Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

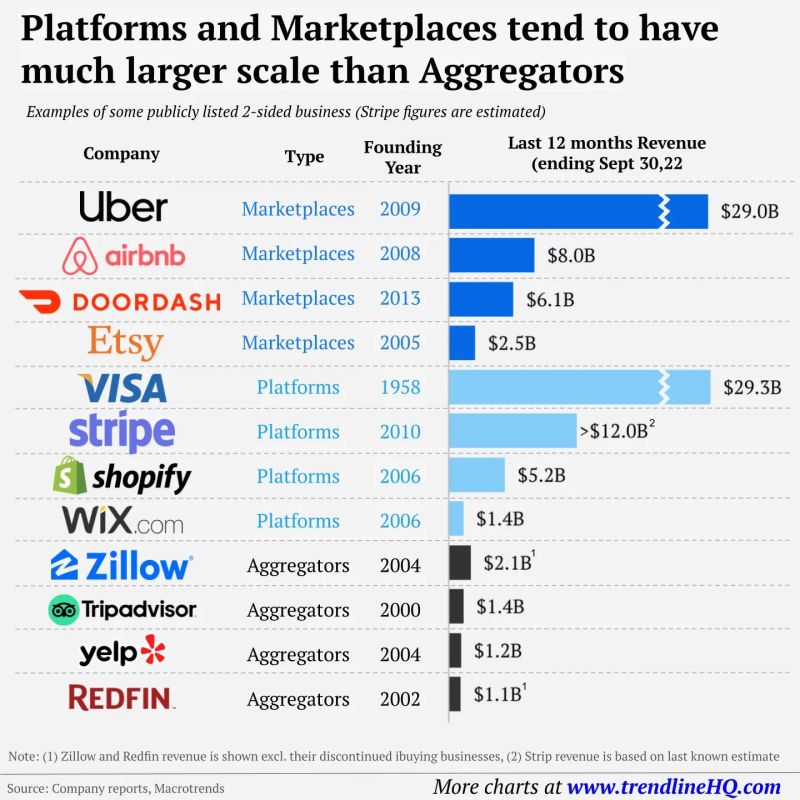

What's the difference between a marketplace, an aggregator, and a platform? A lot...

Source: CJ Gustafson

Semiconductor stocks have reached their highest valuation compared to the S&P 500, exceeding the levels seen during the dot-com bubble peak.

source : bloomberg

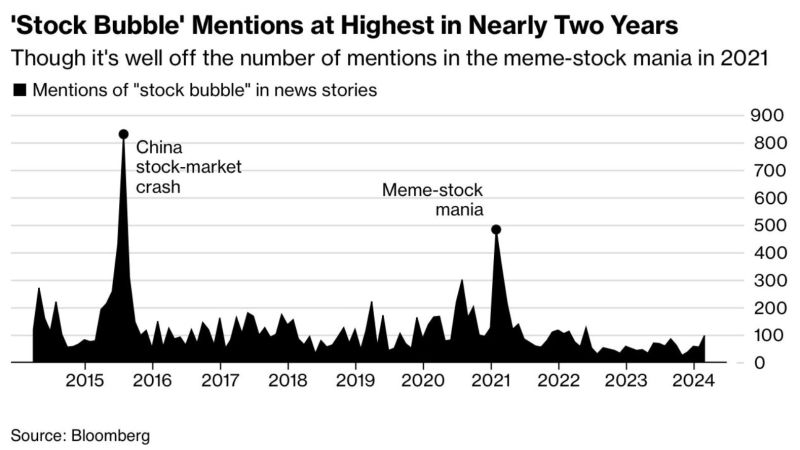

Stock Bubble mentions in the media are at 2-year highs but still well short of the meme-stock mania period in early 2021

