Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Oil prices are now down nearly 10% from their highs as fears over higher interest rate policy spread.

With markets now seeing less than 2 rate cuts in 2024, demand outlook is questionable. This has put oil prices at their lowest level since March 28th. However, prices are still up more than 15% from their February 2024 lows. Source: The Kobeissi Letter

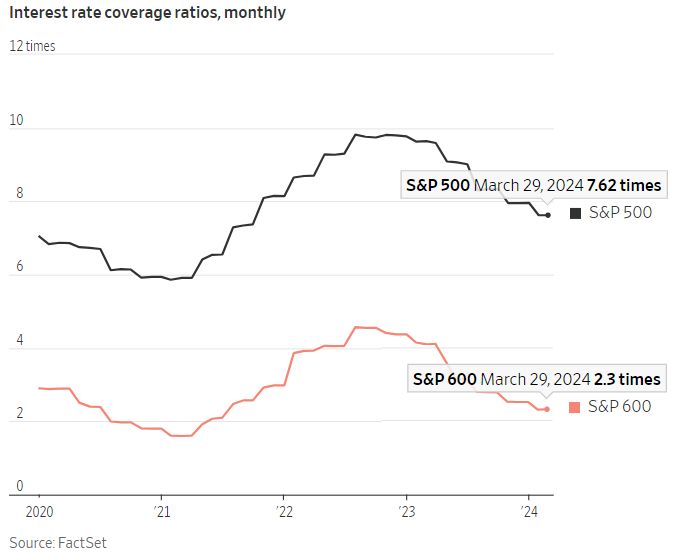

Smaller companies generally spend a much higher % of their income on debt service, making them more sensitive to rising rates.

The interest coverage ratio (operating income / interest expense) for the small cap S&P 600 is 2.3 times vs. 7.6 times for the large cap sp500. Source: Charlie Bilello

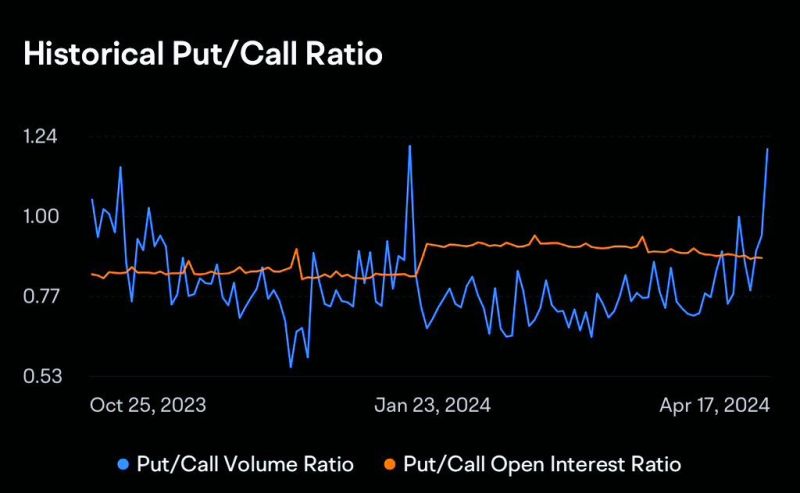

SP500 Put/Call Ratio has risen to multi-year highs amid the recent market sell off.

Source: David Marlin

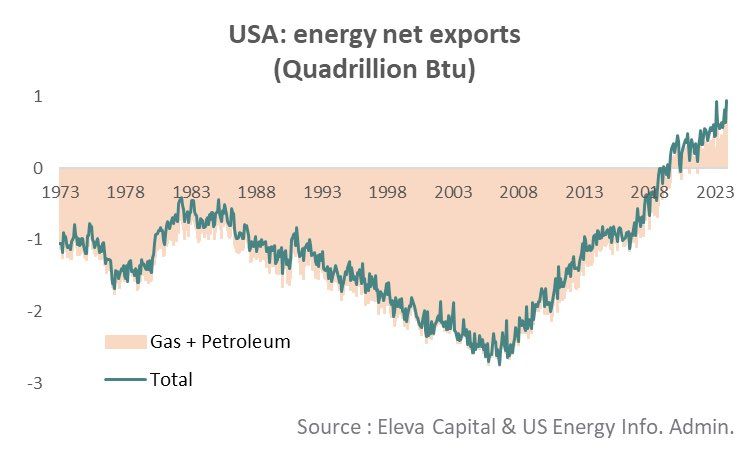

The US being a net energy exporter in one chart

Chart: Stephane Deo, Michel A. Arouet, Eleva Capital

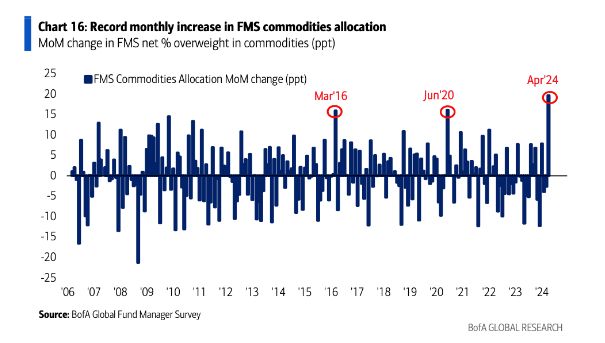

Commodities saw their largest monthly allocation increase in history

Source: BofA

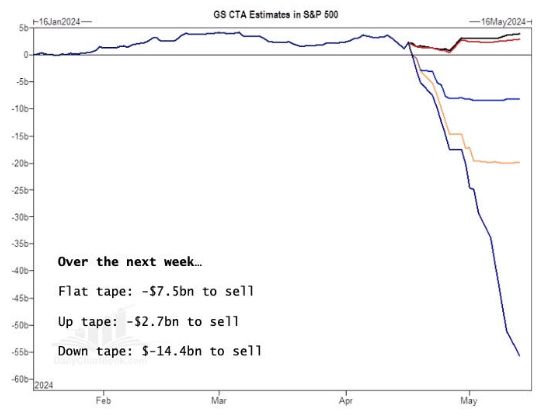

CTAs will dump billions worth of stocks over the next week in EVERY SINGLE SCENARIO warns Goldman Sachs

Source: Barchart

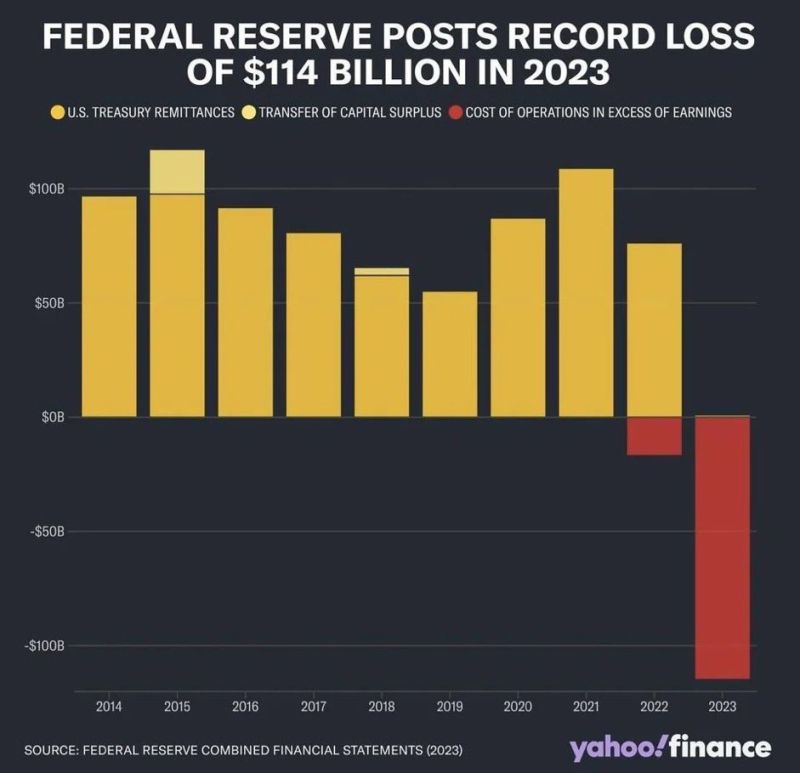

Federal Reserve posted its biggest loss in history of $114 billion last year 👀

Source: Yahoo Finance

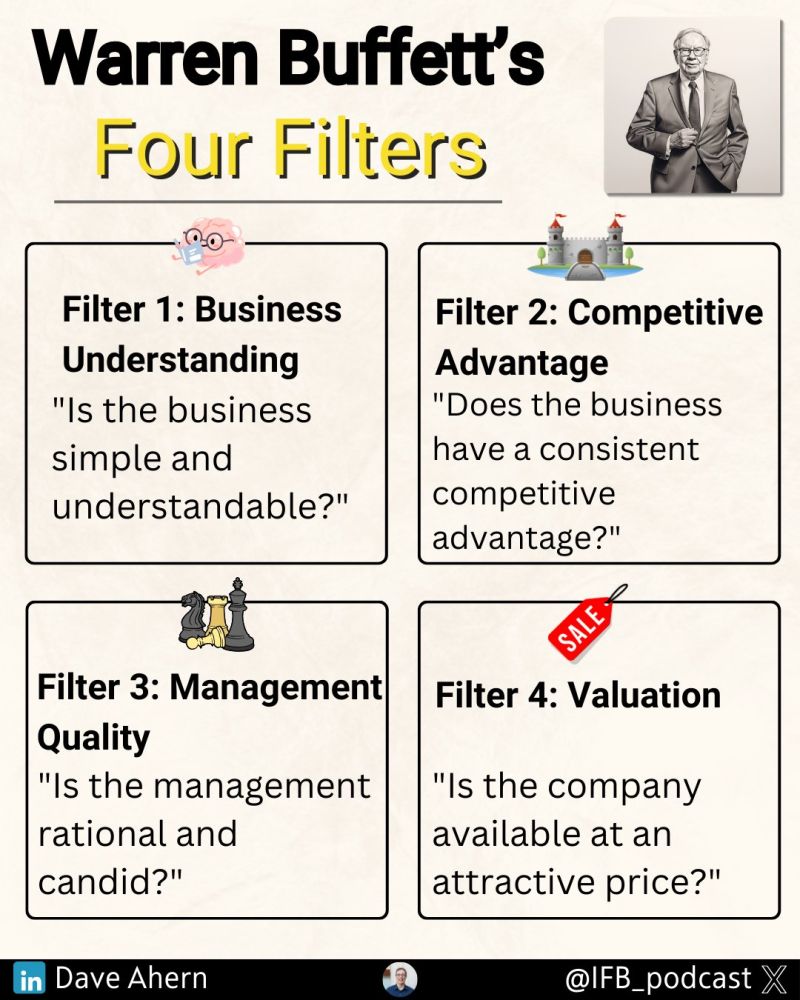

How does Buffett find great investments?

He uses his 4 filters: "Charlie and I look for companies that have a) a business we understand; b) favourable long-term economics; c) able and trustworthy management; and d) a sensible price tag." Simple, but not easy rules to follow. By "The Investing for Beginners Podcast"

Investing with intelligence

Our latest research, commentary and market outlooks