Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

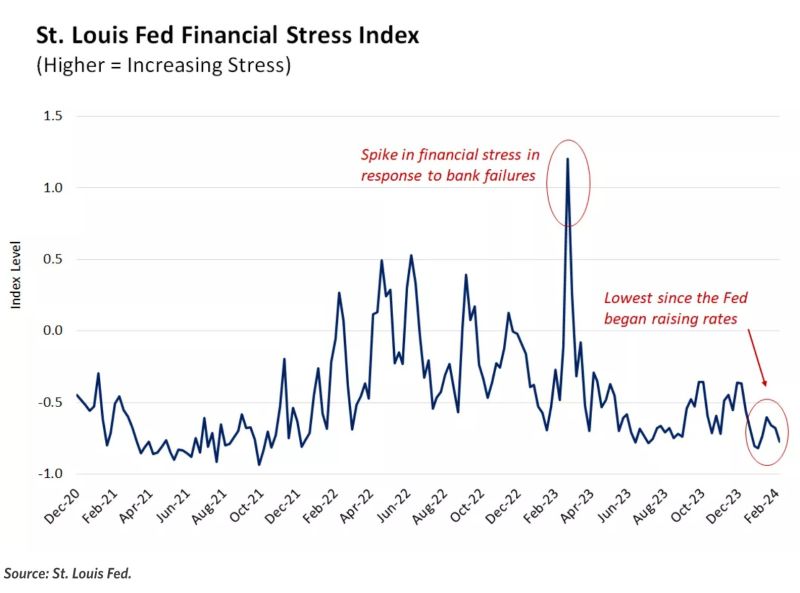

Financial stress is the lowest since the Fed began raising rates, which begs the question -- why cut this year? 🤔

Source: Markets & Mayhem, St Louis Fed

China kicks off the year on strong note as retail, industrial data tops expectations - CNBC

- Retail sales rose 5.5%, better than the 5.2% increase forecast in a Reuters’ poll, while industrial production increased 7%, compared with estimates of 5% growth. - Fixed asset investment rose by 4.2%, more than the forecast of 3.2%. - Online retail sales of physical goods rose by 14.4% from a year ago during the first two months of the year.

Nikkei reported BOJ conducted a gensaki (reverse repo with JGB collateral) operation Monday for the first time in about a month.

*Article cited broad upward pressures on rates amid heightening expectations of an imminent BOJ rate hike, leading traders to conclude the measure was meant to prepare for market reactions Source: C.Barraud https://lnkd.in/e8c8ubcx

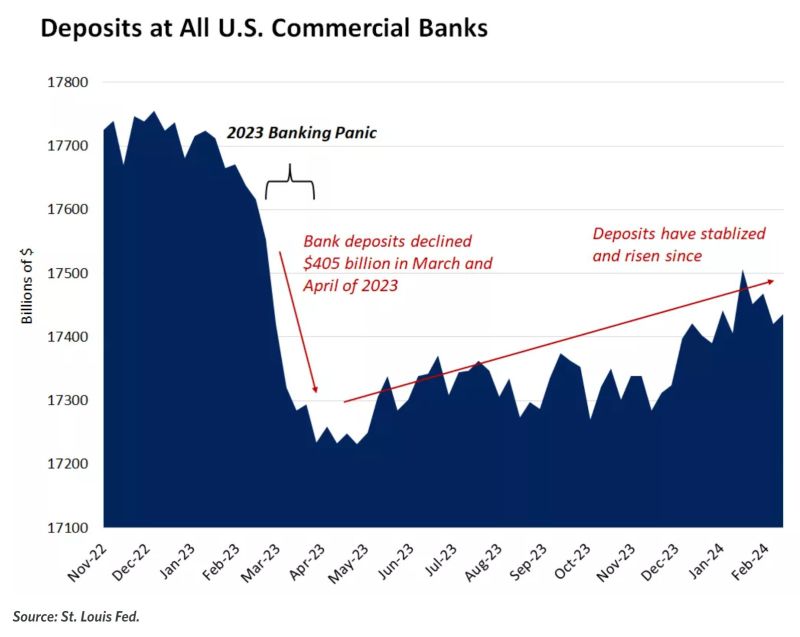

us bank deposits have stabilized and risen since the 2023 banking panic, showing that confidence is slowly returning.

Source: BofA, Markets & Mayhem

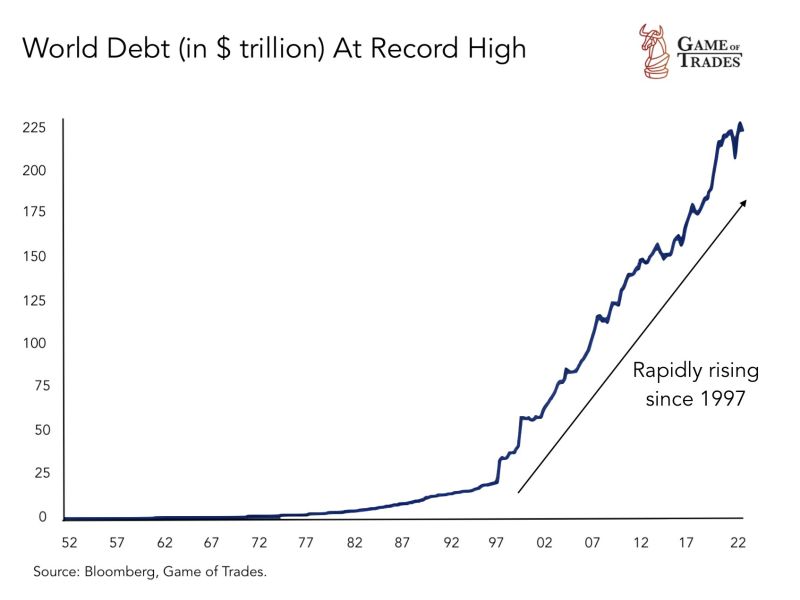

World debt has crossed $225 TRILLION.

This is unlike anything we’ve seen. Source: Game of Trades

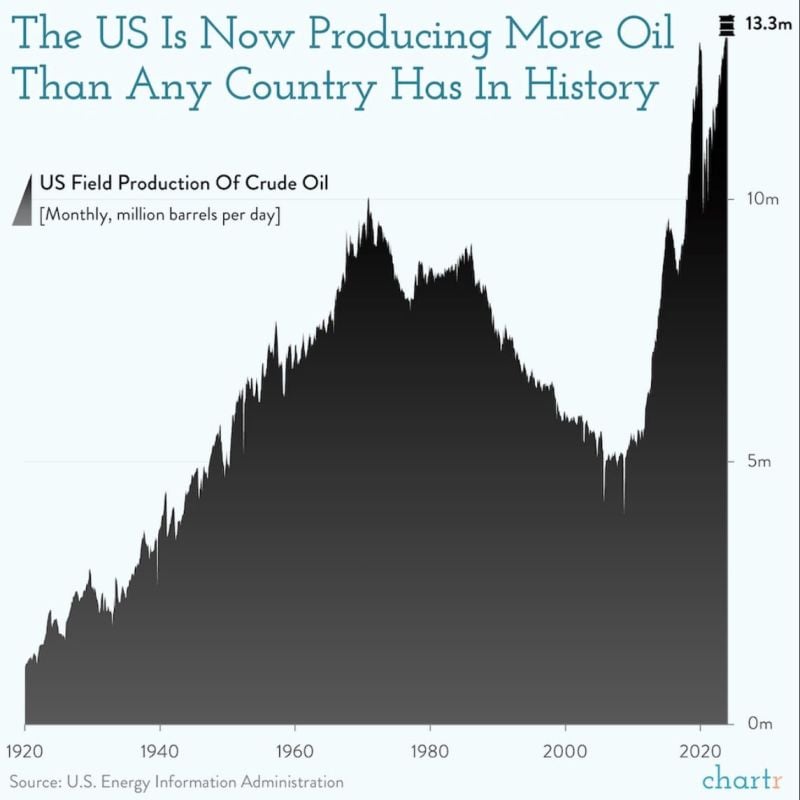

The US is now producing more oil than any country has in history

Source: Michel A.Arouet, Chartr

Investing with intelligence

Our latest research, commentary and market outlooks