Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

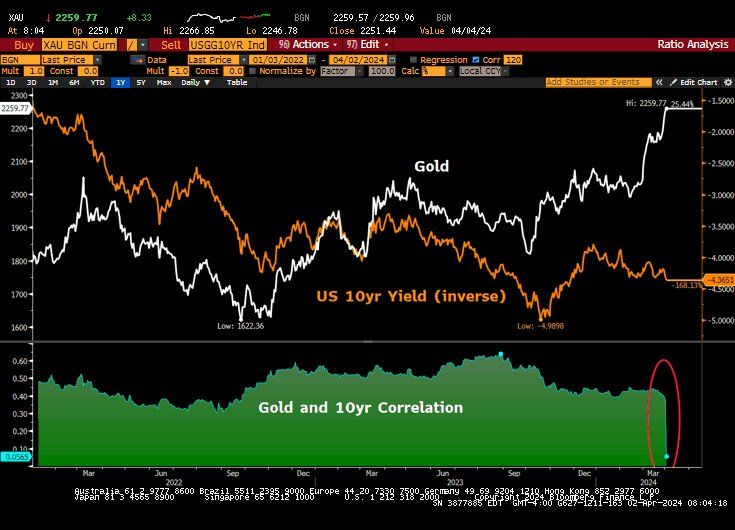

Bond yields up and gold up?

This looks like a classic 1970s action, with the inverse relationship between gold and 10-year Treasury yields starting to decouple. Gold is at all-time highs in the face of bond market weakness. This, coupled with the rise in commodity prices (especially oil / gasoline), could mean troubles for the Fed and the banks. Source: Bloomberg, Lawrence McDonald

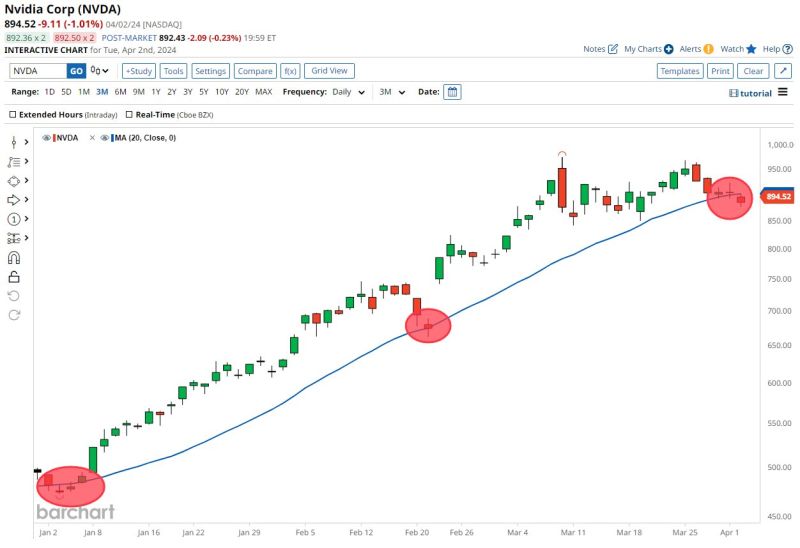

Nvidia $NVDA closed below its 20D moving average for only the 3rd time this year 👀

Source: Barchart

China and Hong Kong stocks lost nearly $5 trillion in 3 years — more than India’s market cap

Stocks in China and Hong Kong sold off a massive $4.8 trillion in market capitalization since 2021, which according to HSBC, is more than the value of the Indian stock market. Indian stocks have rallied amid broader optimism about the country’s growth. Despite a subdued global IPO market, research from EY showed Indian stock exchanges also had the most IPOs in 2023. https://lnkd.in/eFCFMe2s Source: CNBC

NEW: 🇺🇸 Spot Bitcoin ETFs bought 66,008 BTC in March, while miners only produced 28,513 BTC

