Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The master has failed more than the beginner has tried

Thru Yasin Arafeh

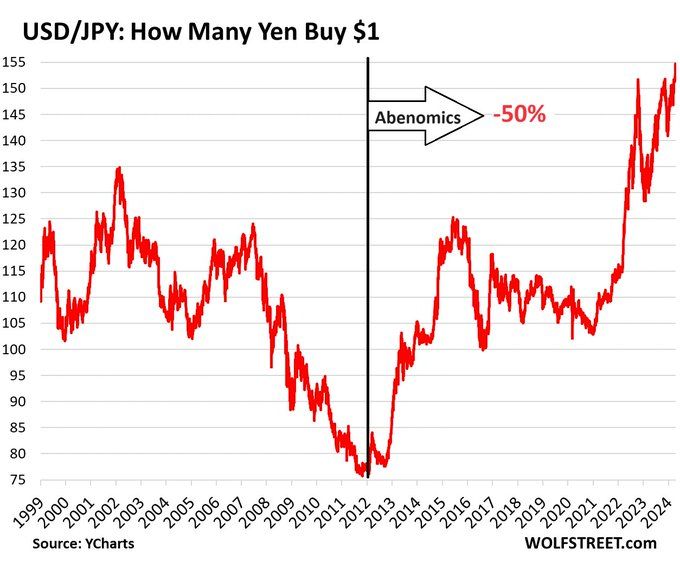

The YEN is COLLAPSING and Abenomics has taught us some lessons:

After years of money printing, Yen now trades to 155 against USD: -32% against USD since 2021, -50% since 2012 The Bank of Japan has been buying over half of the national debt with freshly created yen, plus a bunch of other securities. But there is a price to pay after all: the destruction of the currency: Source Wolfstreet

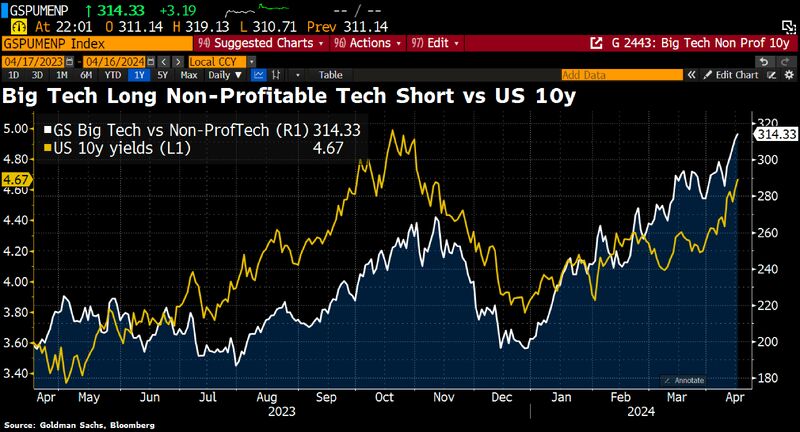

A great chart by HolgerZ ->

Big Tech vs Non-Profitable Tech (long-duration stocks) curve tracks perfectly the US 10y yield rise. It shows very nicely the consequences of the rise in yields for the stock market. Source chart: Bloomberg

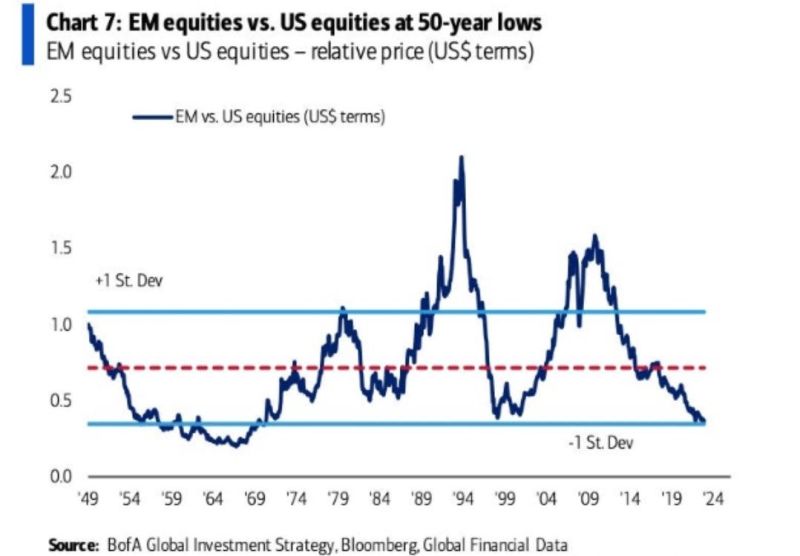

US big tech revolution steamrolling emerging markets equities in one chart.

What would make this trend reverse? Source: BofA, Michel A. Arouet

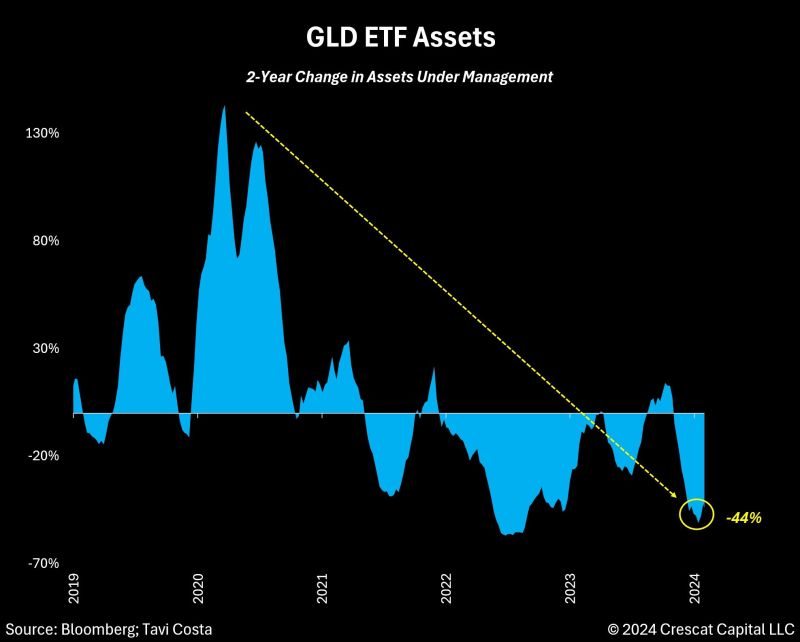

2022-2024 summarised in one cartoon

Thru Andreas Steno Larsen

BREAKING: The 10-year note yield is now up 90 basis points YTD and nearing 4.70% for the first time since November 2023.

As treasury yields rise, we are seeing further pressure on stocks and other risky assets. Meanwhile, the base case now shows just 2 interest rate cuts in 2024. Higher for longer is officially back and interest rates are surging quickly. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks