Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

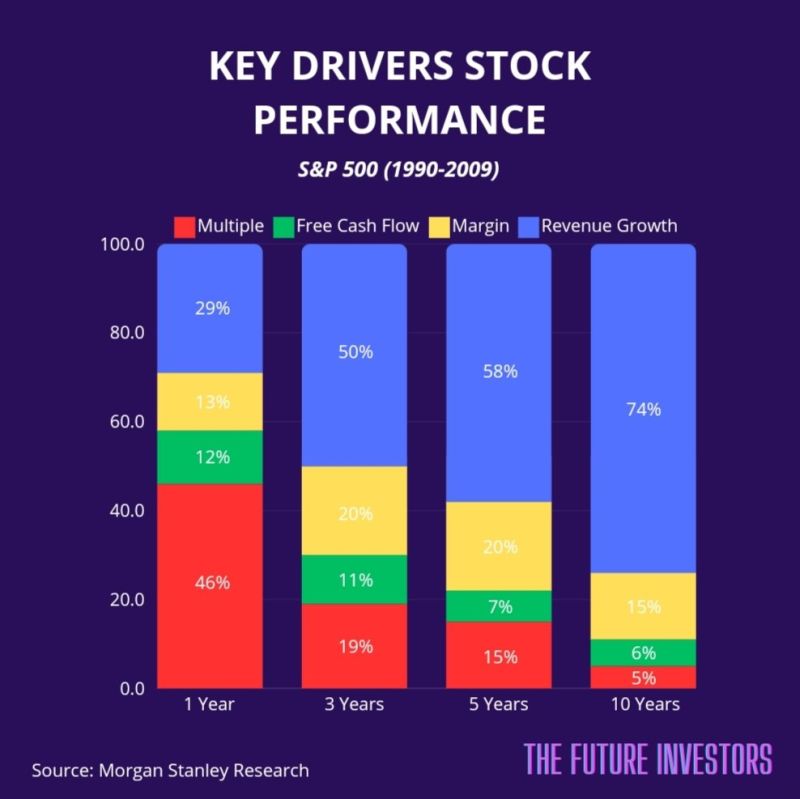

What is the key driver of long-term stock performance? Let's have a look at 4 periods: 1Y, 3Y, 5Y & 10Y.

In the short term, the multiple is key. Over longer periods, the importance of the multiple decreases, while revenue growth and margins become more significant. Source: The Future Investors, Morgan Stanley

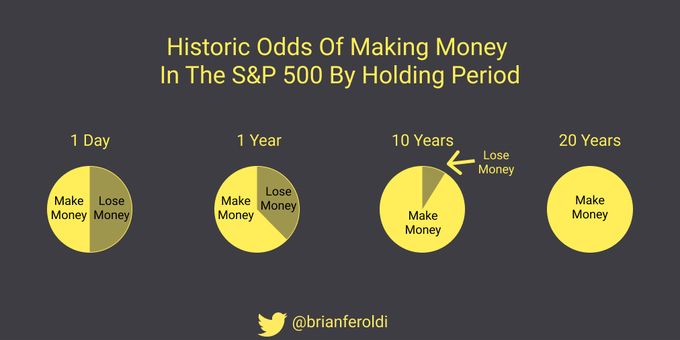

To double your odds of success, double your holding period

Source: Brian Feroldi

Excellent tweet by Otavio (Tavi) Costa on how money debasement looks like and why the BoJ is "trapped” in one chart.

"Japan is experiencing increasing inflation expectations alongside a continuous devaluation of the yen, exhibiting an almost perfectly negative correlation. This reflects the dilemma of an economy burdened by excessive debt, necessitating continuous accommodative monetary policies in the face of structural inflationary pressures. While this might be more pronounced in Japan, this trend is reflective of a global fiat debasement phenomenon". Source: Crescat Capital, Tavi Costa

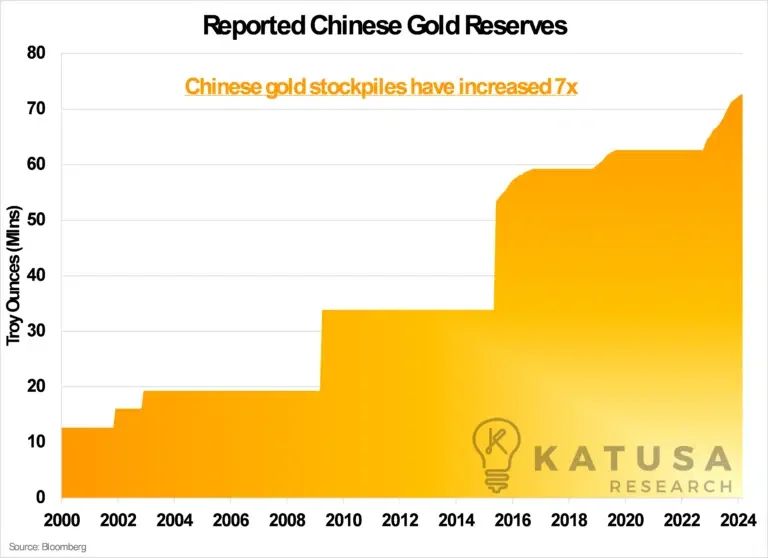

China has quietly accumulated large quantities of gold for 17 straight months – to the tune of 72.7 MILLION ounces (about 2,250 tonnes).

Despite its rise as an economic power, China’s vast reserves are predominantly in USD, an exposure it aims to minimize. To reduce this reliance, the People’s Bank of China is diversifying by increasing its gold holdings. Since 2011, China has decreased its dollar reserves by a third, down to approximately $800 billion. Meanwhile, China’s gold reserves have skyrocketed. China’s economic strategy involves diversifying away from the US dollar, which dominates global trade and commodity pricing. Source: Katusa Research

FINANCIAL GRAVITY as explained by Peruvian Bull:

If we divide the performance of the S&P 500 by the Fed’s Balance Sheet since the GFC, the LINE IS FLAT. This means that there has been basically NO REAL growth in stock prices since 2008- with the only rise in prices due to money printing. The correlation coefficient between central bank quantitative easing and the price of stock indexes is nearly 1... Source: Bloomberg

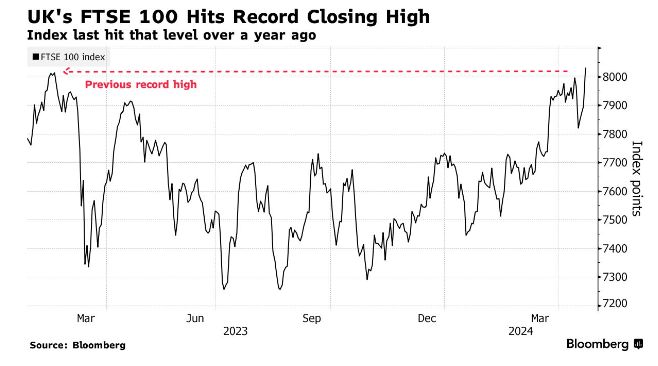

United Kingdom's stock exchange, FTSE 100, hit an all-time high for the first time in more than a year

Source: Bloomberg, Barchart

German economy has returned to growth.

German Composite PMI Index moved back to >50 growth threshold in Apr for 1st time in 10mths, driven by a buoyant services sector. At 50.5, up from 47.7 in March, it signaled a modest expansion rate in private-sector business activity. Service PMI recorded its strongest growth since Jun2023 (index at 53.3). The manufacturing PMI meanwhile remained in sub-50 contraction territory at 42.2. Source: HolgerZ, Bloomberg

The power of share buybacks

'Since 2013, we have now bought back almost 50% of our shares.' Pulte 2023 Annual Report Source: MastersInvest.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks