Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

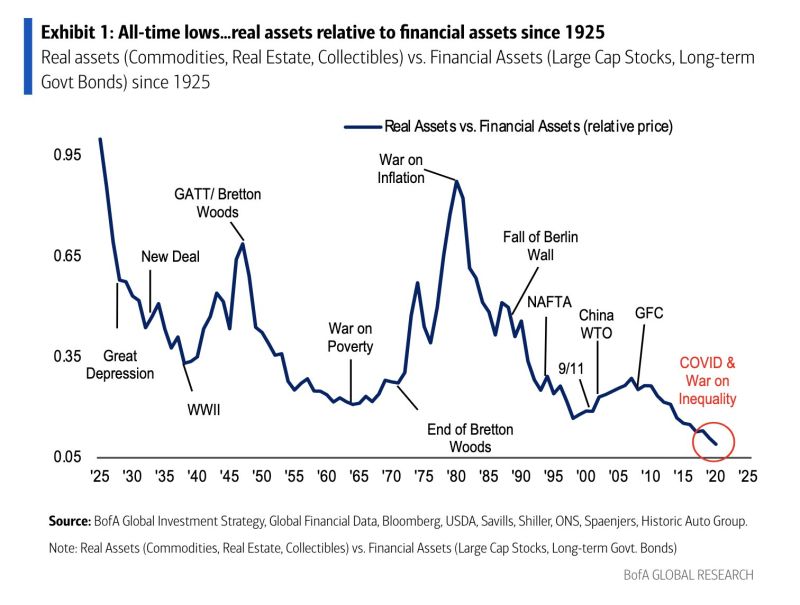

HARD ASSETS ARE AT LOWEST RELATIVE TO FINANCIAL ASSETS SINCE 1925...

Source: BofA

$SPX/GDP, the 'Buffet' indicator, is back near the 2021 highs

Source: Swordfishvegetable

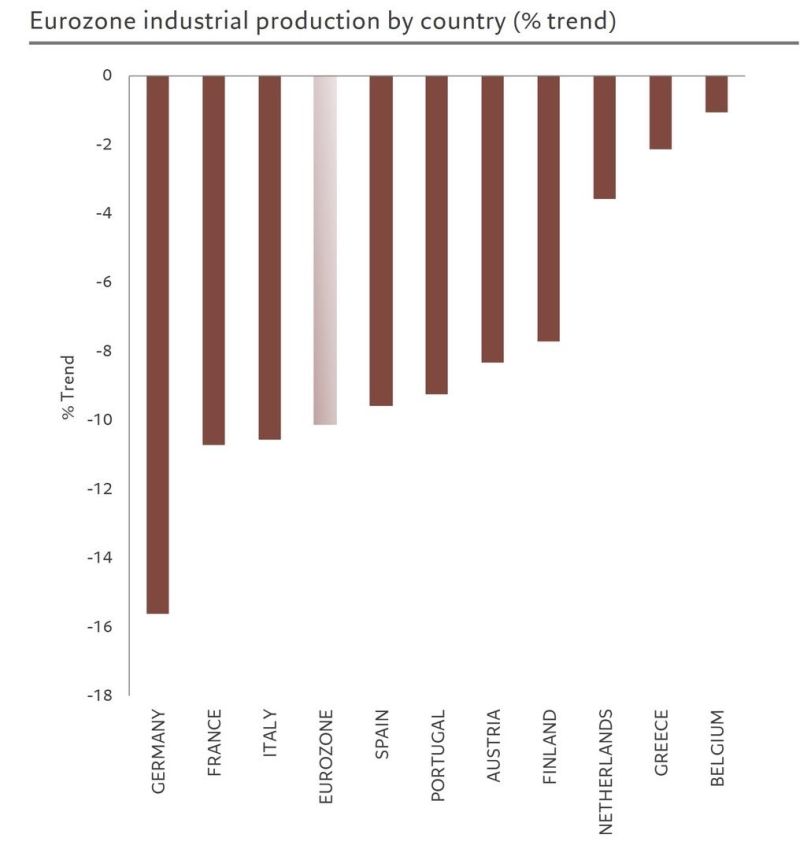

Everyone is aware of German deindustrialization by now, unfortunately industrial production in other major European countries is not looking much better.

Source: Michel A.Arouet, skhanniche

Bond markets are getting crushed this week: The bond tracking ETF, $TLT, is down 4% since Friday and on track for its worst week this year.

Why is this happening? - First, CPI inflation data showed that inflation JUMPED to 3.2% and is now up from 2 straight months. - Then, PPI inflation data nearly DOUBLED, rising to 1.6%, further igniting fears of a rebound in inflation. - Interestrate cuts are quickly being removed from market expectations. Source: The Kobeissi Letter

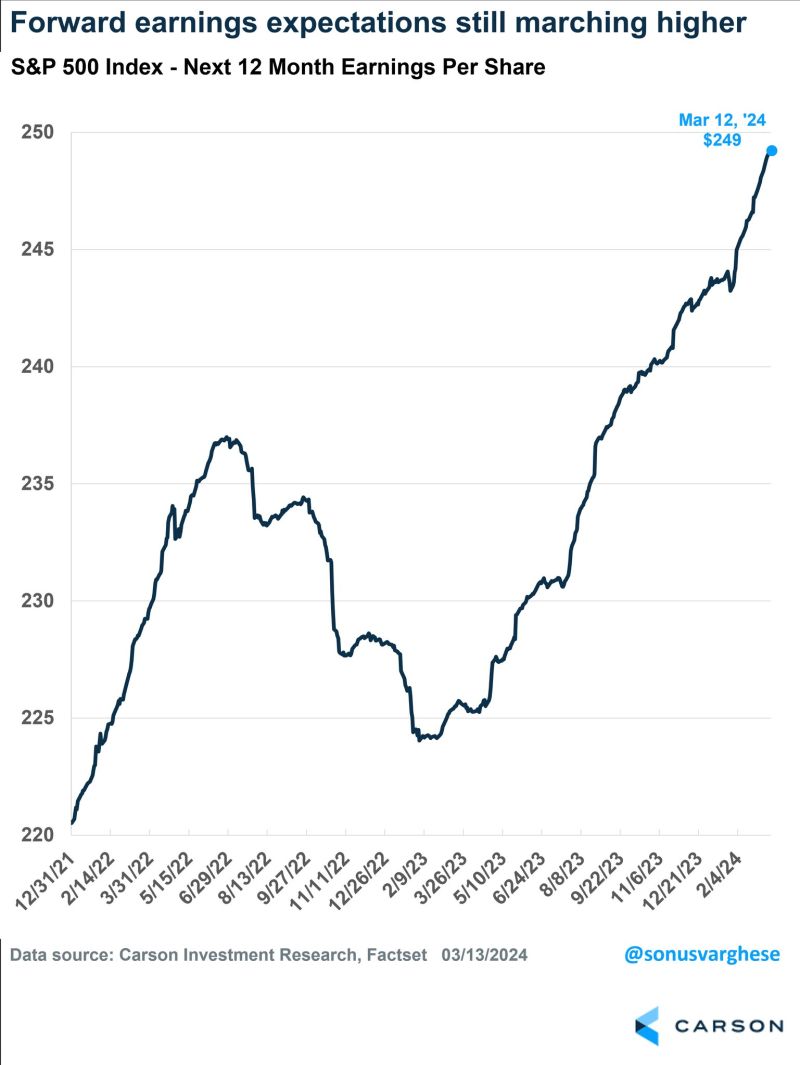

Why has the sp500 been moving higher despite rate cuts expectations being revised downward?

It is as simple as EPS 12 month estimates have soared. Up another 2% the past 12 months. Source: Ryan Detrick

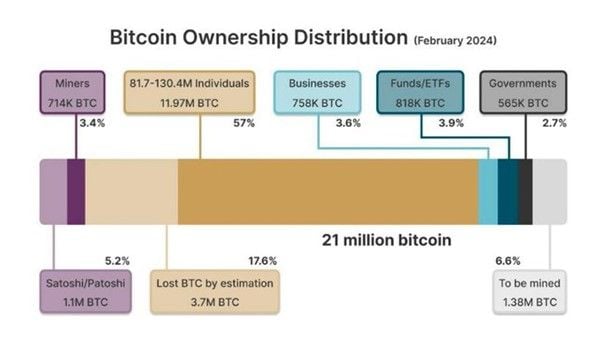

JUST IN: Wealth advisor platform Cetera just approved Bitcoin ETFs to be offered to clients.

It has $475 billion in assets under administration and $190 billion in assets under management. Source: Bitcoin Archive, X

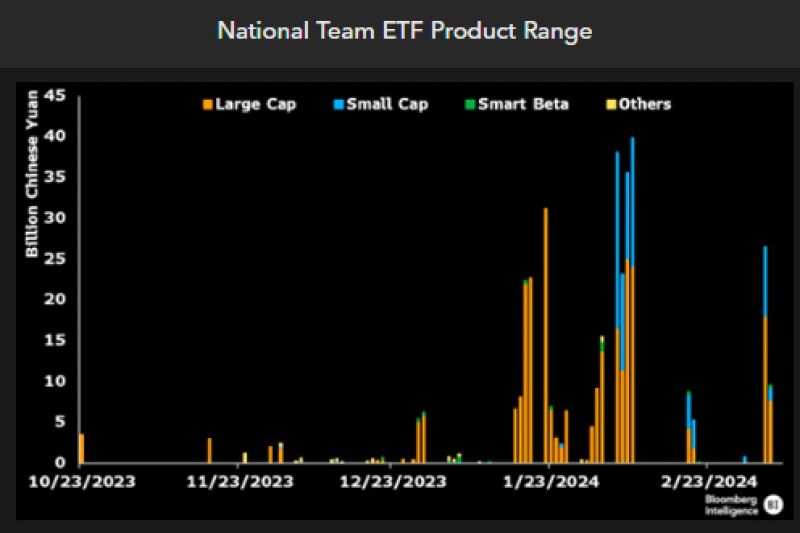

The Chinese government has gone "Full BoJ style", purchasing $45b of ETFs in the past 2 months to pump up market.

They already own like 1/5 of all equity ETFs. They moved to buying small caps because it moves stocks more. Purchases could reach $100b this year. Source: Bloomberg, Eric Balchunas

Investing with intelligence

Our latest research, commentary and market outlooks