Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

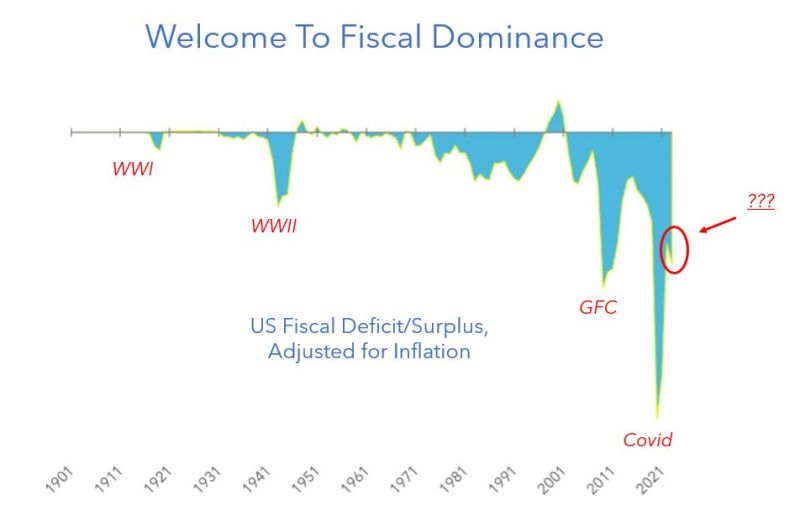

The era of fiscal dominance

source: MacroAlf. Inflation-adjusted US fiscal deficits popping up at: - World War I - World War II - Great Financial Crisis - Covid - 2023 Find the outlier...

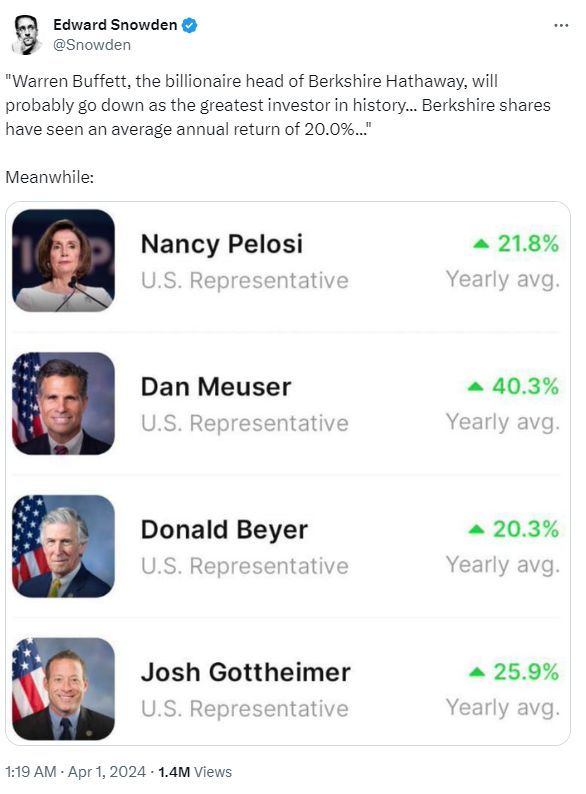

All these US representatives are outperforming Warren Buffet...

Source: Snowden on X

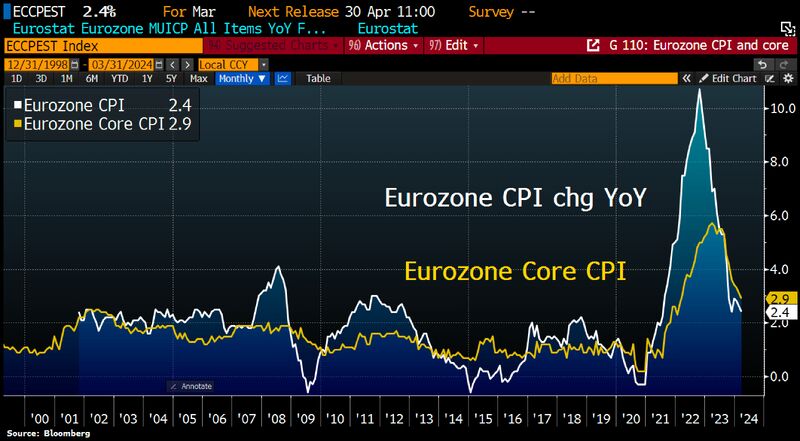

Eurozone inflation cools, setting stage for June rate cut:

Headline CPI slowed to 2.4% YoY in March from 2.6% in February below consensus forecast of 2.5%. Core CPI slowed to 2.9% from 3.1%, again below economists' expectations to reach lowest level in >2yrs. But there were signs that inflationary pressures have yet to ease in labor-intensive parts: Service Price inflation +4.0% YoY, unch from 4 preceding mths. (via DJ, Bloomberg thru HolgerZ).

Is there a chance for the us to start slowing down the pace of debt increase?

Well... think about this: "I'm the king of debt. I'm great with debt. Nobody knows debt better than me." - Donald Trump Source: Ronald-Peter Stoeferle, CMT, CFTe, MSTA

The Imminent Inclusion of Indian Sovereign Bonds in EM Bond Indices is Attracting Huge Foreign Inflows👇

Source: Neha Sahni, JP Morgan

Gold is soaring while Bitcoin – digital Gold – is slumping?

Bitcoin has shown itself to be more correlated w/risk-sensitive assets. Over the past 3yrs, Bitcoin has the highest monthly correlation w/Mag7 at 0.63. Correlation between Bitcoin and Nasdaq 100 is 0.58, between Bitcoin and S&P 500 is 0.54. Correlation between Bitcoin and Gold is very low at 0.23 - at 1 link would denote the two assets trade in sync. (HT @barronsonline) - HolgerZ, Bloomberg

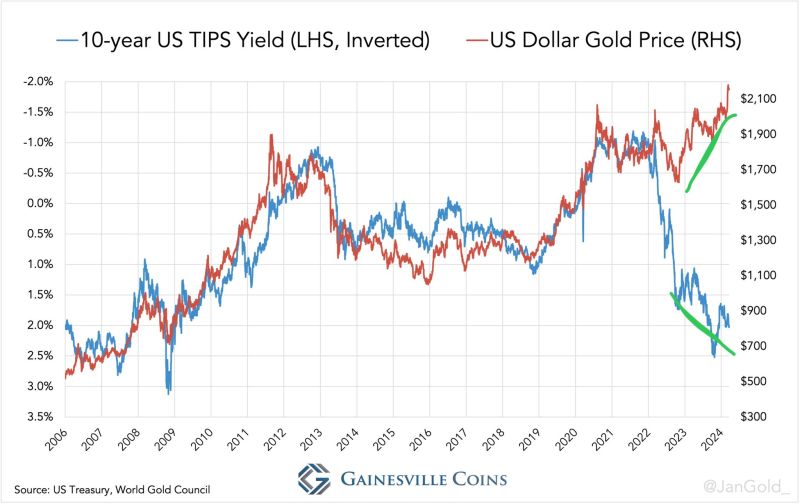

Gold is going up together with real yields (inverted axis in the chart).

Who would have thought?!! Source: Jan Nieuwenhuijs

The first ever 2x and -2x spot bitcoin ETFs hit the market yesterday from ProShares.

$BITU and $SBIT (tickers could have been better). $BITX is 2x but it tracks futures and $BITI is -1x but is also futures. Fee 95bps on both. Haven't traded too much so far, under $1m. Source: Eric Balchunas, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks