Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

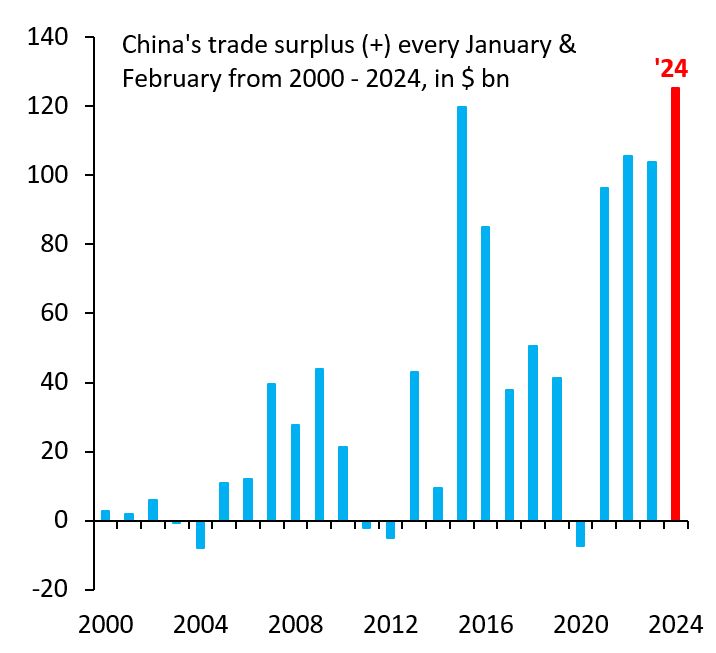

China's trade surplus in the first 2 months of 2024 is the biggest EVER.

Here's China's dilemma. It's caught in a deflationary debt spiral. Exports are a way out. But - at the same time - China's relations with the "developed" world are deteriorating. Source chart: Robin Brooks

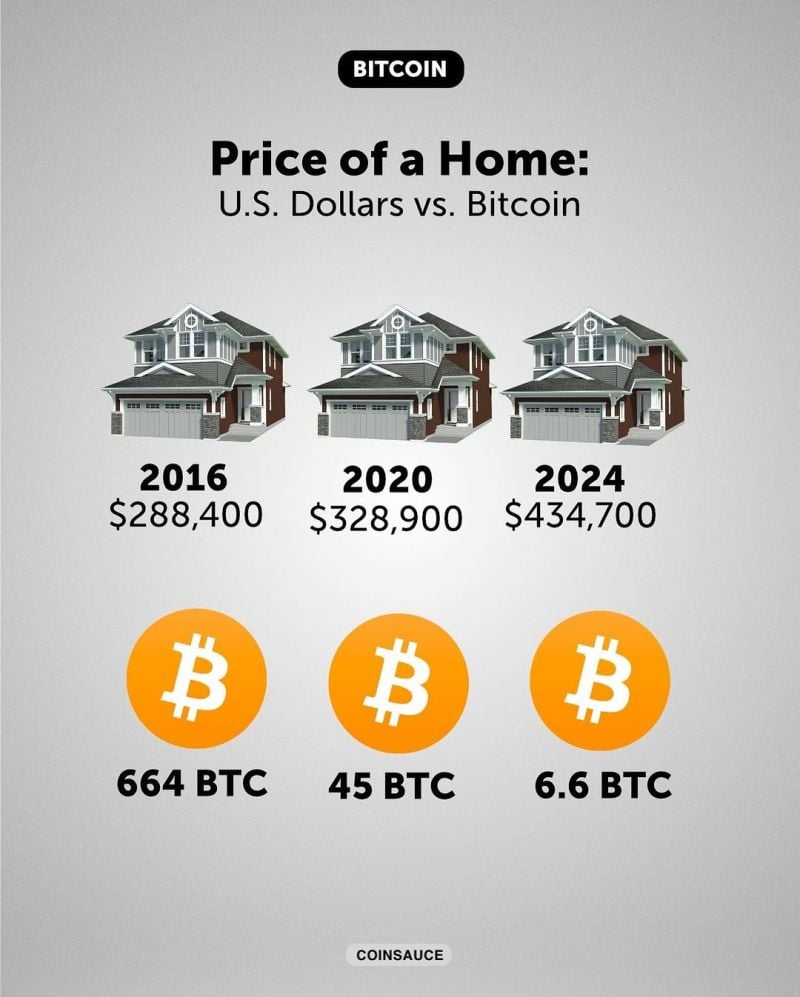

Price of a home in the us (median price) vs. bitcoin over time

Source: coinsauce

Indian bonds are set to be added to global indexes. Here’s why it could be a gamechanger - CNBC

- The decision to include Indian government bonds in two prominent global indexes recently is being viewed as a shot in the arm for the rapidly growing country and is expected to bring in billions of inflows. - India’s bonds will be added to the JPMorgan Government Bond Index-Emerging Markets (GBI-EM) in June, the Wall Street lender announced in September. - Goldman Sachs said it expects India’s bond markets to see inflows “upwards of $40 billion from the time of announcement to the end of the scale-in period, or around $2 billion per month.” - The biggest buyers of India’s government debt have so far been institutional organizations such as banks, mutual funds and insurance firms but addition to global indexes means it could now diversify the country’s avenues to raise funds. https://lnkd.in/d7hwmgZH Source: CNBC

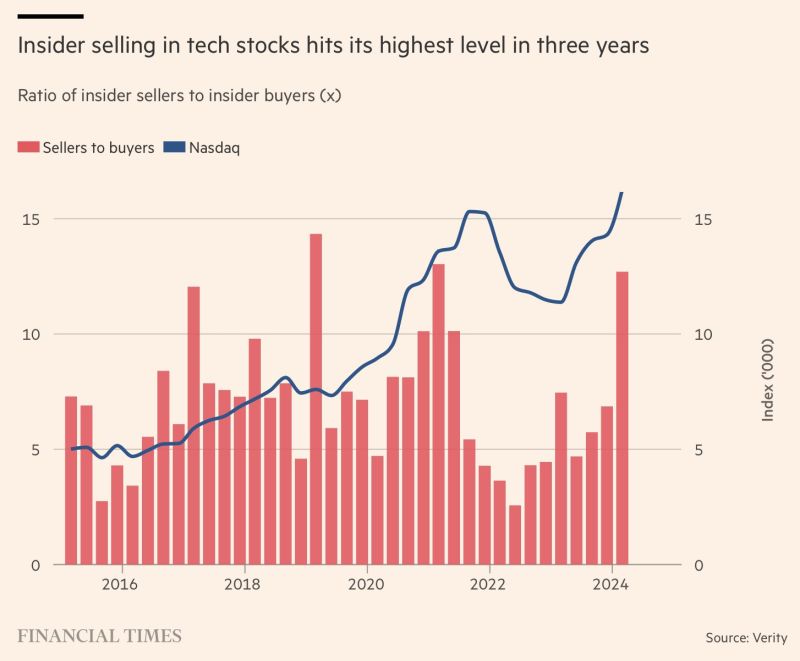

FT: 'Peter Thiel, Jeff Bezos and Mark Zuckerberg are leading a parade of corporate insiders who have sold hundreds of millions of dollars of their companies' shares this quarter

In a signal that recent stock market exuberance could be peaking. https://t.co/lFp5iOD53j Source: FT Activate to view larger image,

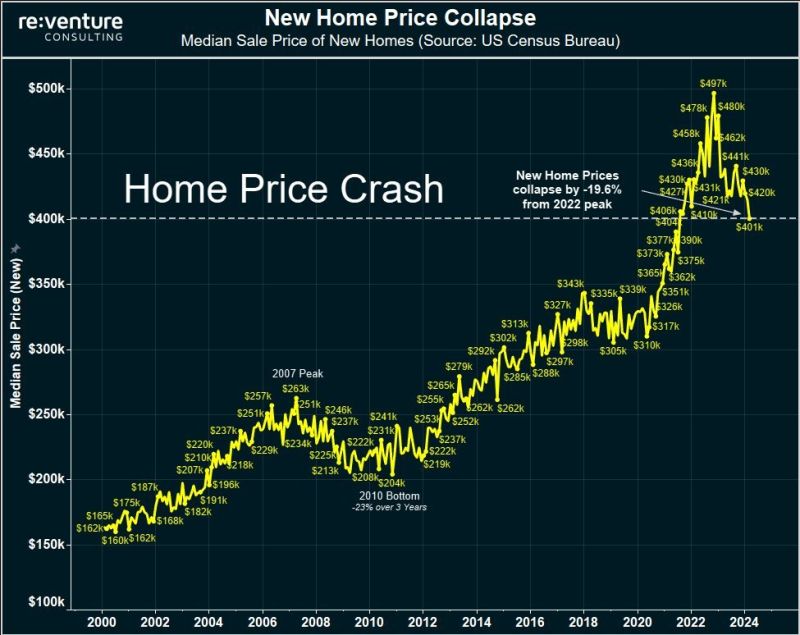

BREAKING: US new home prices are now down 20% from their highs, in bear market territory, and falling faster than rates seen in 2008, according to Reventure.

New home prices peaked in late-2022 at $497,000 and have fallen to $401,000 as of the latest data. In the financial crisis, new home prices dropped by 23% from 2007-2010, according to Reventure. US Home prices are down roughly the same amount in just 1.5 years, or half the amount of time. Still, new home prices are ~20% above pre-pandemic levels and existing home supply is near record lows. Is the hashtag#us housing market beginning to crack? Source: The Kobeissi Letter, Re-venture

Investing with intelligence

Our latest research, commentary and market outlooks