Source: Bitcoin Magazine

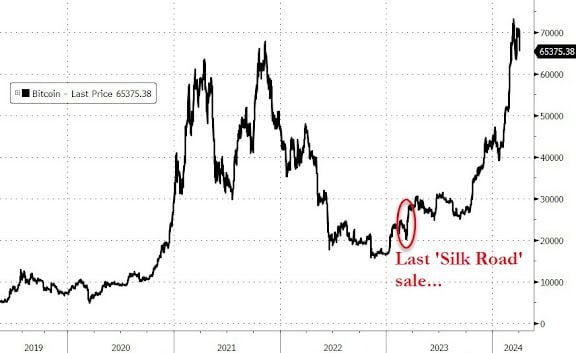

- &summary=*WALLET LABELLED AS 'SILK ROAD DOJ CONFISCATED FUNDS' CONTAINING $2 BILLION OF BITCOIN INSTIGATES POSSIBLE TEST TRANSACTION FOR 0.001 BTC TO COINBASE PRIME WALLET: ARKHAM DATA AND LABELLING - THE BLOCK PRO See chart below highlighting the effects on bitcoin of last Silk Road sale... Source: www.zerohedge.com&source=https://blog.syzgroup.com/syz-the-moment/heres-the-probable-reason-for-todays-sell-off-on-bitcoin-' target="_blank">

Here's the (probable) reason for today's sell-off on bitcoin ->

*WALLET LABELLED AS 'SILK ROAD DOJ CONFISCATED FUNDS' CONTAINING $2 BILLION OF BITCOIN INSTIGATES POSSIBLE TEST TRANSACTION FOR 0.001 BTC TO COINBASE PRIME WALLET: ARKHAM DATA AND LABELLING - THE BLOCK PRO See chart below highlighting the effects on bitcoin of last Silk Road sale... Source: www.zerohedge.com

Maybe we have hit the pain threshold...

i,e the hashtag#nasdaq green line) can not move higher as the number of rate cuts expected for this year (red line) keeps decreasing... Source: www.zerohedge.com, Bloomberg

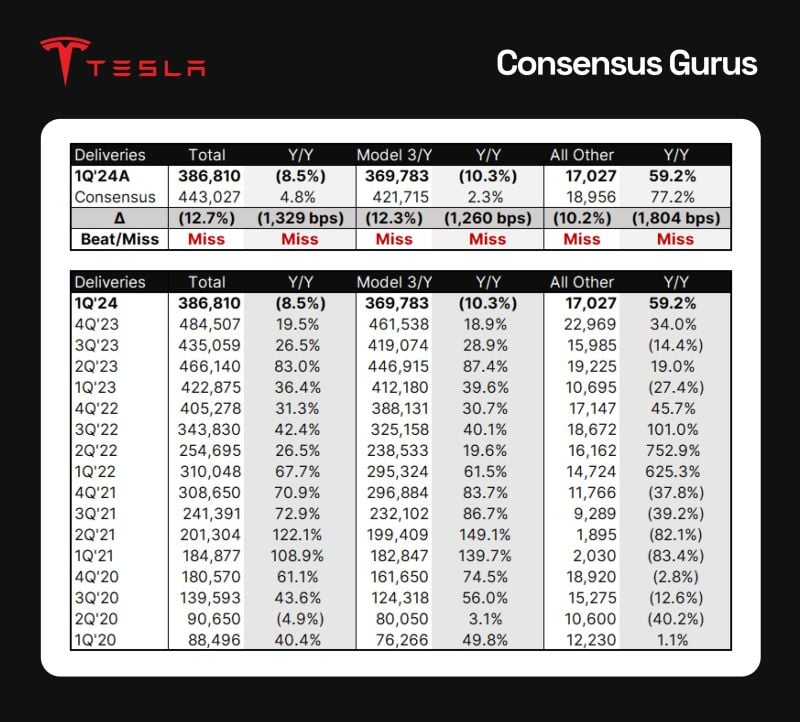

Tesla $TSLA 1Q'24 Deliveries are ugly: Total deliveries -8.5% Y/Y with Model 3/Y -10%

Stock is down -5% today and now down -33% year-to-date... Source: Consensus Guru

Investing with intelligence

Our latest research, commentary and market outlooks