source : bloomberg, barchart

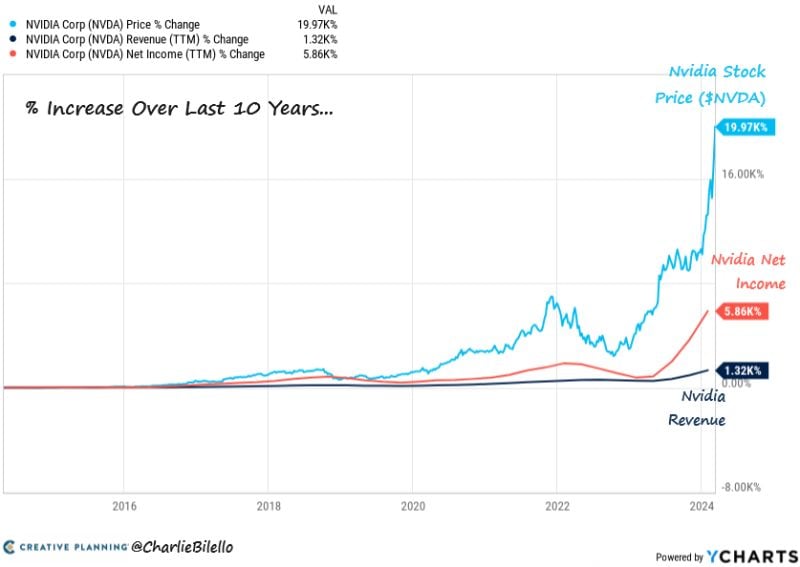

% Increase Over Last 10 years...

Nvidia stock price: +19,970% Nvidia net income: +5,860% Nvidia revenue: +1,320% $NVDA Source: Charlie Bilello

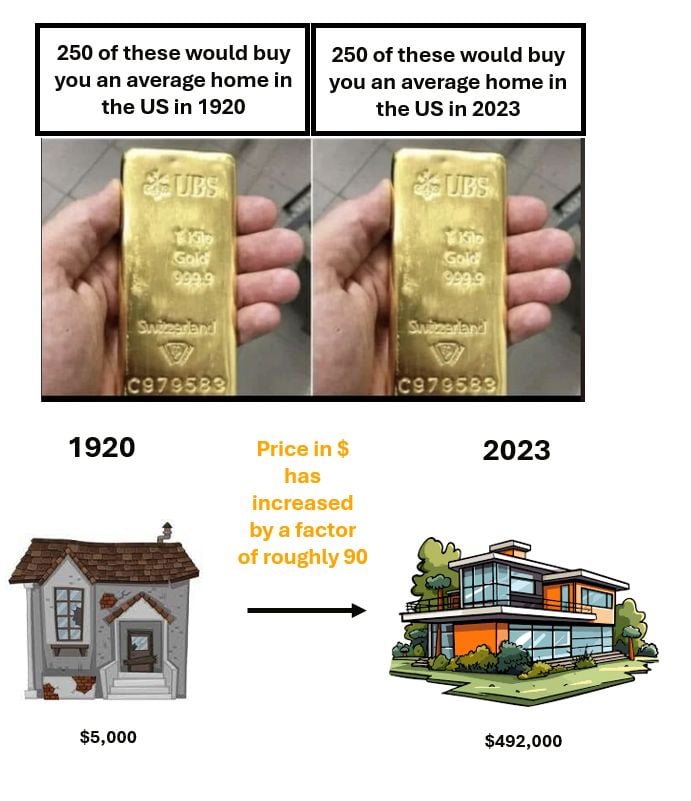

What is a store of value?

A good store of value preserve the amount of goods / services money can buy over time. Example (simplified): - The average gold price in 1920 was $20.68 per ounce. Today it is worth $2,100 per ounce. A 100 fold increase. - The average house price in the US in 1920 was between $5,000 and $6,000. The average sales price of a new home in 2023 was $492,000. A 90 to 100 fold increase.

The cocoa rally.

Cocoa prices hit a fresh record high, fast approaching the once unthinkable $7,000 per tonne level. At current levels, we will see soon widespread retail price increases for all kinds of chocolate. Source: Bloomberg, Javier Blas

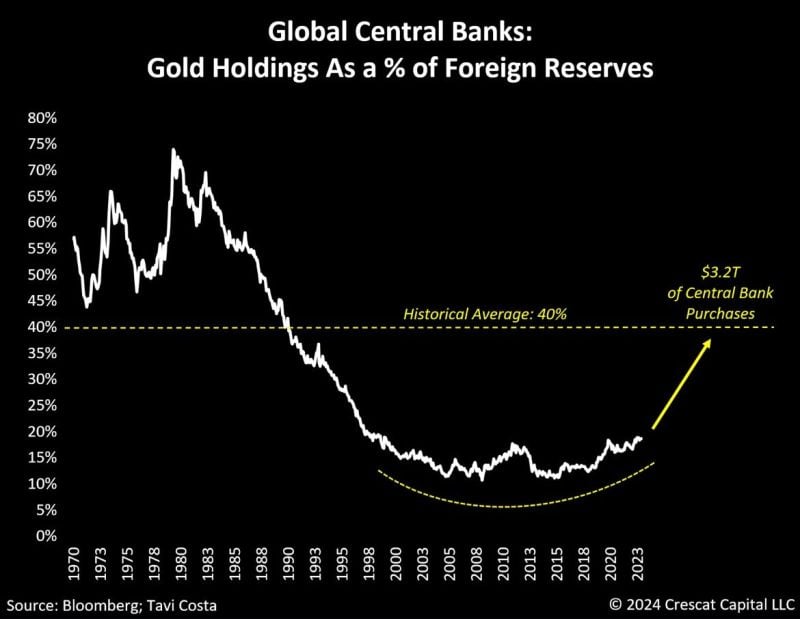

As highlighted by Tavi Costa:

The recent surge in gold prices, despite a lack of corresponding growth in assets managed by related ETFs, suggests that central banks' purchases have likely been the primary catalyst for the rally. Although there's been a record pace of metal accumulation, central banks currently hold a much smaller proportion of gold compared to historical levels. Back in the late 1970s and early 1980s, these institutions held around 80% of their balance sheet assets in gold, whereas today it's less than 20%. Will they continue to accumulate gold going forward? If we come back to the historical average (in terms of % of reserves), there is massive pent up demand ahead Source: Tavi Costa, Bloomberg

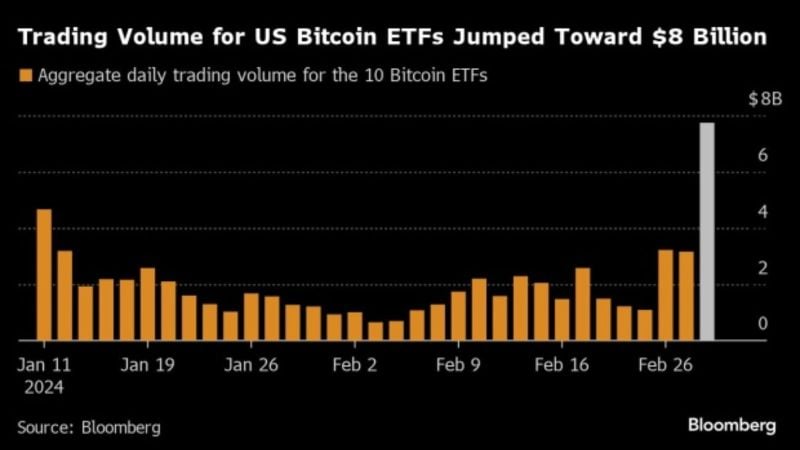

Trading volume in US Bitcoin ETFs hit YTD highs of $8B as Bitcoin prices are up 59% YTD, after reaching a new all-time high.

The surge follows regulatory approvals for spot-Bitcoin ETFs and comes ahead of the anticipated halving event, reflecting significant shifts in crypto accessibility and investor interest. Source: Bloomberg, Beth Kindling

Investing with intelligence

Our latest research, commentary and market outlooks