Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

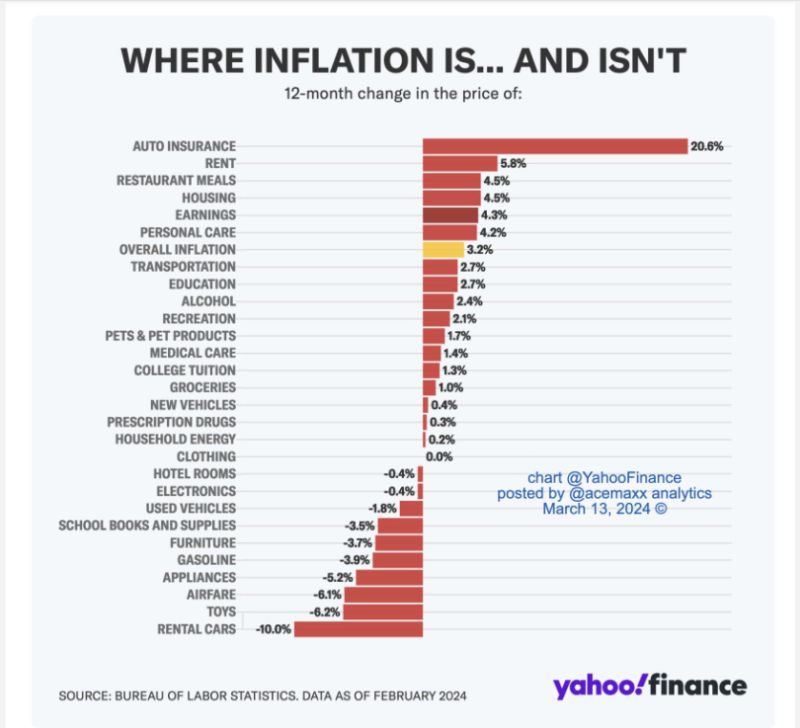

Where Inflation Is... and Isn't ...

source : yahoofinance, acemaxx

Japanese companies boost wages in departure from 'lost decades'

Japan's largest employers announced record pay increases on Wednesday. Every spring, unions and management hold talks, known as shunto, to set monthly wages ahead of the start of Japan's fiscal year in April. Toyota Motor, Hitachi and Panasonic Holdings were among the companies that on Wednesday fully met labor unions' demands to raise wages. Nippon Steel's response exceeded the union's demands, raising monthly wages by a record 35,000 yen ($237), or 14%. Toyota did not disclose details of its wage increases but said it fully met union demands. The Toyota Motor Workers' Union has demanded a record bonus payment worth 7.6 months of salary, citing the company's all-time high annual operating profit forecast of 4.5 trillion yen for the current fiscal year. The union has also proposed specific demands for each job category, up to a 28,440 yen monthly wage increase. Hitachi and Toshiba said their pay hikes are the largest since the current negotiation style was introduced in 1998. According to the Japan Council of Metalworkers' Unions (JCM), an alliance of unions in the manufacturing industry, 87.5% of member organizations had their demands either fully met or exceeded. source : nikkeiasia

Dr. Copper Breaks Out Again ?

Copper prices have remained significantly below their peaks in 2022, yet they've established a robust foundation over the past eighteen months, from which they are now beginning to rise. Based on the price and momentum readings, several technical analysts believe this could be the start of a more sustained move to the upside. source : tradingview

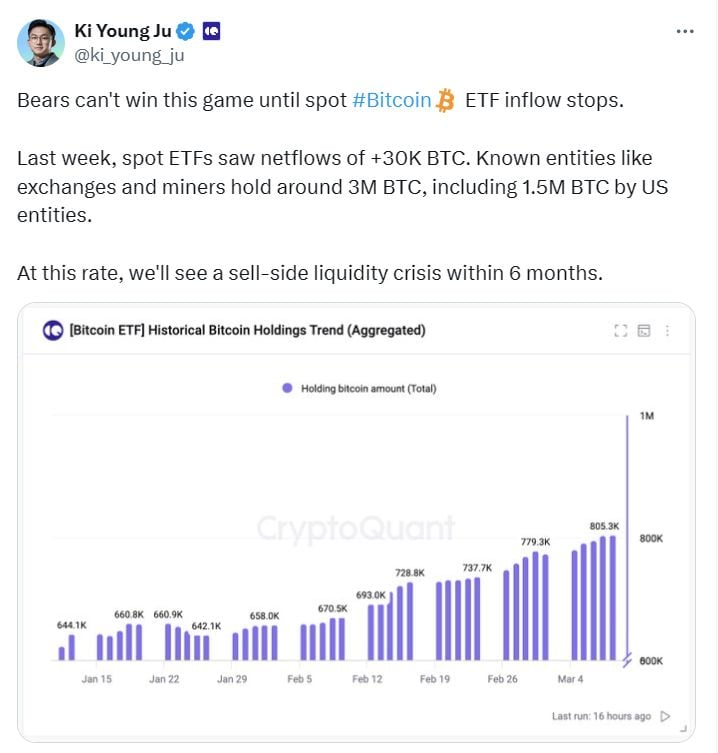

An important read >>> Bitcoin Has 6 Months Until ETF "Liquidity Crisis"

Bitcoin faces a “sell-side liquidity crisis” by September if institutional inflows continue, an industry analyst says. In a thread on X on March 12, Ki Young Ju, founder and CEO of on-chain analytics platform CryptoQuant, predicted a BTC supply watershed “within six months.” Bitcoin as an institutional investment allocation is only just getting started, industry participants have said, as United States-based spot Bitcoin exchange-traded funds (ETFs) gain momentum. Now holding nearly $30 billion, they have become the most successful ETF launch in history. Should the trend continue, however, a new phenomenon could arise where THERE WILL BE NOT ENOUGH BTC AVAILABLE TO MEET DEMAND. “Bears can’t win this game until spot Bitcoin ETF inflow stops,” Ki summarized. He noted that ETFs alone put away more than 30,000 BTC last week, and with 3 million BTC in exchange and miner wallets, the odds of a supply-induced price shock become clear. “Last week, spot ETFs saw net flows of +30K BTC. Known entities like exchanges and miners hold around 3M BTC, including 1.5M BTC by US entities,” he continued. “At this rate, we’ll see a sell-side liquidity crisis within 6 months.” Given BTC price gains since the ETF launch in January, popular commentator WhalePanda notes, the dollar value of GBTC’s diminished BTC holdings has, in fact, barely declined. “The problem is that with the price going up and their massive outflows, their holdings in $ are still same as where we started at.” When the tipping point from ETF demand comes, Ki forecasts the BTC price impact may be beyond market expectations. “Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and thin orderbook,” he concluded. To avoid the liquidity crisis, we need to see whales starting to move their BTC to exchanges and sell them. This should happen if BTC price hit higher levels. The law of supply and demand... Source: www.zerohedge.com

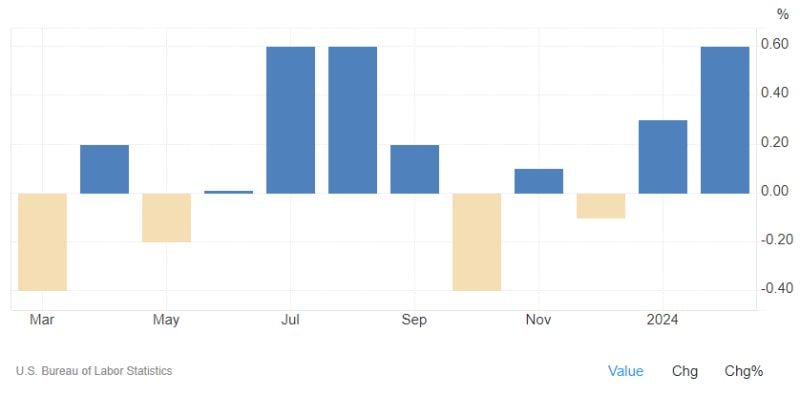

The US Producer Price Index surged by 0.6% MoM in February 2024, marking the largest increase since August and surpassing expectations.

Goods prices rose notably, led by a 4.4% surge in energy costs. Meanwhile, services edged up by 0.3%. Despite a slowdown in core rate growth, yearly inflation accelerated to 1.6%, surpassing forecasts. YoY: 1.6% vs 1.1% est. MoM: 0.6% vs 0.3% est. Core YoY: 2% vs 1.9% est. Core MoM: 0.3% vs 0.2% est. Bottom-line >>> PPI came in stronger than expected driven by a surge in energy costs and higher insurance costs among other categories. Not a breakout to the upside, but declining trend is leveling off.

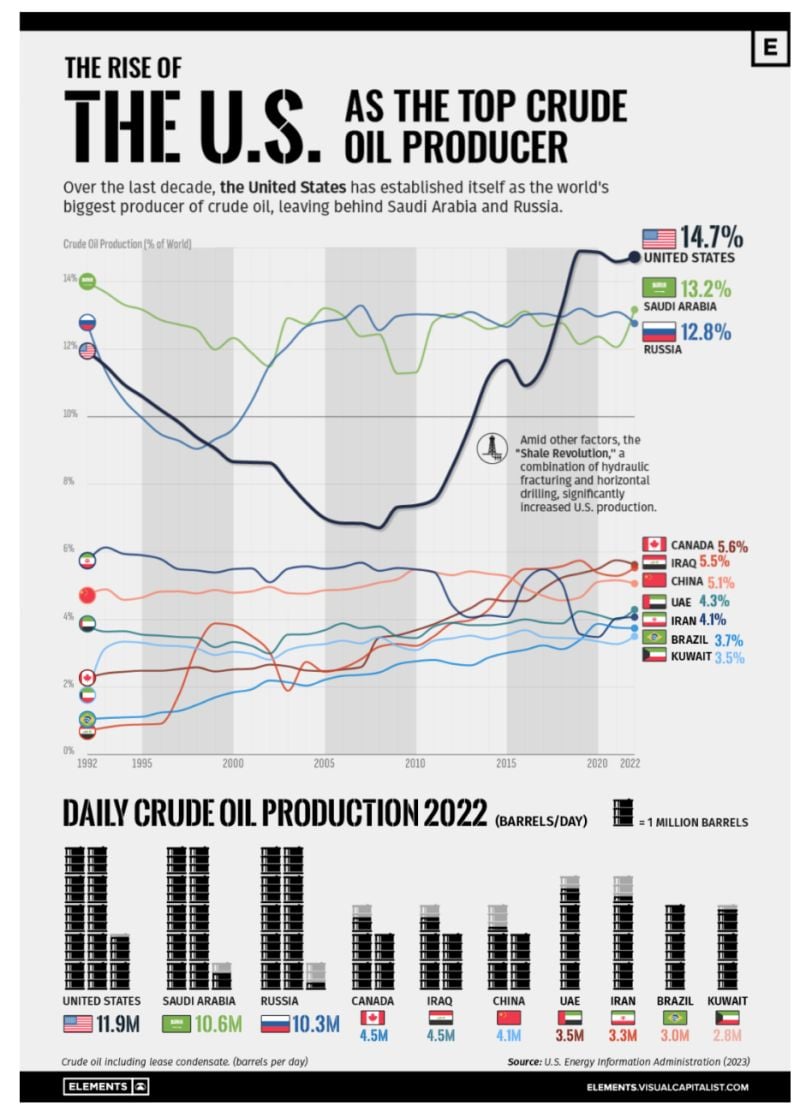

Visualizing the Rise of the U.S. as Top Crude Oil Producer - by Elements & Visual Capitalist

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia. This infographic illustrates the rise of the U.S. as the biggest oil producer, based on data from the U.S. Energy Information Administration (EIA).

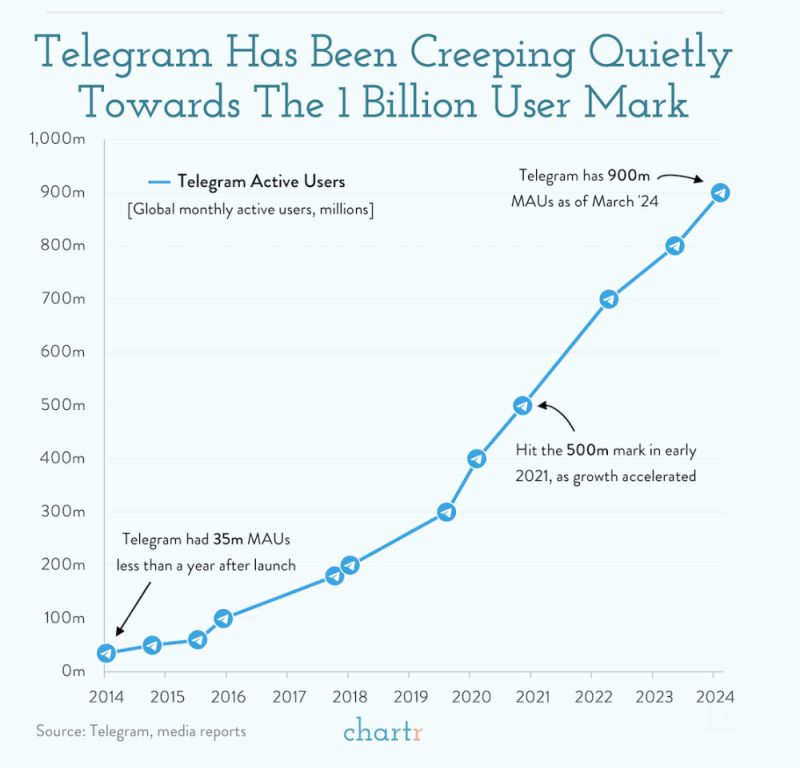

Telegram, a global social media and messaging giant that only ~1 in 4 Americans are actually familiar with, has just reached 900 million monthly active users globally.

Despite its relatively low profile in the US, the platform has been making waves in other countries since its launch in 2013 — largely thanks to its apparent emphasis on privacy and security, which has helped it notch hundreds of millions of downloads in India, parts of South America, and Russia, where the app was originally founded. Telegram is many things to many people. It’s a place to joke with friends; a means for freedom fighters to arrange protests; a valuable outlet to get news to readers where media is censored… but, it’s also a place where people go to buy guns, drugs, fake bank cards, and was (or maybe still is) a major platform for terror groups to organize and spread information on. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks