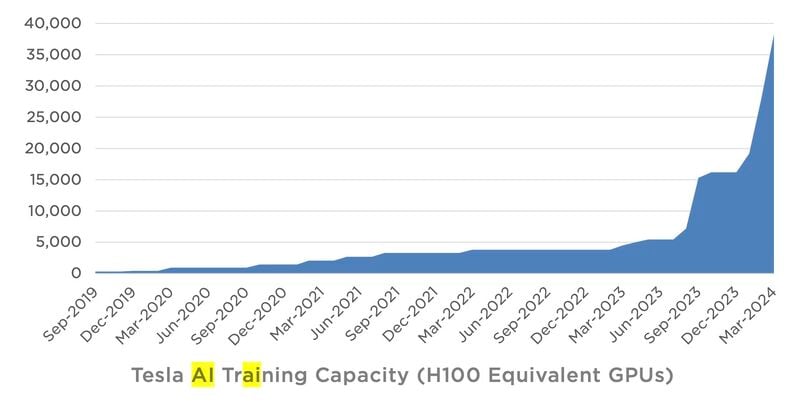

TESLA DOUBLED ITS AI COMPUTE OVER THE LAST 3 MONTHS

TESLA SPENT 1 BILLION DOLLARS ON AI INFRASTRUCTURE OVER THE LAST 3 MONTHS $TSLA Source: Gurgavin

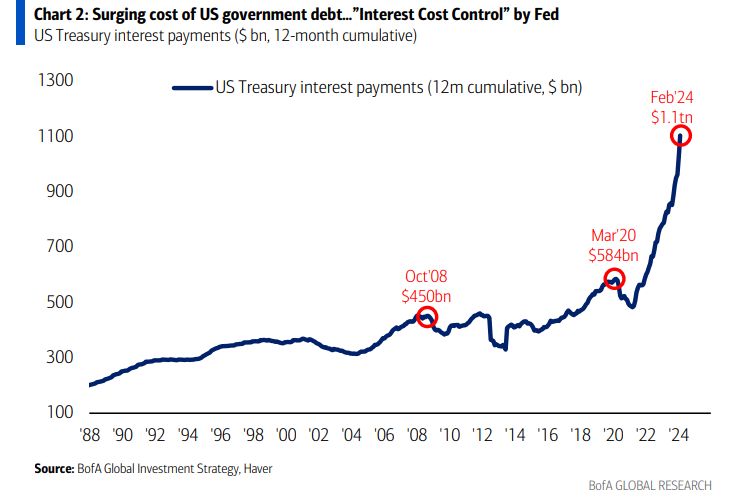

The annual interest expense on US debt is literally moving in a straight line higher, now at $1.1 TRILLION.

To put this in perspective, less than 3 years ago the annual interest expense on this debt was $450 billion. That's a 144% jump as total US debt has surged by over $11 TRILLION since 2020. Even in 2008, at the peak of the Financial Crisis, annual interest expense was just $450 billion. As interest rates surge and debt levels hit record highs, the US paying the prices for decades of deficit spending. Money is not "free" anymore... Source: BofA, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks