Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

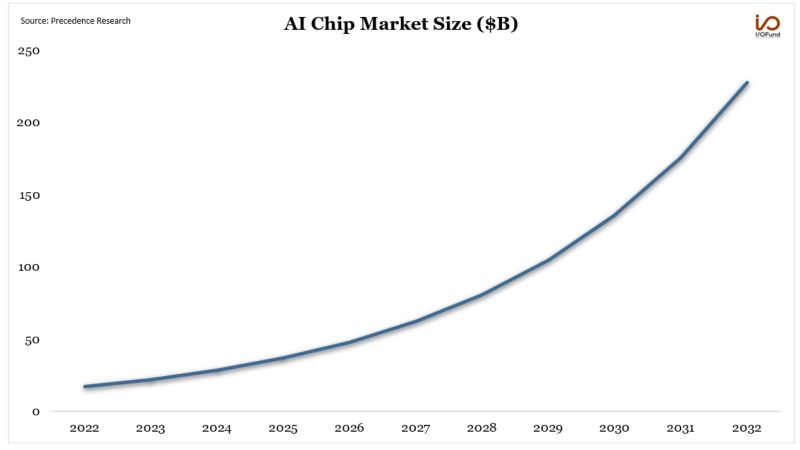

The AI chip market size is forecasted to grow at a CAGR of 29% through 2032

Driven by the rising adoption of artificial intelligence across various industries, coupled with the growing demand for high-bandwidth memory, rapid computation, and parallel processing capabilities. Source: Beth Kindig

Are us financial conditions becoming too easy to tame inflation ?

Source: Bloomberg, Steno Research, Macrobond

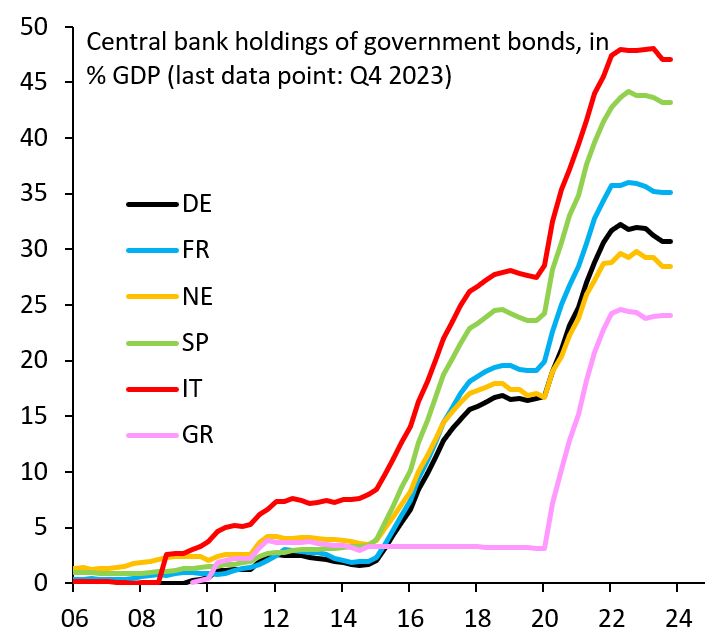

Below central bank holdings of government bonds...

Greece was excluded from ECB QE under Draghi, but was included in COVID QE, giving it a big boost (pink). Greece then undermined the G7 cap on Russia at every turn, protecting its shipping oligarchs at the expense of the EU. If you can't behave properly, there should be no QE... Source; Robin Brooks

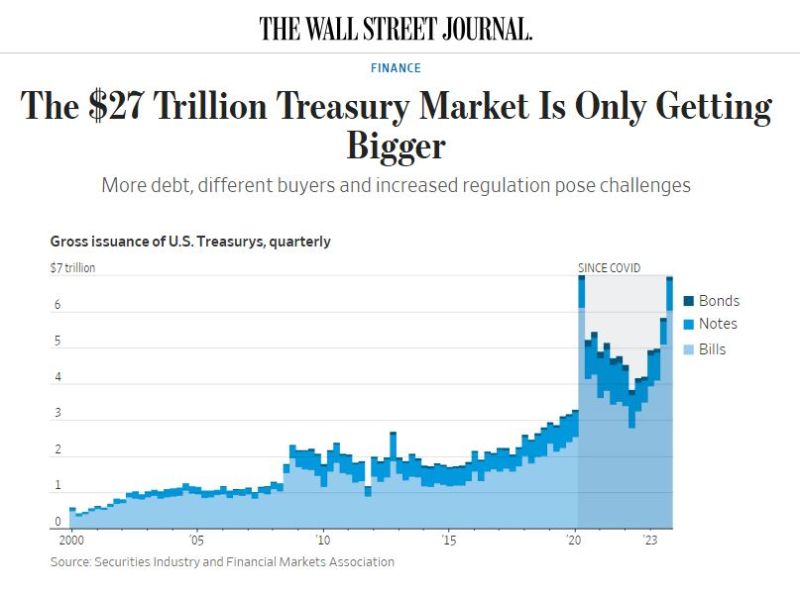

US Treasury issuance has expanded in recent years, sending the size of the US government bond market to a record ~$27tn.

Up ~70% since the end of 2019 & nearly 6x larger than before the ’08-’09 GFC. That is making some Wall Streeters nervous. Source: HolgerZ, WSJ

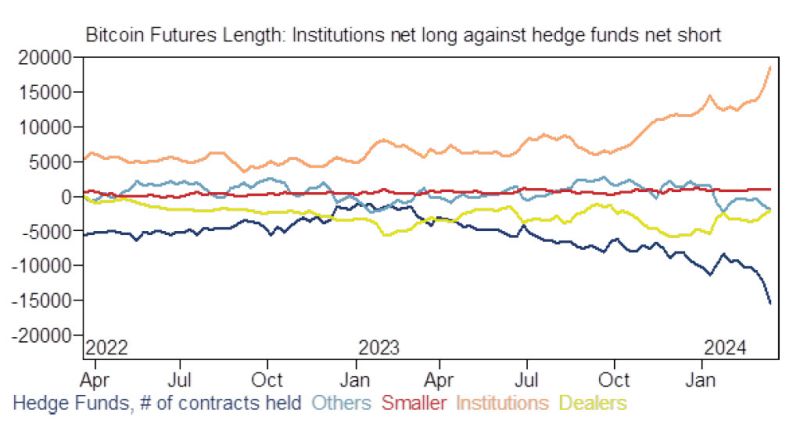

Goldman: "The institutional Bitcoin net long and hedgefund Bitcoin net short lengths are at record levels".

Is another epic squeeze coming? Source: www.zerohedge.com

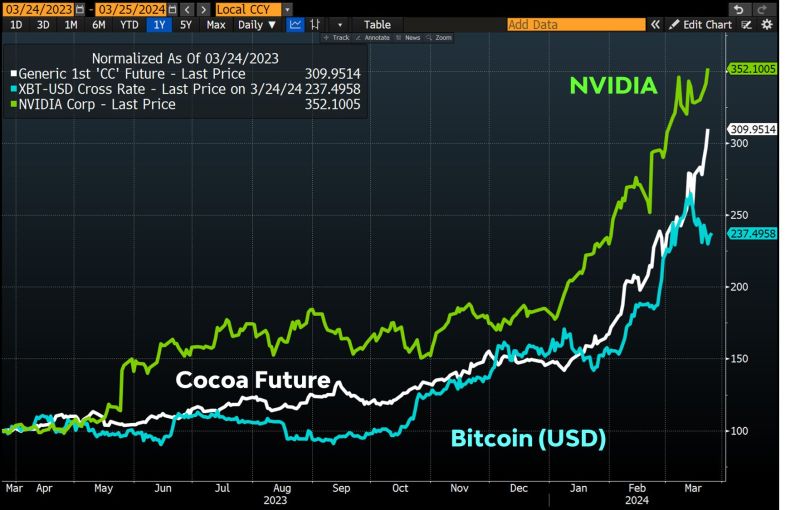

The race continues...Bitcoin is up a 'modest' 237% in the last 12 months.

Cocoa is up 310% and NVIDIA 350%. Source: Bloomberg, Jeroen Blokland

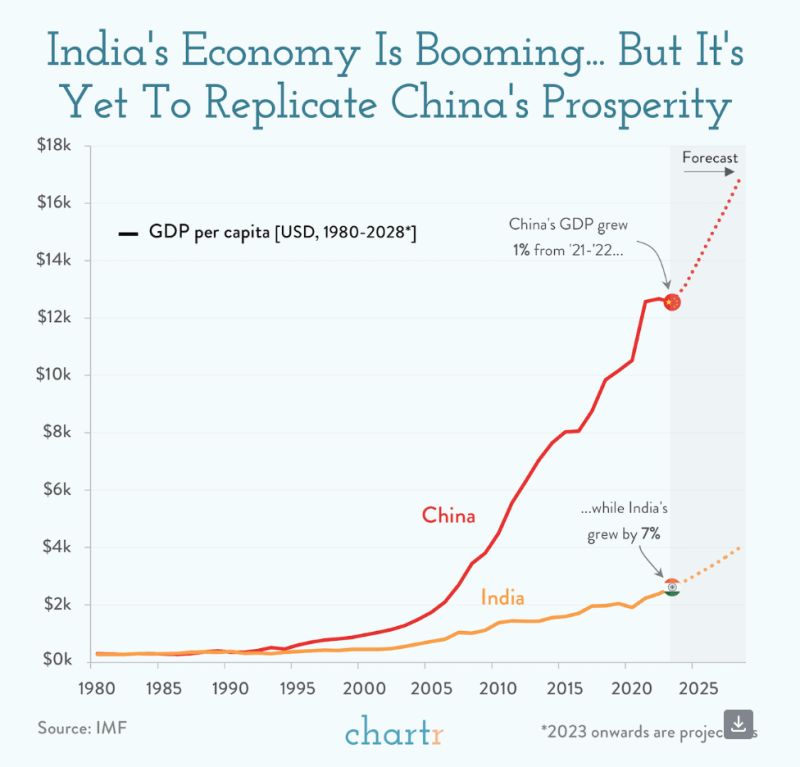

In recent years, India’s economy has continued to boom, just as China and other fast-growing countries have endured a post-pandemic slowdown.

But, the country has a long way to go to replicate China’s success, after the economic fortunes of the two diverged dramatically some 30 years ago. Indeed, as recently as 1992, the GDP per capita of the 2 countries — which share a 2,167-mile border — was roughly equivalent: today, India’s is roughly one-fifth of China’s reported $12.7k. The International Monetary Fund (IMF) predicts that India made up 15% of global growth in 2023, and, having overtaken the UK as the world’s 5th largest economy in 2022, it’s now on track for 3rd place behind the US and China by 2030. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks