Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

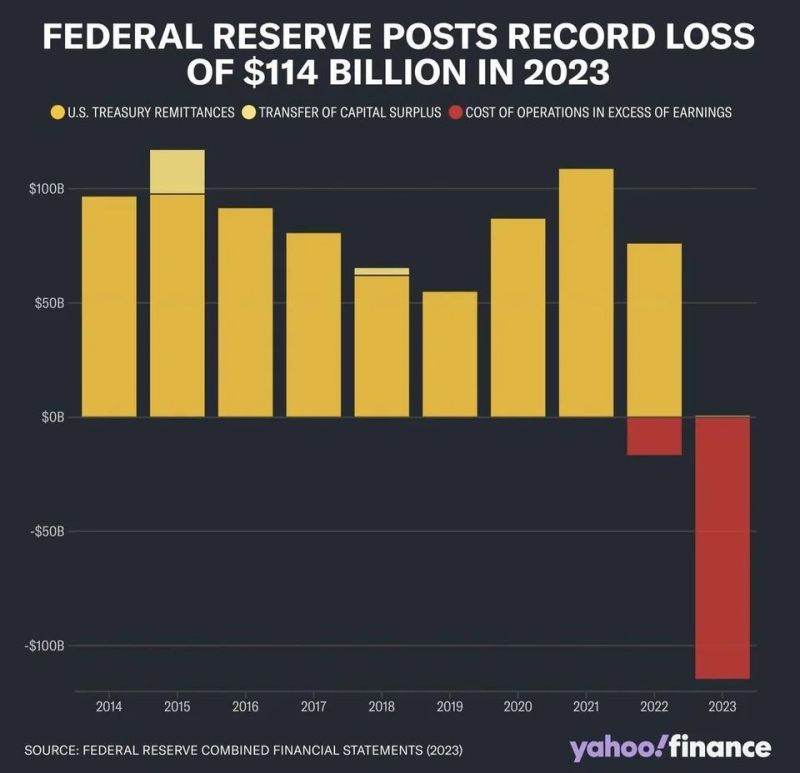

BREAKING: Federal Reserve

The Fed said on Tuesday that it officially saw a net negative income of $114.3 billion in 2023, a record loss tied to expenses related to managing the U.S. central bank's short-term interest rate target. The loss last year follows $58.8 billion in net income in 2022, the Fed said. Source: Barchart

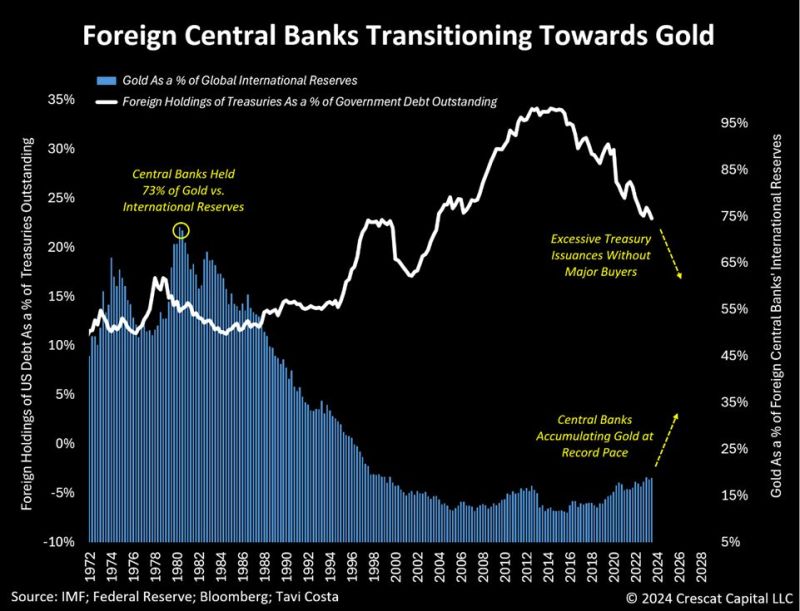

Gold's role as a neutral asset with millennia of history as money is experiencing a resurgence relative to US Treasuries for global central bank reserve accumulations.

Source: Tavi Costa, Bloomberg

Cartoon of the Day by Hedgeye

$34.6 TRILLION and counting... Are we past the point of no return?

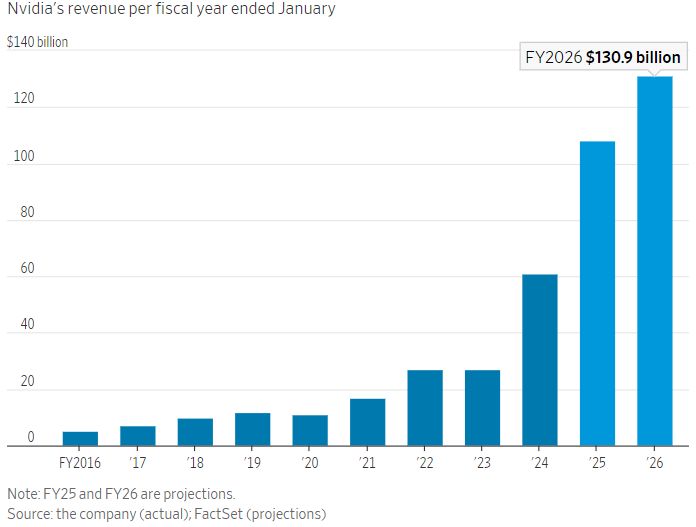

Analysts are forecasting Nvidia's annual revenue will jump to $131 billion by 2026, more than double the $61 billion recorded in the fiscal year that just ended.

$NVDA Source: Charlie Bilello

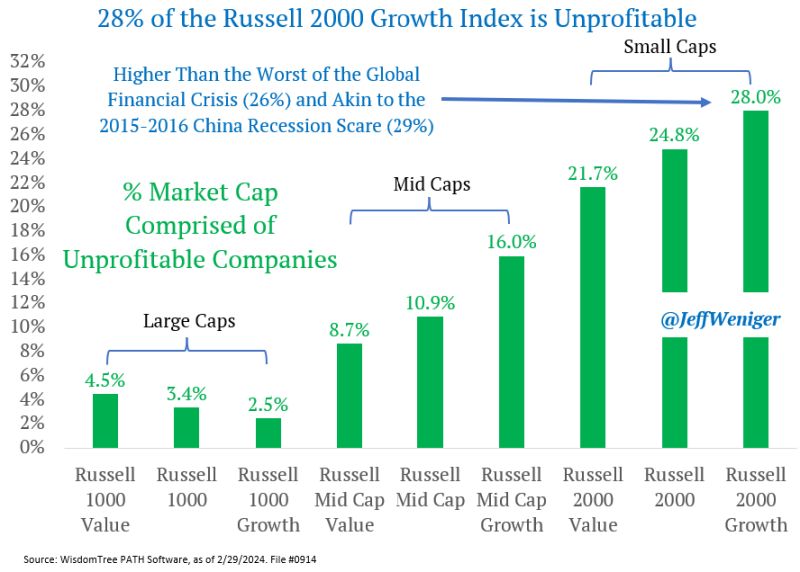

Do people appreciate how speculative "Small Cap Growth" has become?

The Russell 2000 Growth has 28% in negative earners. Prior to the GFC, negative earners were 15-18% of the index. Even in a depression (2009), it only went up to 26%. How many will "grow" into bankruptcy court? Source: Jeff Weniger

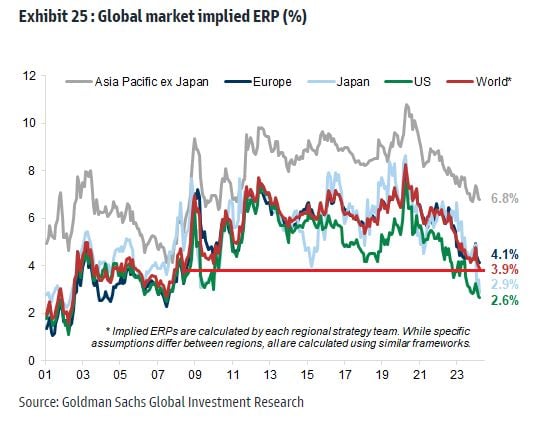

Global equity risk premium are now at the lowest since 2008.

Source: Mike Zaccardi

Investing with intelligence

Our latest research, commentary and market outlooks