Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

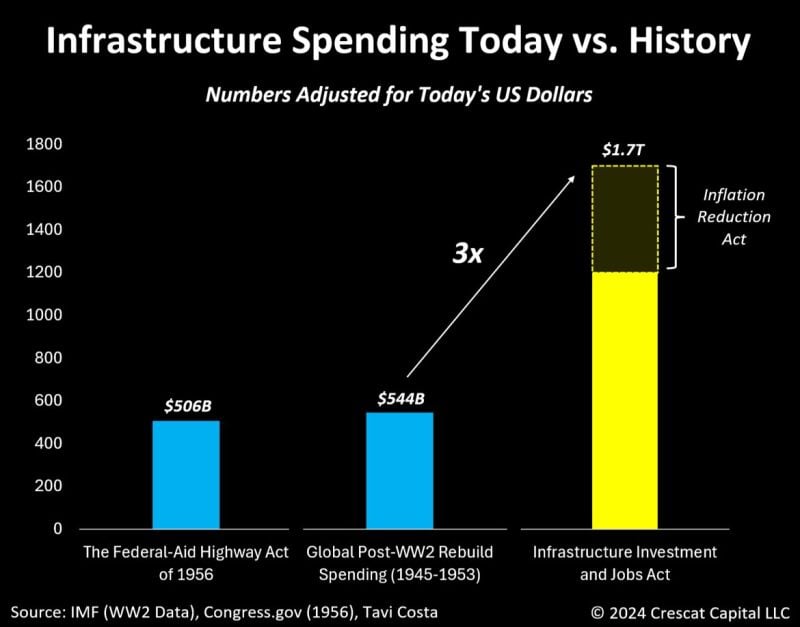

As highlighted by Tavi Costa, today’s US infrastructure spending is likely to dwarf what we experienced during the rebuild period post-WWII by the US and the rest of the world.

Escalating geopolitical tensions and growing disagreements among nations are incentivizing countries to bolster their self-reliance in domestic operations. These circumstances are poised to catalyze what could evolve into one of the most ambitious infrastructure initiatives in history, with the potential to be highly inflationary. The last major infrastructure push in the United States occurred in 1956 with the National Interstate and Defense Highway Act under President Dwight D. Eisenhower. Initially budgeted at $25 billion, equivalent to approximately $207 billion in today's currency. This initiative pales in comparison to the recent Infrastructure Investment and Jobs Act, which authorizes government spending nearly six times that amount, totaling $1.2 trillion. The chart below also considered the Inflation Reduction Act passed in 2022, expecting a significant portion of those funds to be directed towards new infrastructure projects, including those associated with the green revolution and other initiatives. Sources: Tavi Costa, Crescat Capital, Bloomberg

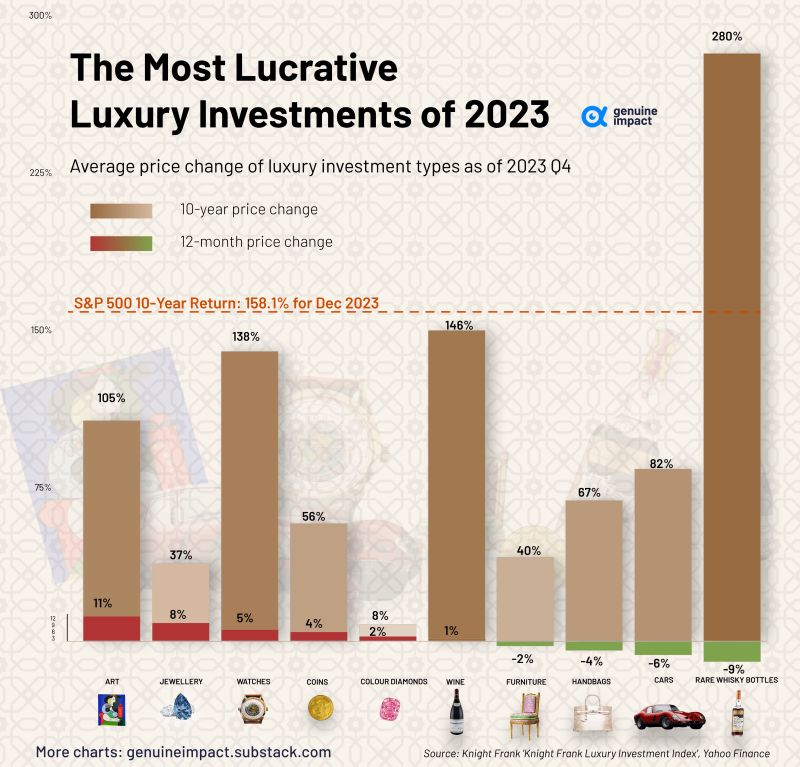

Returns on different types of luxury goods have ranged from 8% to 280% over the last 10 years, compared to 158.1% for the S&P 500.

However , only one has outperformed the S&P 500 in terms of 10-year returns: Rare whiskey🥃, boasting an impressive 280% return. Source: Genuine Impact

In any thriving workplace, skilled workers often choose to remain because they are rewarded with good benefits and incentives.

Source: agrossoblog.org

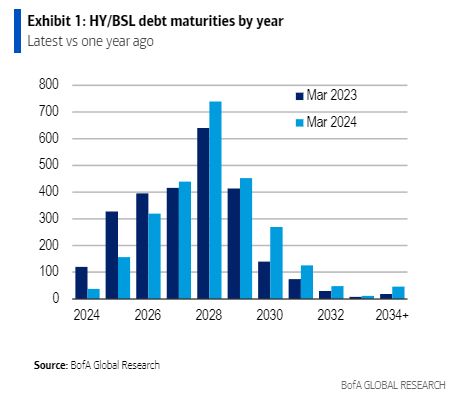

Junk bond and leveraged loan issuers have cut ttheir 2024-2026 maturity wall by 40% from a year ago, according to BOA estimates.

"This episode represents one of the most aggressive instances of maturity extension in the history of leveraged finance." Source: BofA, Tracy Alloway

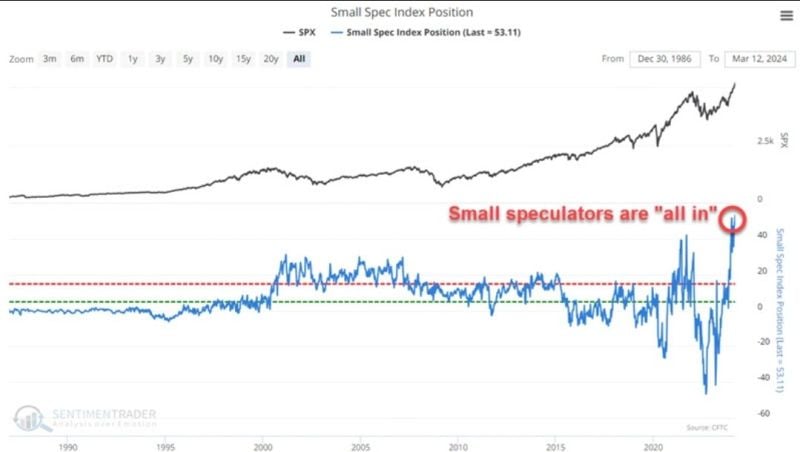

Small speculators in stock indexes have reached their most bullish net position ever.

Source: WinSmart

Quartr just created this infographic that illustrates the 13 largest luxury companies worldwide by market cap.

Four intriguing facts: → $LVMH's market cap is almost 60% larger than the combined market caps of the bottom 10 companies on the list. → $RMS is by far the largest single-brand company on the list and ~3.5x larger than $RACE. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' €13B. → Tiffany & Co. was acquired by LVMH during the pandemic at a valuation of $16 billion, which would place them at #8 on this list.

Investing with intelligence

Our latest research, commentary and market outlooks